From: Wagner, Jonathan

Sent: Wednesday, April 15, 2020 6:08:06 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

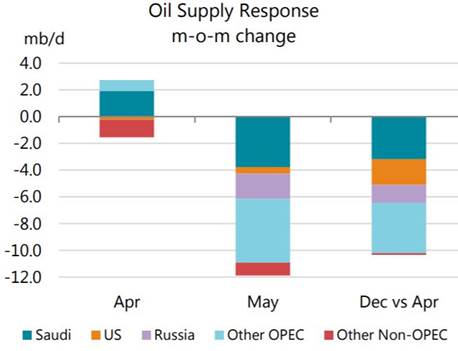

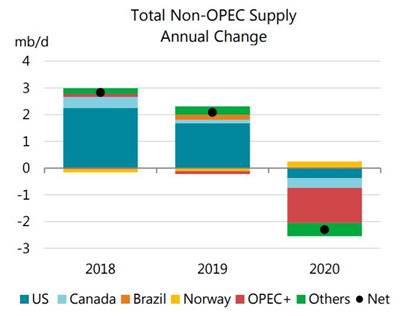

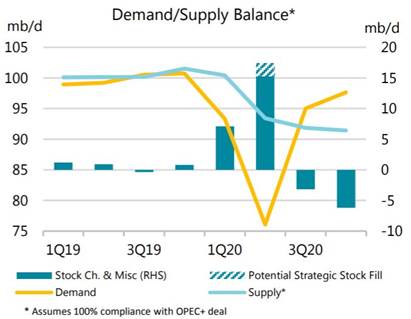

Good morning. Oil prices are down another 3% this morning following the latest IEA forecast showing a 29m b/d demand drop in April to levels not seen in 25 years. The IEA warned that “no output cut by producers could fully offset the near-term falls facing the market.” The IEA forecast a 9.3 million bpd drop in demand for 2020 despite what it called a “solid start” by producers following a record deal to curb supply in response to the coronavirus pandemic. “By lowering the peak of the supply overhang and flattening the curve of the build-up in stocks, they help a complex system absorb the worst of this crisis.” “There is no feasible agreement that could cut supply by enough to offset such near-term demand losses. However, the past week’s achievements are a solid start.” Ahead of that, however, April could prove the worst month ever for the industry as production is set to increase while demand tumbles amid economic lockdowns around the world, IEA Executive Director Fatih Birol said. “When we look back on 2020 we may well see that it was the worst year … April may well have been the worst month – it may go down as Black April,” Birol told reporters on a call. Oil producers “lost two very important months”, Birol added, referring to events including the failure of producers in early March to agree on cutting output. Instead, Saudi Arabia, Russia and others pledged to increase production as they looked to grab back market share. Now, in addition to planned supply cuts, some nations are expected to boost buying for strategic reserves. The IEA said it was “still waiting for more details on some planned production cuts and proposals to use strategic storage”, noting the United States, India, China and South Korea have either offered or are considering such purchases. “If the transfers into strategic stocks, which might be as much as 200 million barrels, were to take place in the next three months or so, they could represent about 2 million bpd of supply withdrawn from the market,” the IEA said. Birol said the IEA’s forecasts on such purchases were based on “our communications with the countries, what we see in the press and the countries’ public announcements”.

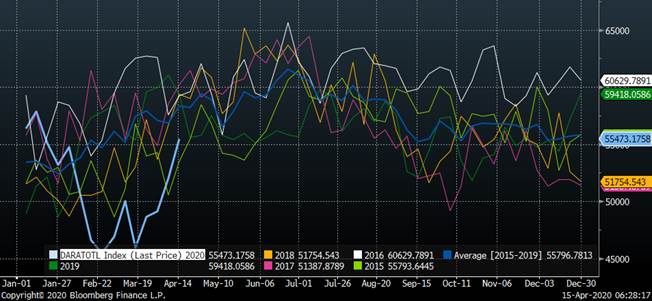

As Global storage continues to fill rapidly (Cushing stocks should increase to around 55m bbls in today’s DOE report as well), IEA that it expects global refinery throughput to decline by 7.6 million b/d this year to 74.3 million b/d “on sharply reduced demand for fuels.” Second-quarter throughput is likely to “plummet” by almost 17 million b /d, due to “widespread run cuts and shutdowns in all regions,” the IEA said. Refinery runs need to drop below 60 million b/d “to avoid product inventory builds,” the IEA said. The IEA expects that, along with 250 million barrels of storage space available in the US, “it is possible that there could be as much storage capacity available in the rest of the world” to house the expected product stocks build-up in Q2.

However, in the second half of 2020, the agency expects refining activity to recover “slowly” as the global market moves into deficit. It also expects runs to be lower than demand levels while there is destocking from the Q2 “product overhang.” The IEA said that, while the 2020 events are “truly unprecedented,” a somewhat similar development occurred in the early 1980s due to a global economic recession, which had “profound and long-lasting consequences for the refining sector and the oil industry in general.” But the COVID-19 related demand shock is “much faster and more profound,” the IEA said. Refineries will use different options to reduce throughput, such as reduced utilization rates, hot or cold circulation mode, depending on the units, or complete stoppage of the equipment. But the IEA noted that “shutting down refinery units is not as simple as pushing a button or pulling a plug. The more complex the unit, the longer the process takes.” In addition, “many industrial accidents occur during the restart phase, if precautions were not observed during the shutdown,” the report said. The US refineries have experience with “abrupt falls in refining activity” especially in the hurricane-prone regions of the Gulf Coast. But OECD Europe is likely “to be one of the worst hit regions in terms of refining activity.” OECD Asia, by contrast, is expected “to boast the highest utilization rates anywhere” in Q2. Early data show China’s implied stock build in 1Q20 at 2.1 mb/d, and US stocks increased by 0.5 mb/d. OECD data show that industry stocks in February fell by 35.4 mb to 2 878 mb as a draw for products more than offset a build in crude. Total OECD oil stocks stood 42.4 mb below the five-year average and, due to the weak outlook, now provide 79.2 days of forward demand coverage. In March, floating storage of crude oil increased by 22.9 mb (0.7 mb/d) to 103.1 mb. Some IEA charts are listed below.

Countries in the Middle East and Central Asia region will see a contraction this year bigger than the one seen during the 2008 global financial crisis and the 2015 oil price shock, the International Monetary Fund said on Wednesday. The fund said earlier this week the global economy was expected to shrink by 3.0% during 2020 in a coronavirus-driven collapse of activity that will mark the steepest downturn since the Great Depression of the 1930s. In the Middle East, countries that rely heavily on oil exports will suffer the additional pressure of collapsing oil prices caused by reduced demand for oil and, until last Sunday, a battle for market share between oil titans Saudi Arabia and Russia that added to a glut of oversupply. Real GDP among regional oil exporters could contract by 4.2% this year, a sharp downward revision from the IMF’s 2.1% growth projected in October last year. Their oil exports are expected to decline by more than $250 billion. Saudi Arabia started marketing a three-part dollar bond sale today, as the world’s biggest oil exporter seeks to replenish state coffers battered by low oil prices and expectations of lower output. The kingdom, acting through the ministry of finance, is marketing 5-1/2-year notes at a yield of around 315 basis points over U.S. Treasuries, 10-1/2-year bonds at around 325 bps over Treasuries, and 40-year notes yielding around 5.15%. The 40-year bonds would be the longest-dated ever issued in dollars by a Gulf borrower, said Dino Kronfol, chief investment officer of global sukuk and MENA fixed income at Franklin Templeton. “We’re coming around the same discount levels as the Abu Dhabi and Qatar issues on the long-end, around 30-40 bps,” he added, referring to bond sales last week by Saudi Arabia’s Gulf neighbors that raised a combined $17 billion. “The 5-1/2 and 10-1/2-year look cheaper, around 65-75 bps, so we’d expect those to tighten a little bit before they issue.” The size of the deal will depend on market appetite, but bankers and fund managers have said they expect a multi-billion dollar transaction.

As Middle East production continue their race to zero (or lower negatives) to sell their barrels to Asia, Saudi Aramco has offered oil refineries in Asia and Europe the option to defer payments for crude cargo deliveries by up to 90 days as plants struggle with shrinking demand, refining industry sources said. The credit terms, which Saudi Arabia’s national oil company has offered through unnamed Saudi banks, are also seen as part of the country’s efforts to increase its market share, the sources told Reuters. Aramco “are asking us to amend our existing agreement to include a bill of exchange which will give you basically an opportunity to pay through a bank in 90 days time,” one source at an Asian refiner said. Under the terms, Aramco will receive the payment for the cargoes from the same bank within 21 days of shipment, he said. Under the terms, Aramco will receive the payment for the cargoes from the same bank within 21 days of shipment, he said. At least five Chinese refiners are seeking full contractual crude volumes for May from Saudi Aramco, according to sources. Three of the five refiners had previously told Bloomberg that Aramco’s OSP reductions were not as sharp as they had expected. Two Southeast Asian refiners and a North Asian refiner are also seeking normal volumes.

Abu Dhabi National Oil Company today lowered its prices for light crude grades in May and said it was committed to reducing output as part of the OPEC+ deal. ADNOC said it was committed to lowering production from its current levels of 4.1 million bpd of crude, but added that its contractual terms with customers remain unaffected by the announcement. ADNOC said it will follow up with customers regarding any required changes and confirmations for cargoes loading in May and June. ADNOC set its official selling price (OSP) for May for its benchmark Murban crude at minus $6.95 per barrel to Dubai quotes published by S&P Global Platts, the company said. That is down from minus $2.75 for April. Umm Lulu’s OSP for May was set at parity to Murban’s OSP while the OSP for Das crude was at 35 cents a barrel below Murban’s OSP, it added. The OSP for Upper Zakum was 10 cents above Murban’s OSP. This is the second month that ADNOC is pricing its term cargoes on forward prices. ADNOC said it will continue to provide forward pricing on a monthly basis. “This will ensure that our customers have visibility of the prices that they will pay ahead of delivery and can plan accordingly,” ADNOC said. Oil majors including P66 sold up to five cargoes of Qatar’s Al-Shaheen crude for June loading at discounts of $8.50-$9.50/bbl to the Dubai benchmark price according sources. Commodities trader Trafigura has sold a cargo of Russian ESPO Blend crude at a spot discount of around $2.80 a barrel to August Ice Brent for delivery in June, three trade sources told Reuters on Wednesday. The buyer was China’s Zhenhua Oil, two of them said.

Vols are higher across the curve with M20 WTI and Brent trading higher by roughly 10% to 109% and 120% respectively. Most of the flow seen so far this morning has come in the form or WTI puts and put spreads. Overnight the N20 30/25 European PS vs the M20 25/20 European put spread was active trading over 1k. The June WTI 23 put has been active on the screen as well this am trading almost 3k (some of those were via a 26/23 put spread as well). The N20 15 put vs the Q20 15 put has been trading on the screen as well. More recently more vanilla American N20 30/25 1×1.5 put spreads have traded 1k.

Top stories listed below

Coronavirus to hit Mideast growth more than 2008 crisis, 2015 oil shock – IMF – Reuters News

Saudi Arabia starts three-part bond sale to fill state coffers – Reuters

Oil Storage Network Is Being Tested ‘Like Never Before’: Apicorp

Aramco offers struggling refiners sweeter terms for crude – Reuters News

Chinese Oil Buyers Seek Full Contractual Saudi Crude Volumes

Trafigura sells June ESPO crude at spot discount to Chinese buyer – sources – Reuters

UAE’s ADNOC lowers Murban official selling price for May cargoes – Reuters

Oil Majors Sell June Al-Shaheen Oil at Discounts of $8.50-$9.50

Dubai’s premium over Brent widens on expected crude price cuts for Asia – Platts

Mideast Oil Pricing Cuts May Have Been Deeper Than Needed: Vitol

Crude Storage in ARA Rises 6.7%, Genscape Weekly Data Show

Gazprom Neft Needs to Delay Some Projects on New OPEC+ Deal: CEO

Saudi Aramco Conducting Maintenance at Riyadh Refinery Units

Cargo Sizes Below 50% for Oil Barges Sailing to Inland Europe

Europe gasoil cash prices, cracking margins collapse as virus catches up with market – Platts

Jet fuel demand to remain low for years as airlines buckle up for tough ride – Reuters News

Fujairah data: Oil product stocks climb to highest since record in February – Platts

U.S. oil refiners’ weekly capacity seen down 75,000 bpd -IIR – Reuters News

Implied Vol Change this morning

|

WTI Vol |

15-Apr |

Change |

BRT Vol |

15-Apr |

Change |

|

|

M0 |

108.71 |

8.73 |

M0 |

120.27 |

11.13 |

|

|

N0 |

78.31 |

6.56 |

N0 |

87.56 |

8.47 |

|

|

Q0 |

64.23 |

4.98 |

Q0 |

70.88 |

6.21 |

|

|

U0 |

57.01 |

4.42 |

U0 |

58.68 |

4.47 |

|

|

V0 |

52.53 |

3.87 |

V0 |

53.12 |

3.21 |

|

|

X0 |

49.23 |

3.22 |

X0 |

49.96 |

3.07 |

|

|

Z0 |

46.52 |

2.75 |

Z0 |

46.81 |

2.92 |

|

WTI M20 20 European Put LIVE TRADES 105 1,350x |

|

WTI M20 25 European Put LIVE TRADES 245 1,000x |

|

2x BRT M20 30/25 Put Spread vs 1x 37/42 Call Spread x28.35 TRADES 374 75x |

|

BRT M20 25/30 Fence x28.25 TRADES 28 100x 75d |

|

WTI N20 30 European Put LIVE TRADES 254 250x |

|

WTI N20 30/25 1×1.5 Put Spread x31.60 TRADES 63 1,000x 4d |

|

BRT Q20 40/45 Call Spread x34.70 TRADES 114 200x 22d |

|

BRT U20 43 Call LIVE TRADES 175 200x |

|

BRT Z20 50 Call x38.70 TRADES 155 100x 25d |

|

BRT Z20 50 Call x38.75 TRADES 158 300x 27d |

|

BRT Z20 50/55 Call Spread LIVE TRADES 66 50x |

Coronavirus to hit Mideast growth more than 2008 crisis, 2015 oil shock – IMF – Reuters News

Countries in the Middle East and Central Asia region will see a contraction this year bigger than the one seen during the 2008 global financial crisis and the 2015 oil price shock, the International Monetary Fund said on Wednesday. The fund said earlier this week the global economy was expected to shrink by 3.0% during 2020 in a coronavirus-driven collapse of activity that will mark the steepest downturn since the Great Depression of the 1930s. In the Middle East, countries that rely heavily on oil exports will suffer the additional pressure of collapsing oil prices caused by reduced demand for oil and, until last Sunday, a battle for market share between oil titans Saudi Arabia and Russia that added to a glut of oversupply. Real GDP among regional oil exporters could contract by 4.2% this year, a sharp downward revision from the IMF’s 2.1% growth projected in October last year. Their oil exports are expected to decline by more than $250 billion. A record output cut agreement on Sunday between international producers could provide some support to oil prices, the IMF said, but “decreases in oil prices are so large that fiscal and export revenues are expected to decline across all oil-exporting countries in the region, including those that might manage to gain market share from higher-cost producers”. Overall economic growth in the region is expected to fall from 1.2% in 2019 to a 2.8% contraction this year, said the fund, which however expects growth to pick up again to 4% next year as threats from the pandemic recede. Saudi Arabia, the world’s biggest oil exporter, is expected to see its economy shrink 2.3% this year from 0.3% growth in 2019, said the IMF, which had forecast 2.2% in real GDP growth for this year before the pandemic changed all growth scenarios. Iran – the Middle East country worst hit by the disease – is seeking $5 billion in emergency funding from the IMF, as it tries to balance virus containment measures with action to boost a suffering economy already bruised by U.S. sanctions. “Necessary containment measures to halt the spread of the virus have affected job-rich sectors across the region, with negative effects on confidence and non-oil activity,” the IMF said in its Regional Economic Outlook. After a steep recession in 2019, the Iranian economy is forecast to shrink 6% this year, it said.

SECOND-ROUND EFFECTS

Small and medium-sized enterprises in the region are likely to feel the largest impact of virus containment measures that have brought to a near halt vital economic sectors, such as tourism, hospitality and retail. “Moreover, given heavy employment in these service sectors, there could be significant second-round effects on domestic demand across the region if unemployment rises and wages and remittances fall,” the IMF said. Other economic activities are being hit by supply chain disruptions, and a plunge in business and consumer confidence. Adding further pressure, a deterioration in the global financial markets has led to capital outflows. The IMF said nearly $5 billion of portfolio flows had left the region in March, raising the risk of refinancing challenges for governments with upcoming external debt maturities, amounting to a total of $35 billion this year. This is particularly concerning for some regional oil importing countries with high levels of public debt, as it adds to reduced capital and remittance flows from oil-extracting countries and may pressure foreign reserves and exchange rates. Conflict-affected countries in the region, including Iraq, Sudan and Yemen, face the biggest challenges in containing the spread of the virus. “To help address these challenges, timely external medical and financial support from major economies and international organisations could prove to be necessary,” the IMF said, adding it had already provided debt relief to Yemen. The IMF in addition has already provided financial support to Jordan, the Kyrgyz Republic, Pakistan, Tunisia, and debt relief from international creditors to Somalia.

Saudi Arabia starts three-part bond sale to fill state coffers – Reuters

Saudi Arabia started marketing a three-part dollar bond sale on Wednesday, a document showed, as the world’s biggest oil exporter seeks to replenish state coffers battered by low oil prices and expectations of lower output. The kingdom, acting through the ministry of finance, is marketing 5-1/2-year notes at a yield of around 315 basis points over U.S. Treasuries, 10-1/2-year bonds at around 325 bps over Treasuries, and 40-year notes yielding around 5.15%. The 40-year bonds would be the longest-dated ever issued in dollars by a Gulf borrower, said Dino Kronfol, chief investment officer of global sukuk and MENA fixed income at Franklin Templeton. “We’re coming around the same discount levels as the Abu Dhabi and Qatar issues on the long-end, around 30-40 bps,” he added, referring to bond sales last week by Saudi Arabia’s Gulf neighbors that raised a combined $17 billion. “The 5-1/2 and 10-1/2-year look cheaper, around 65-75 bps, so we’d expect those to tighten a little bit before they issue.” The size of the deal will depend on market appetite, but bankers and fund managers have said they expect a multi-billion dollar transaction. Doug Bitcon, head of credit strategies at Rasmala Investment Bank, said he expected the deal to raise more than $10 billion. A Saudi banker said the deal seemed to be targeted at foreign investors, given the long maturity and the spreads on offer. Citi, Goldman Sachs, HSBC, Bank of China, Mizuho, MUFG, SMBC and Samba Capital have been hired to arrange the debt sale, which will be finalized later on Wednesday. A spokesman for the Saudi ministry of finance did not immediately respond to a request for comment. Riyadh increased its debt ceiling to 50% of GDP from a previous 30% in March as it plans to increase borrowing to offset lower oil revenues and amid an economic downturn caused by the coronavirus outbreak. The Saudi issue also follows a historic deal on Sunday to cut oil output among major producers, which — while it may contribute to stabilizing the oil market — is expected to put further pressure on Riyadh’s revenues this year.

Oil Storage Network Is Being Tested ‘Like Never Before’: Apicorp

The coronavirus pandemic has exacerbated a growing surplus in global oil markets, putting pressure on storage and other oil infrastructure, said Leila Benali, Chief Economist at Arab Petroleum Investments Corp.

“Storage and infrastructure today has been tested like never before,” Benali said earlier Wednesday in a video conference with Dubai-based consultant Gulf Intelligence

Producers with high operating costs and limited access to storage will be the first to be forced to shut producing wells

Greatest-ever contraction in oil demand may occur in April

“There is clearly a disconnect between the futures and the physical market. Prices at which barrels are being exchanged in the physical market are much lower”

Aramco offers struggling refiners sweeter terms for crude – Reuters News

Saudi Aramco has offered oil refineries in Asia and Europe the option to defer payments for crude cargo deliveries by up to 90 days as plants struggle with shrinking demand, refining industry sources said. The credit terms, which Saudi Arabia’s national oil company has offered through unnamed Saudi banks, are also seen as part of the country’s efforts to increase its market share, the sources told Reuters. Aramco “are asking us to amend our existing agreement to include a bill of exchange which will give you basically an opportunity to pay through a bank in 90 days time,” one source at an Asian refiner said. Under the terms, Aramco will receive the payment for the cargoes from the same bank within 21 days of shipment, he said. Saudi Aramco declined to comment. The new terms, offered to at least four refiners in Asia and Europe, could alleviate the short-term financial burden for refineries, which have struggled with a collapse in oil demand around the world due to coronavirus-related movement restrictions. They will however lead to overall higher costs due to more expensive financing terms, according to sources at the refineries. As a result, at least three refineries have rejected the terms, the sources said. “It is… useful for people who are actually looking at rolling or rotating money (but) it comes at a cost. We are actually trying to reduce our overall cost,” the first source said. The Organization of the Petroleum Exporting Countries, along with Russia and other oil producers – a group known as OPEC+ – last week joined with other producing countries, including the United States, for an agreement which is set to remove a total of around 19.5 million barrels per day (bpd) from the market in the face of the demand collapse. The agreement followed a sharp drop in oil prices to below $20 a barrel after Saudi Arabia and Russia launched a price war to try to increase their market share after ending a four-year production cut deal. “Following the OPEC+ deal, Saudi’s agenda remains broadly intact in as far as maintaining pressure on U.S. and international oil companies while continuing its passive-aggressive price war with other producers,” said Christyan Malek, JPMorgan’s top European oil and gas analyst.

Chinese Oil Buyers Seek Full Contractual Saudi Crude Volumes

At least five Chinese refiners are seeking full contractual crude volumes for May from Saudi Aramco, according to traders who asked not to be identified.

Three of the five refiners had previously told Bloomberg that Aramco’s OSP reductions were not as sharp as they had expected, the traders said

Two Southeast Asian refiners and a North Asian refiner are also seeking normal volumes, according to the traders

Trafigura sells June ESPO crude at spot discount to Chinese buyer – sources – Reuters

Commodities trader Trafigura has sold a cargo of Russian ESPO Blend crude at a spot discount of around $2.80 a barrel to August Ice Brent for delivery in June, three trade sources told Reuters on Wednesday. The buyer was China’s Zhenhua Oil, two of them said. Asia’s spot differential for ESPO crude, a popular grade for Chinese refiners, has come under pressure due to ample supply in the global oil markets

UAE’s ADNOC lowers Murban official selling price for May cargoes – Reuters

Abu Dhabi National Oil Company (ADNOC) on Wednesday lowered its prices for light crude grades in May and said it was committed to reducing output as part of the OPEC+ deal. The OPEC+ group, consisting of the Organization of the Petroleum Exporting Countries (OPEC) and its allies including Russia, on Sunday agreed to cut output by a record 9.7 million barrels per day (bpd) in May and June to ease a supply glut exacerbated by a slump in global fuel demand because of the coronavirus outbreak. ADNOC said it was committed to lowering production from its current levels of 4.1 million bpd of crude, but added that its contractual terms with customers remain unaffected by the announcement. ADNOC said it will follow up with customers regarding any required changes and confirmations for cargoes loading in May and June. ADNOC set its official selling price (OSP) for May for its benchmark Murban crude at minus $6.95 per barrel to Dubai quotes published by S&P Global Platts, the company said. That is down from minus $2.75 for April. Umm Lulu’s OSP for May was set at parity to Murban’s OSP while the OSP for Das crude was at 35 cents a barrel below Murban’s OSP, it added. The OSP for Upper Zakum was 10 cents above Murban’s OSP. This is the second month that ADNOC is pricing its term cargoes on forward prices. ADNOC said it will continue to provide forward pricing on a monthly basis. “This will ensure that our customers have visibility of the prices that they will pay ahead of delivery and can plan accordingly,” ADNOC said.

Oil Majors Sell June Al-Shaheen Oil at Discounts of $8.50-$9.50

Oil majors including P66 sold up to five cargoes of Qatar’s Al-Shaheen crude for June loading at discounts of $8.50-$9.50/bbl to the Dubai benchmark price according to traders who asked not to be identified.

Standard cargo size 500k or 600k bbl

The spot deals come ahead of Qatar’s monthly tender offering June-loading Al-Shaheen crude, which is valid until Wednesday

Dubai’s premium over Brent widens on expected crude price cuts for Asia – Platts

Benchmark Dubai crude futures saw an uptick during midmorning trade in Asia on Wednesday, with the outright contract and intermonth spreads supported by expectations of further price cuts for Asian customers by Middle East crude exporters in the coming days. At 11 am in Singapore (0300 GMT) Wednesday, the June Dubai futures contract was pegged at $32.31/b, up 1.3% from $31.91/b assessed at 4:30 pm in Singapore (0830 GMT) at the close Tuesday. Middle East crude benchmark Dubai futures resisted a downward slide in global oil prices overnight as Saudi Arabian official selling price cuts issued to Asian customers solidified the case for other Middle East crude exporters to cut prices as well, said market participants. This was in contrast to June ICE Brent futures, which slid nearly 5% within the same time frame. The contract, assessed at $31.44/b at Tuesday’s Asian close, was down at $29.97/b by Wednesday morning, widening the European oil benchmark’s discount to Dubai futures. The June Brent/Dubai Exchange Futures for Swaps spread slid down to minus $2.34/b Wednesday morning in Asia. The spread, which typically pitches the higher quality Brent crude at a premium to medium sour Dubai-linked grades, has spent most of the month in negative territory. It briefly flipped into a premium at the end of last week, assessed at 41 cents/b on April 9, when optimism surrounding the OPEC+ production cuts deal propelled global oil prices upward. However, the spread slid back down to discounted territory after OPEC+ production cuts at 9.7 million b/d were regarded insufficient to balance the high degree of demand destruction in global oil markets for 2020. Saudi Aramco cut prices for all five grades to be exported to Asia in May, but did not mete out the same generosity to its European and US customer base. The kingdom’s May OSPs, the first to be issued among other global crude exporters such as Iraqi SOMO, and Kuwait Petroleum, will likely shape how these producers set prices for their exports to Asia, Europe and the US, respectively. Crude buyers in Asia are yet to receive OSPs from a host of Middle East producers, even though OSPs have been delayed well past their typical release dates this month.

India lockdown in focus

Meanwhile, an extended lockdown in India played on the minds of market participants in Asia Wednesday morning, damping sentiment for the June cycle further, they told S&P Global Platts. “India on extended lockdown is awful news for the market, it’s a huge [volume of] demand offline,” said one crude trader. India extended its countrywide lockdown until May 3 in its battle against the coronavirus pandemic, with Prime Minister Narendra Modi saying the extension was needed to stem the spread of the disease. The initial 21-day lockdown started March 25 and was due to end April 14. Crude demand in the country is expected to take more of a hit as refineries cut runs and crude throughput figures fall in step with lockdown measures, market participants told Platts. “We expect India’s crude runs to fall year-on-year by nearly 1.4 million b/d in the second quarter,” said Lim Jit Yang, adviser for oil markets at S&P Global Platts Analytics. Platts Analytics currently expects India’s oil demand to contract year on year by 405,000 b/d in the second quarter before posting positive growth in the second half of the year, taking the whole year demand decline to 110,000 b/d year on year. India has restricted cargo movements on coasts, but has allowed oil and gas cargoes, falling under the category of essential commodities, after clearance of COVID-19 quarantine protocol by port authorities. Upstream companies like ONGC and Cairn have managed to keep their operations running but have witnessed about 10%-15% fall in output due to shortage of workers.

Mideast Oil Pricing Cuts May Have Been Deeper Than Needed: Vitol

Abu Dhabi and Saudi Arabia may have priced their oil for delivery to Asian buyers in May more cheaply than was needed because they don’t want to risk a struggle to find buyers, said Mike Muller, Vitol Group’s director of oil business development and head of trading for Asia.

“A lot of people were fearful that with the reduced supply there would be less generosity shown toward the Asian refiners but the Saudis and now the Emiratis have come in with OSPs that are pragmatic to shift volume, possibly even more so than they needed, but it’s difficult to judge,” Muller said earlier Wednesday in a video conference with Dubai-based consultant Gulf Intelligence

Saudi Aramco “would rather be over-nominated and tell people ‘no, sorry you can’t have any more because we are at our quota now’ than find people are under-nominating”: Muller

Producers are likely to continue offering discounts in the physical market

“The overall market is pricing to shift barrels at the front of the market and if there’s a market perception that we have too much supply those prompt discounts will continue to manifest themselves”

Muller also said there is “lots of stress” in oil refining industry; “forecasts for economic recovery of negative numbers into next year means that some of those refineries on the margin are going to struggle to survive”

Crude Storage in ARA Rises 6.7%, Genscape Weekly Data Show

Crude inventories in ARA region rose 3.5m bbl in week ended April 10 to 55.5m bbl, Genscape data show.

Gazprom Neft Needs to Delay Some Projects on New OPEC+ Deal: CEO

Gazprom Neft needs to delay some projects as it will have to become more conservative after the new OPEC+ deal to cut oil production, CEO Alexander Dyukov said in a statement on the company’s website.

New large-scale projects haven’t reached the “active investment stage yet,” so the company has flexibility in decision making

Gazprom Neft has low debt

OPEC+ deal will help to stabilize the oil market

Coordinated reduction in global oil production is “the only correct reaction” to falling demand

Oil market situation and the OPEC+ deal won’t affect company’s 2030 strategy

Saudi Aramco Conducting Maintenance at Riyadh Refinery Units

Aramco doing maintenance work at its Riyadh refinery, according to the company’s weekly newsletter The Arabian Sun.

Aramco conducting “turnaround and inspection activities at various refining facilities” at crude-processing plant in Saudi capital

Co. doesn’t specify duration of work or units affected

Riyadh refinery can process 120k b/d of crude

Cargo Sizes Below 50% for Oil Barges Sailing to Inland Europe

Low water levels on the Rhine river mean that barges hauling middle distillate-type oil products — mostly gasoil/diesel — to inland Europe can only load less than half of their full capacity, according to Riverlake Barging, a brokerage.

A standard barge loading in Amsterdam-Rotterdam-Antwerp — which can haul 2.5k tons when fully laden — is limited to carrying 1.2k tons if sailing to destinations beyond Kaub, Germany, a key bottleneck on the river

Europe gasoil cash prices, cracking margins collapse as virus catches up with market – Platts

While gasoil demand in Europe has held up better than that of other refined oil products since the outbreak of coronavirus, the European gasoil complex has come under severe pressure this week, with cracking margins in the Amsterdam-Rotterdam-Antwerp hub and cash prices in the Mediterranean hitting their lowest levels on record, a trend sources have attributed to increasingly tepid demand and full storage tanks. At the end of March, sources in the ARA oil hub said demand for gasoil at 50 ppm and 0.1% sulfur in the region remained resilient in spite of various lockdowns and travel restrictions intended to halt the spread of coronavirus. “Demand is still there for heating oil, less so for the road fuel obviously,” a barge trader said at the end of March. “Consumers trying to get product at the good prices,” and were keen to buy in a contango market. In fact, demand for gasoil was so strong in certain markets, some sources said they were blending 10 ppm ULSD down into higher sulfur gasoil grades in order to satisfy consumers, a trend that seems to be winding down now. “I think that demand for diesel to use as heating oil will quieten down,” a trader said last week. “There are still a lot of deliveries to be done, notably in Belgium, which uses 10ppm diesel and 50ppm gasoil for heating buildings, but I am receiving fewer and fewer orders.” According to data from insights global, ARA gasoil and diesel inventories rose about 2% last week to reach their highest level in four weeks.

Now, sources in the ARA region say the demand picture is bleaker, more in line with market sentiment for ULSD, jet fuel and gasoline. For gasoil as well as other middle distillates in Europe, “looking at April and May, demand is just horrible,” one market source said Tuesday. This take on the market lines up with research from Platts Analytics, which shows European refineries have scaled back operations since the pandemic broke out, eating into refining margins. At the start of April, Platts Analytics said some 180,000 b/d of refining capacity in Northwest Europe had been lost due to discretionary run cuts, maintenance and planned idling of units. It is in this context that the ARA 0.1% barge cracking margin versus front-month ICE Brent crude futures was assessed at $1.88/b on Tuesday , a $1.37/b drop on the day and the lowest level for the crack on record. Platts first began to assess the crack in January 2007. Another source on Tuesday said that cracking margins for most oil products cannot improve until government restrictions on travel to prevent the spread of coronavirus are lifted.

Mediterranean markets under pressure

Compared to Northwest Europe, the Mediterranean gasoil market has been in an even more severe free fall since the outbreak of coronavirus. With warmer weather in the Mediterranean and less need for heating, sources have said local demand has crashed, leading to the lowest prices on record. Based on a standing offer observed in the Platts Market on Close assessment process, Mediterranean 0.1% gasoil cargoes were assessed at $227/mt on Tuesday, down $24/mt on the day and the lowest outright price on record since the assessment began in January 2008. Put differently, Mediterranean cargoes on Tuesday were assessed at a $52/mt discount to front-month ICE low sulphur gasoil futures, another record low. This helps explain why Mediterranean crude netbacks have been decimated since coronavirus. On Tuesday, Platts assessed the Arab Light crude cracking netback at an Italian refinery at $19.56/b, about 73% lower than a year ago. According to Platts Analytics, while refining capacity has dropped around 180,000 b/d in Northwest Europe due to discretionary run cuts, maintenance and planned idling of units at the start of April, in the Mediterranean, he figure was estimated at about 1.819 million b/d. In effect, this means the Mediterranean accounts for more than 12% of the 14 million b/d in global refining outages observed by Platts Analytics in early April. Looking ahead, there does not seem to be much hope that refinery cracks or gasoil cash prices will recover in April. According to the latest Oil Market Report from the International Energy Agency, “the impact of virus containment measures on global fuel demand has been severe. In March, global demand is estimated to have fallen by 10.8 million b/d year on year … in April, the year-on-year declines have almost certainly accelerated.” Thanks to coronavirus, global gasoil and diesel fuel consumption “for 2020 will fall 2 million b/d or 7%,” the report forecasts.

Jet fuel demand to remain low for years as airlines buckle up for tough ride – Reuters News

Demand for flights and jet fuel could take years to recover from the coronavirus crisis as airlines struggle to survive their worst downturn, haunted by possible changes in the habits of tourists and business travelers. Among the various fuels, jet has been hit hardest and industry leaders warn it will take years for all-important airline industry demand to return to 2019 levels. “Jet fuel consumption will be impacted for a longer time and maybe not recover fully even next year, as travelers remain concerned about long-haul vacations, and businesses get used to online meetings,” said Per Magnus Nysveen, head of analysis at Rystad Energy, a consultancy. Exemptions for agriculture and freight transport from widespread lockdowns have offered some support to diesel and fuel oil, but jet demand remains weak as a significant slice of the world’s 23,000-strong commercial plane fleet is in storage. Jet fuel prices in Singapore JET-SIN have slumped 61% over the last two months. Refining margins or cracks for jet fuel in Singapore are currently lingering at narrow premiums over Dubai crude after hitting minus $3.35 per barrel earlier this month, their lowest on record. The International Air Transport Association, representing airlines, has already warned of a slower recovery than in past crises. On Tuesday, it raised its forecast for 2020 revenue losses by 25% to $314 billion. Director General Alexandre de Juniac told Reuters he sees a staggered lifting of restrictions starting with domestic, then regional and finally intercontinental routes being reopened where fuel consumption plays a critical role. IATA has warned any recovery would not start before the last quarter of the year and could be short-lived if there is a new winter wave of coronavirus. Planemakers Airbus AIR.PA and Boeing BA.N have also warned of an extended crisis, with few analysts predicting a return to previous conditions until 2023 or 2024. According to Robert Stallard of Vertical Research Partners, it could be almost five years before the active aircraft fleet returns to where it was at the end of 2019. Just as important for fuel demand, many airlines expect to use the crisis to speed up retirements of their oldest and thirstiest jets. That said, low oil prices mean the incentive to invest in costly new equipment is tempered for now. Jet fuel demand averages about 8 million barrels per day (bpd). IEA said on Wednesday it expected demand for jet fuel and kerosene to fall by 2.1 million bpd on average in 2020, or 26%. Rystad expected jet fuel demand to fall at least 1.9 million bpd in 2020, and JBC Energy consultancy estimated jet fuel demand over the next few months to fall to below 2 million bpd and to 5.2 million bpd on average in 2020. “We see some normalization only in 2021,” said JBC Energy Asia’s managing director Richard Gorry, who sees a drop of 70% in jet demand in the second quarter of 2020. Some analysts believe the shift of businesses to a virtual arena during mandatory lockdowns might not disappear entirely once the coronavirus goes away. For finance directors, the crisis could be a tempting chance to reduce office, event and travel costs until economies grow and pressure to do business face-to-face resumes. Air travel and GDP growth have traditionally been closely tied. Homayoun Falakshahi, senior analyst at Kepler, said leisure trips could recover in the next couple of years, but business travel may take longer. “Technology improvement is a key reason why we don’t think business travel will resume sharply any time soon,” he said. Airport health checks, while helping to restore confidence through visible safety measures, could also discourage people from travelling by air. “Rather like what happened in the United States after 9/11, we could see the imposition of health checks, more paperwork, and basically more hassle and time getting through airports,” said Stallard. Under lockdowns people are adapting to a more local existence and consuming less globally produced fresh food, which may have a lasting impact on fuel demand, analysts at Goldman Sachs said. “Commuters and airlines account for 16 million bpd of global oil demand and may never return to their prior levels.” But IATA’s de Juniac said economic integration would continue and that has supported consistent growth in air transport. “Yes there will be a slowdown – there is already – but after a while people will recognize all the benefits coming from globalization,” he said in a video interview.

Fujairah data: Oil product stocks climb to highest since record in February – Platts

Volumes of oil products held in storage at Fujairah climbed to their highest since the all-time high seen in February as tumbling demand from the coronavirus pandemic left more supplies in the eastern UAE port. Stocks rose 5.3% over the past week to 24.953 million barrels as of Monday, with the greatest build seen in light distillates, according to data released Wednesday by the Fujairah Oil Industry Zone. Stocks are now the highest since the record of 25.98 million barrels was set on February 24. The Fujairah stock reporting began in January 2017. “With the demand depression caused by coronavirus, crude and oil product markets are in a steep contango structure,” Alex Yap, senior analyst at S&P Global Platts Analytics in Singapore, said. “This incentivizes companies to hold oil in storage.” Light distillate inventories jumped 21% in the week to a total of 6.94 million barrels, a four-week high, the data showed. Market sources said the gasoline market East of Suez has a glut of supply due to regional travel restrictions to contain the coronavirus. Gasoline demand this month is expected to be 50% lower than normal in Saudi Arabia and 55% lower in India, the International Energy Agency said in a report Wednesday. Demand is expected to remain below normal for the next several months, reaching 40% below normal for both countries in May and 5% below normal in June, it said. Physical 92 RON gasoline cargoes stood at a $13.20/b discount to front-month ICE Brent futures on Tuesday, a drop of $2.74/b week on week, S&P Global Platts data showed. In middle distillates, stocks built by 15% to 2.919 million barrels, also a four-week high, the data showed. India’s shaky demand for gasoil, as well as plentiful surplus volumes being pushed into the spot market, has had a negative impact on the East of Suez middle distillates market, sources said. Stocks of heavy distillates and residues stood at 15.094 million barrels, down 2% from the record 15.445 million set a week earlier. Bunker traders in Fujairah said they saw an uptick in demand this week. “Demand is good and we are getting orders for 20,000 mt to 30,000 mt,” a bunker trader said. Platts is the official publisher of the oil products data and Fujairah has the Middle East’s largest commercial storage capacity for refined oil products.

U.S. oil refiners’ weekly capacity seen down 75,000 bpd -IIR – Reuters News

April 15 (Reuters) – U.S. oil refiners are expected to have about 4.3 million barrels per day (bpd) of capacity offline for the week ending April 17, decreasing available refining capacity by 75,000 bpd from the previous week, research company IIR Energy said on Wednesday. Offline capacity is expected to fall to 4.2 million bpd in the week ending April 24. Refiners in the United States are delaying maintenance activities and curbing production as the coronavirus outbreak dents demand for fuel across the globe. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

April 15 |

April 13 |

April 10 |

|

04/24/2020 |

4,246 |

4,298 |

4,105 |

|

04/17/2020 |

4,286 |

4,315 |

4,121 |

|

04/10/2020 |

4,211 |

4,249 |

4,173 |

|

04/03/2020 |

3,364 |

3,295 |

3,229 |

|

03/27/2020 |

1,892 |

1,856 |

1,808 |

Jonathan Wagner

Ion Energy Group

180 Maiden Lane 25th Floor

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

![]()

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.