From: Terry Reilly

Sent: Thursday, March 19, 2020 8:08:35 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 03/19/20

PDF attached

Morning.

Green

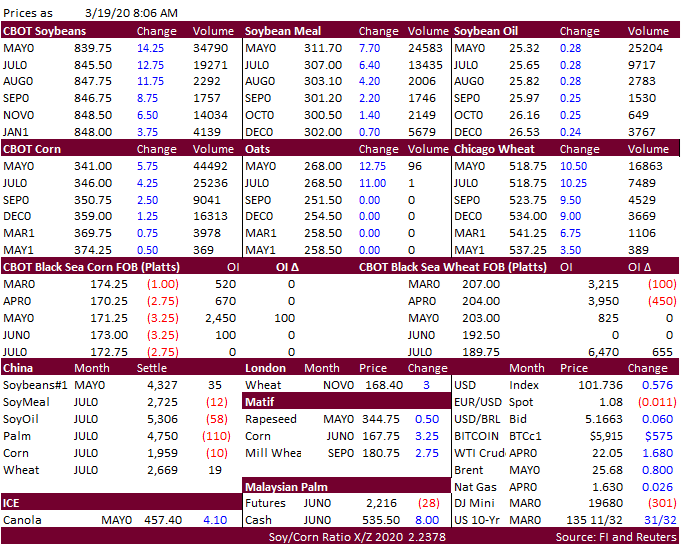

on the screen this morning driven by soybean meal and high protein wheat. USD is screaming higher. Global import tender demand remains strong with SK picking up at least 3 cargoes of corn and South Korean millers buying 136,000 tons of US wheat. Short covering

in corn seen after funds sold an estimated net 143,000 corn contracts over the past 6 business days.

Soybean

crush margins are on fire again. On our analysis, China crush margins are up 10 cents to $1.45 from the previous day, which promotes import business.

We remain

bearish corn based on US demand destruction, bullish meal and bullish high protein wheat.

![]()