From: Terry Reilly

Sent: Monday, February 24, 2020 7:59:56 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 02/24/20

PDF attached

Morning.

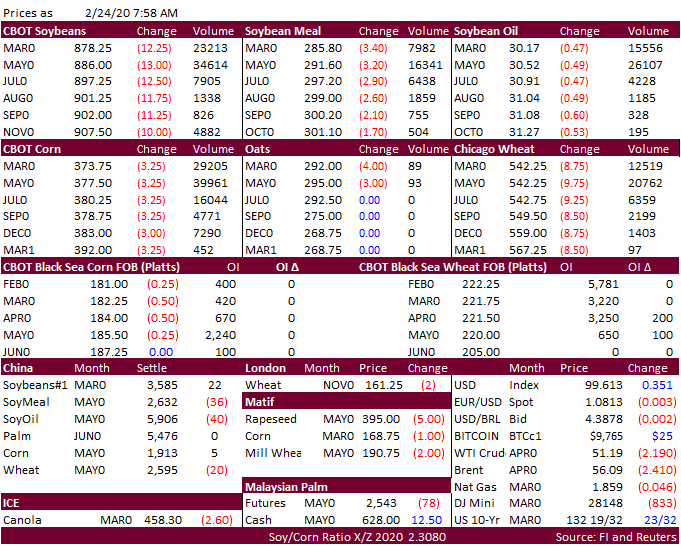

Global markets are turbulent Monday morning as COVID-19 was

reported to emerge in clusters outside of China. Nearly 79,500 infected and more than 2,600 deaths have been confirmed. The agriculture markets are not rolling over as hard as energy or equities. CH corn failed to trade at $3.80 at the time this was written.