From: Terry Reilly

Sent: Friday, February 21, 2020 8:52:47 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 02/21/20

Morning.

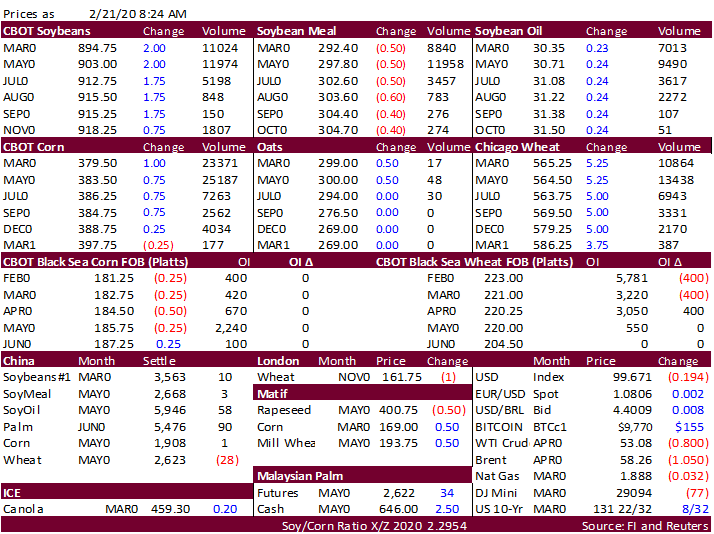

USDA released 2020-21 US S&D’s. SK was in for more corn. China expanded travel/lockdown restrictions as coronavirus continues to spread (500 cases in prisons). Look for

positioning today. Palm oil exports during the Feb 16-20 period improved.

![]()

USDA

released 2020 US Outlook Tables

https://www.usda.gov/oce/forum/2020/Outlooks.htm

https://www.usda.gov/oce/forum/

2020-21

US soybean ending stocks 320 vs. trade ave. 519 (-199) and compares to 2019-20 of 425

2020-21

US corn ending stocks 2637 vs. trade ave. 2443 (+194) and compares to 2019-20 of 1892

2020-21

US all-wheat ending stocks 777 vs. trade ave. 829 (-52) and compares to 2019-20 of 940

Stocks for corn are very

high, soybeans lower than expected and wheat lower than expected.

·

Favors soybean/corn spreading.

·

Tighter US soybean stocks of 320 million were 10 less than the lowest trade estimate (FI) and 105 million below 2019-20. STU falls to 7.4% versus 10.5 percent for 2019-20. USDA projects 2020-21 US crush up

25 million to 2.130 billion and exports up 225 million to 2.050 billion.

·

US soybean meal domestic use estimated up 700,000 short tons to record 37.500 million and exports are down 100,000 from 2019-20.

·

US soybean oil stocks are expected to rise 35 million pounds at 1.550 billion from 2019-20. They see US soybean oil for biodiesel use at 8.500 billion pounds, unchanged from the baseline, and up 300 million

pounds from 2019-20. Interestingly they have a 33 cent target on SBO.

·

Corn for ethanol projected up only 25 million bushels from 2019-20, while exports are up 375 million from 2019-20. US corn for feed is up 275 million. Unusually high US carryout of 2.637 billion yields a

17.9% STU.

·

Wheat for feed projected down 30 million bushels and stocks are down 163 million from 2019-20. No major surprises.

IMO

– Overall the USDA 2020-21 outlook is supportive for the US soybean complex, but traders will need verification of USDA’s high 2020-21 export number from fresh China buying. Our upward objective for the SX0/CZ0 ratio is 2.425-2.44 area. We like owning soybean

oil over meal over the long-term, unless soybean meal demand shifts from Argentina to US amid increasing economic woes within Argentina in 2020. US corn stocks are viewed as negative, but the market is seeing support from higher wheat prices.