From: Terry Reilly

Sent: Friday, February 07, 2020 8:21:57 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 02/07/20

PDF attached

Morning. Quiet on the news front.

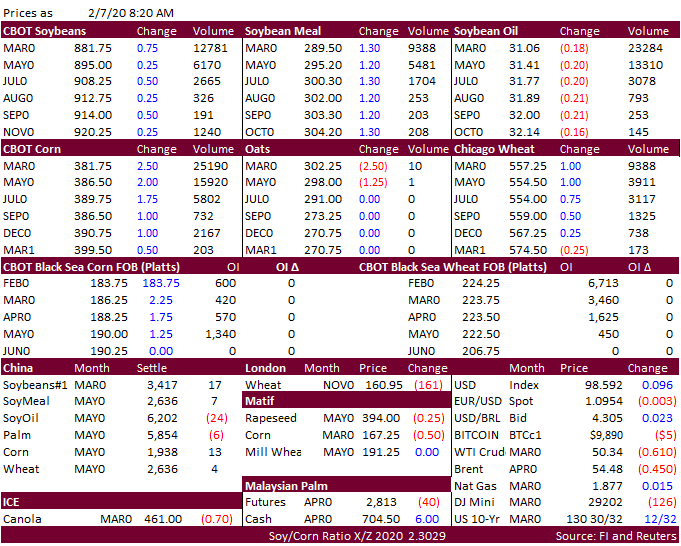

![]()

Does not appear USDA will incorporate Phase One trade deal into their Feb S&D report.

https://www.usda.gov/oce/commodity/reports/USDATradeForecastsAndUSChinaAgreement.pdf