From: Terry Reilly

Sent: Friday, January 10, 2020 8:28:21 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 01/10/20

PDF attached

Morning.

MPOB Malaysian palm S&D was bullish and China CASDE neutral. USDA export sales were flat out poor and one of the worst reports I have seen in a while. USDA weekly export commitments were a marketing year low for wheat, corn, rice, and soybean meal.

![]()

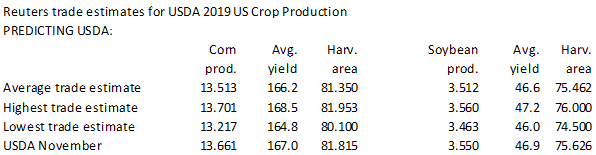

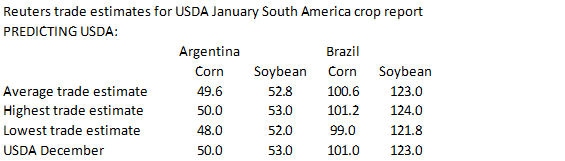

Reuters

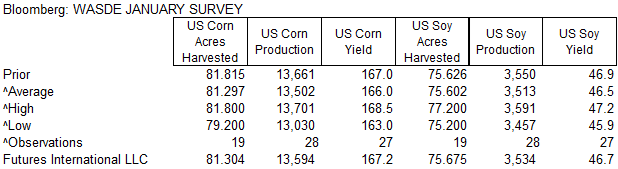

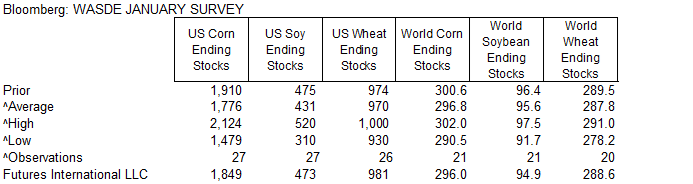

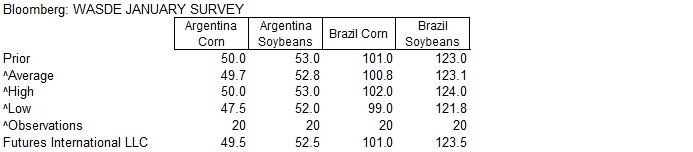

Estimates

Source:

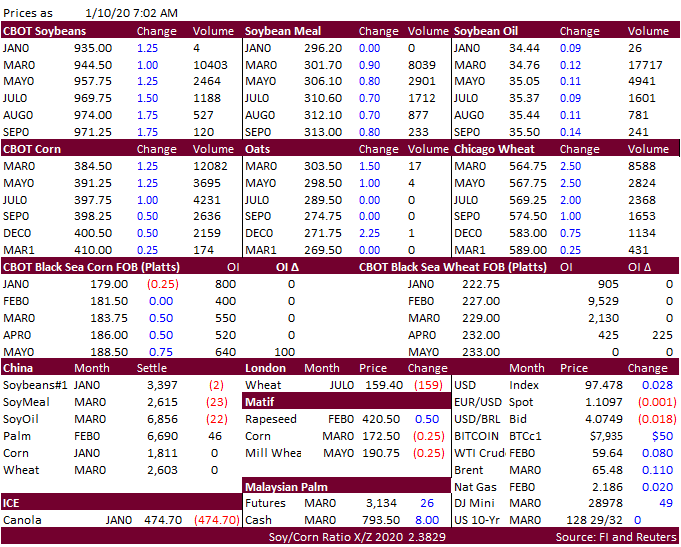

Reuters and FI