From: Terry Reilly

Sent: Tuesday, February 11, 2020 11:43:14 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Grain Market Snapshot 02/11/20

PDF attached

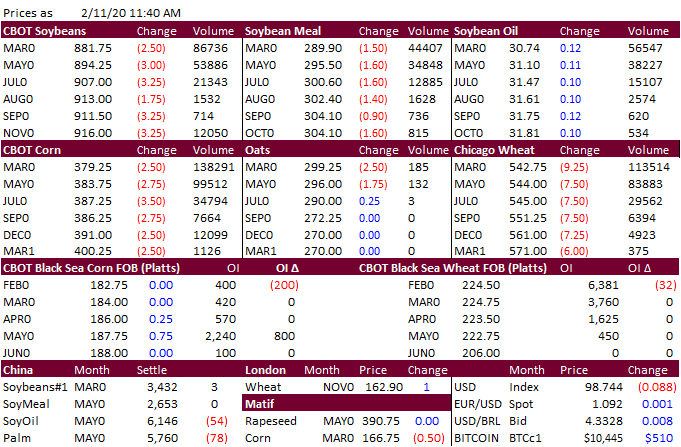

Trading ranges slightly raised on back end for soybeans and corn, lowered both ends for wheat

USDA released it February report updates

Initial reaction:

Bearish soybeans with Brazil upward revisions to production and exports weighing on prices, despite USDA increasing their outlook on US soybean exports. Bearish corn on large South American corn output. USDA did increase its US corn for ethanol projection but lowered exports. Wheat neutral. We believe unwinding of wheat/corn spreads are pressuring wheat prices despite the 25-million-bushel reduction in USDA US ending stocks. Fact remains US wheat stocks will remain very high relative to a ten-year average.

USDA NASS and OCE executive summaries

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

https://www.usda.gov/oce/commodity/wasde/Secretary_Briefing/index.htm

Soybeans

USDA lowered the 2019-20 US soybean carryout by 50 million bushels to 425 million, 18 million less the average trade guess. US soybean stocks are down 53.5 percent from 2018-19.

US 2019-20 soybean STU decreased to 10.5 percent from 11.9% projected in January.

2019-20 US soybean exports were lifted higher by 50 million (we were looking for 25) to 1.825 billion bushels, above 1.748 billion in 2018-19. USDA noted China buying of US soybeans, something the trade is still looking for in large quantities. This comes after USDA raised Brazilian soybean exports by 1 million tons to 77 million tons. All other US soybean demand components were left unchanged.

USDA lowered its 2019-20 US soybean oil yield to 11.54 from 11.60 pounds per bushel. US soybean oil production is projected lower by 130 million pounds to 24.290 billion. USDA lowered biodiesel by 300 million pounds and food use by 100 million and raised exports by 200 million pounds. Ending stocks were increased 69 million pounds to 1.515 billion pounds, below 1.775 billion pounds at the end of 2018-19. Note end of January soybean oil stocks were reported at 2.094 billion pounds, 148 million above year earlier. It appears USDA is bullish soybean oil demand for second half 2019-20.

The US soybean meal yield was taken down slightly to 47.01 from 47.03. USDA lowered US soybean meal production by 25,000 short tons and lowered ending stocks by same amount to 375,000 short tons. We agree with these changes.

USDA increase global soybean production and stocks by 1.7 and 2.2 million tons. World ending stocks at 98.9 million tons are projected 11.1% below 2018-19. USDA boosted Brazil soybean production by 2 million tons to 125.0 million tons and increased Brazil soybean exports by 1.0 million tons to 77 million tons. Argentina soybean production was left unchanged at 53.0 million tons. China soybean imports were upward revised 3.0 million tons to 87.0 million, up nearly 7 percent from 2018-19.

Corn

USDA left its 2019-20 US corn carryout unchanged at 1.892 billion bushels, 28 million greater the average trade guess. US corn stocks are down 10.5 percent from 2018-19.

US 2019-20 corn STU was left unchanged at 13.4 percent.

US corn for ethanol was taken up 50 million bushels to 5.425 billion, above 5.376 billion for 2018-19. US corn exports were lowered 50 million bushels, a surprise in our opinion. The large SA crops, and strong pace of Ukraine corn exports, are expected to gain cut into the US export market program.

World corn stocks were lowered 1 million tons to 296.8 million tons, 7.4% below 2018-19. World corn production was taken up 800,000 tons to 1.112 billion tons, 1 percent below 2018-19. USDA left Brazil and Argentina corn production unchanged. SAf corn production was upward revised 500,000 tons.

Wheat

USDA lowered the 2019-20 US all-wheat carryout by 25 million bushels to 940 million, 14 million less the average trade guess. US all-wheat stocks are down 13.0 percent from 2018-19.

US 2019-20 all-wheat STU decreased to 43.4 percent from 45.1% projected in January.

USDA lifted US all-wheat exports by 25 million bushels to 1.0 billion bushels, above 936 recorded for 2018-19.

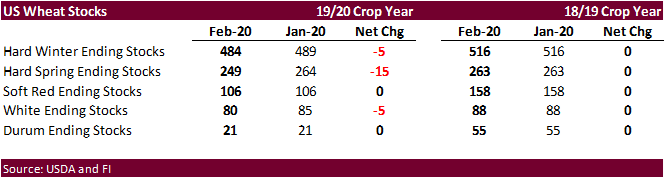

By class, USDA reduced US HSW stocks by 15 million bushels.

World wheat production was lowered 0.4MMT to 764.0 million (4.4% above 2018) and global stocks were down slightly from January estimate. USDA left production estimates unchanged for Brazil, Australia, Argentina, Canada, EU and Russia.

Price outlook

- CBOT March corn is seen in a $3.75 and $3.90 range

- CBOT March soybeans are seen in a $8.70-$8.95 range

- March soybean meal is seen a $285 and $300 range

- March soybean oil 30.10-31.90 range

· CBOT Chicago March wheat is seen in a $5.30-$5.65 range

· CBOT KC March wheat is seen in a $4.55-$4.80 range

· MN March wheat is seen in a $5.20-$5.45 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.