From: Terry Reilly

Sent: Monday, April 13, 2020 3:53:23 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 04/13/20

PDF attached

Japan’s

weather bureau estimates a 60 percent chance of no El Nino.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Today’s

weather has not changed much since Friday for most areas around the world. The U.S. will continue to deal with frequent bouts of precipitation and temperatures will be colder biased in the Midwest, Delta and southeastern states as well as the southern Plains

this week. The environment will not be conducive for improving field conditions.

In

South America, conditions will remain favorable in Argentina over the next week to ten days, although soil moisture will decline and that may lead to some need for timely rain in a few of the very latest maturing crops. Brazil crop weather will be favorably

mixed for mostly good conditions during the next ten days, but greater rain may be needed in the drier pockets of the south.

China

will see a good mix of rain and sunshine in east-central areas which may promote some planting, but it will be slow for a little while longer. Planting in southern China will remain very slow until better drying conditions evolve.

India’s

weather will be good for winter oilseed maturation and harvest progress. South Africa weather will remain good for both late season crop development and early season harvesting.

Southeast Asia oil palm and coconut production is advancing well except in parts of the Philippines where dryness is prevailing.

Europe

dryness may raise some worry among a few coarse grain producers, but the areas that usually plant first have some moisture to work with. Rapeseed in France, Germany and the U.K. may need some moisture soon.

Overall,

weather today will likely provide a mixed influence on market mentality.

Source:

World Weather Inc. and FI

MARKET

WEATHER MENTALITY FOR WHEAT:

No

permanent crop damage is expected this week as unusually cold air overtakes much of the U.S. hard red winter wheat production areas. Cooling in the Midwest will also have little to no impact on crop production. Some vegetation burning is expected in both

areas, however.

Dryness in Europe and a few areas in Ukraine, southern Russia and Kazakhstan will continue a concern, but there is still plenty of time for improved weather before crops are at risk of a change in production potential.

China

and India wheat production potentials still look very good as do yields in Pakistan. Southern Australia’s long-range outlook is also improving for planting conditions late this month and especially in May and June.

Planting

in South Africa may be getting off to a better than usual start because of recent precipitation and that which is coming. Some areas in southern Brazil will need rain soon for planting and establishing its winter wheat.

Overall

weather today will have a mixed influence on market mentality.

Source:

World Weather Inc. and FI

Weekend

webinars

University

Of Illinois:

- Acres

& Crisis: Prospective Plantings and Perspectives from the Past.

Coppess,

J., N. Paulson, G. Schnitkey, C. Zulauf and K. Swanson. “Acres & Crisis: Prospective Plantings and Perspectives from the Past.”

farmdoc daily (10):66, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 9, 2020.

https://farmdocdaily.illinois.edu/2020/04/acres-crisis-prospective-plantings-and-perspectives-from-the-past.html?utm_source=farmdoc+daily+and+Farm+Policy+News+Updates&utm_campaign=5958f1c98f-FDD_RSS_EMAIL_CAMPAIGN&utm_medium=email&utm_term=0_2caf2f9764-5958f1c98f-173649469

- Impacts

of Covid-19 on Agricultural Assets and Lending Markets https://farmdoc.illinois.edu/event/impacts-of-covid-19-on-agricultural-assets-and-lending-markets?utm_source=Webinar+List&utm_campaign=de18e823c3-EMAIL_CAMPAIGN_2020_02_20_07_26_COPY_01&utm_medium=email&utm_term=0_166a5dd42c-de18e823c3-175287057

Kansas

State:

Ongoing

Effects on Livestock Markets from COVID-19 Pandemic

https://agmanager.info/news/recent-videos/ongoing-effects-livestock-markets-covid-19-pandemic

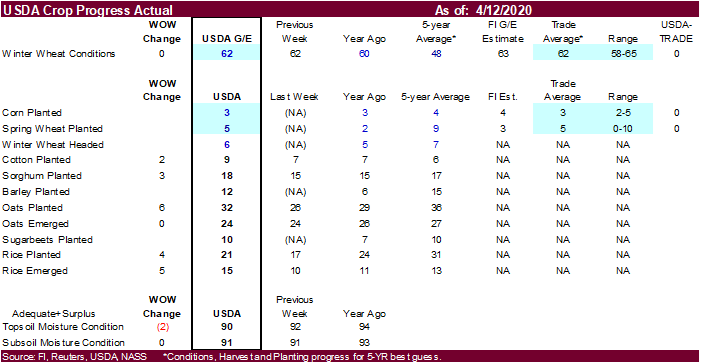

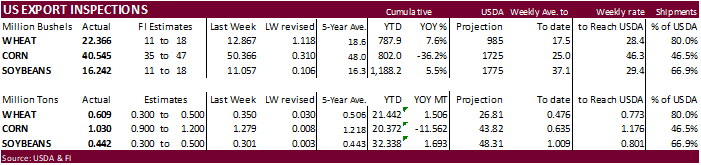

USDA

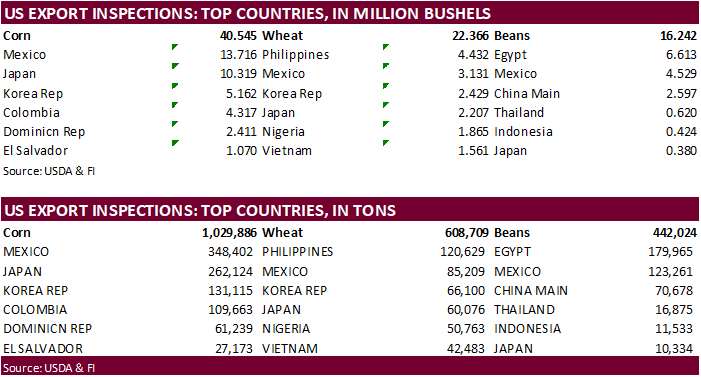

inspections versus Reuters trade range

Wheat

608,709 versus 300000-500000 range

Corn

1,029,886 versus 800000-1200000 range

Soybeans

442,024 versus 300000-500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING APR 09, 2020

— METRIC TONS —

————————————————————————-

CURRENT

PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 04/09/2020 04/02/2020 04/11/2019 TO DATE TO DATE

BARLEY

0 0 0 30,499 9,108

CORN

1,029,886 1,279,364 1,191,442 20,371,971 31,933,828

FLAXSEED

0 0 72 520 462

MIXED

0 0 0 0 0

OATS

0 0 499 3,243 2,592

RYE

0 0 0 0 0

SORGHUM

195,368 9,160 11,488 1,982,484 1,071,424

SOYBEANS

442,024 300,915 476,305 32,338,327 30,645,028

SUNFLOWER

0 0 0 0 0

WHEAT

608,709 350,190 528,714 21,442,019 19,935,798

Total

2,275,987 1,939,629 2,208,520 76,169,063 83,598,240

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

·

USD was down 16 points by 2 pm CT.

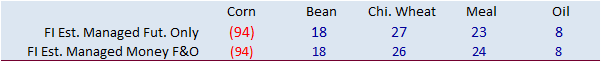

- Corn

futures trended lower but late in the session bounced well off session lows after the May contract held above its contract low. Top global mineral oil producing companies agreed to a deal to lower daily output by about a tenth to help stabilize prices, but

at the same time acknowledged world petrol/gasoline consumption will continue to come under pressure. This didn’t sit well with corn longs hoping for a short-term recovery in US ethanol production. Futures also started the day lower from ongoing concerns

over corn for feed demand. On the other hand, wet weather across the majority of the US growing areas is keeping producers from fieldwork activity, which is slightly supportive. Cold weather for the US for the remainder of the week will slow evaporation

rates. After the morning open, 1,400 July corn puts traded at $3-$3.375. 1,500 CZ 380/360 put spreads were sold at 14. US meat futures dropped like a rock today on coronavirus concerns related to logistics.

- USDA

US corn export inspections as of April 09, 2020 were 1,029,886 tons, within a range of trade expectations, below 1,279,364 tons previous week and compares to 1,191,442 tons year ago. Major countries included Mexico for 348,402 tons, Japan for 262,124 tons,

and Korea Rep for 131,115 tons. - Little

planting, if any, was completed across the US Delta and Southeast over the weekend due to widespread precipitation.

·

USDA confirmed a case of H7N3 bird flu at a commercial farm in South Carolina. This is the first case of any bird flu kind for the US since 2017 (HAI and LPAI H7N8), and not the same strain that killed 50

million birds in 2014 and 2015 (H5N1, H5N2 and H5N8). The H7N3 does not infect humans that we know of.

- More

and more meat processing plants are closing due to coronavirus outbreaks. 100’s of workers tested positive and at least three American meal workers have passed from the disease. One plant in Colorado’s Weld County tested positive.

- Over

the weekend we learned a large US pork processing plant will shut down indefinitely. Smithfield Foods Inc. plant in Sioux Falls, South Dakota accounts to 4 to 5 percent of US production.

·

Brownfield: PLANTING CORN AT ‘A $100/ACRE LOSS’. They see break even in corn around $3.50-$3.60/bu.

https://brownfieldagnews.com/news/planting-corn-at-a-100-acre-loss/

- French

corn plantings as of April 6 were running at 4%, up from 1% a week earlier and below 13% last year.

Vietnam

update on ASF

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Vietnam%20African%20Swine%20Fever%20Update_Hanoi_Vietnam_04-08-2020

- Results

awaited: Syria seeks 50,000 tons of soybean meal in a combo with 50,000 tons of corn on May 12.

- Late

last week Algeria bought 40,000 tons of corn from Argentina for FH May shipment at near $194 to $195/ton c&f.

- May

corn is seen in a $3.15 and $3.65 range. July could reach below $3.00 if we ongoing US industrial demand destruction. December is seen in a $2.85-$3.95 range.

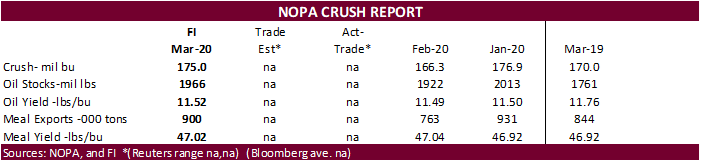

- Soybeans

fell following bear spreading in soybean meal over concerns of weakening US feed demand. Soybean July 860 and 870 puts options were active. July crush fell for the third consecutive day to 85.75 cents to its lowest level since early November 2019. A few

weeks ago, it was trading around $1.17. Soybean oil saw an outside day lower. July soybeans dropped 8.75 cents, July meal by $3.30/short ton, and July soybean oil by 49 points.

- IL

crude SBO was last heard around 50 over, East nominal 75 over and West 25 over. Gulf fob degummed oil was nominal 200 over. Argentina was nominally 10 under and Brazil degummed oil nominal 40 over. - USDA

US soybean export inspections as of April 09, 2020 were 442,024 tons, within a range of trade expectations, above 300,915 tons previous week and compares to 476,305 tons year ago. Major countries included Egypt for 179,965 tons, Mexico for 123,261 tons, and

China Main for 70,678 tons.

·

Last week Sinograin agreed to release another 500,000 tons of soybeans from state reserves to Cofco.

- Bloomberg

reported about a million tons of 2019 Canadian canola that was left in the fields over the winter could be harvested soon.

- APK-Inform

reported new-crop rapeseed quotes dropped $20-30 per ton FOB Black Sea since mid-March to around $378-380 per ton for July delivery. - APK-Inform

estimated the Ukraine 2020 sunflower crop at 15.4-15.7 million tons, nearly unchanged from 2019 while the soybean crop could decline to 3.9-4.2 million tons from 4.4 million tons in 2019. September to date sunflower oil exports are up 83 percent.

·

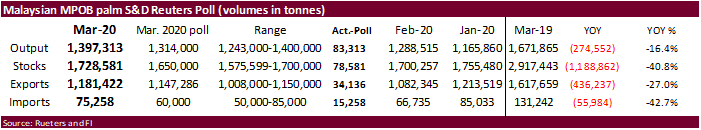

ITS reported Malaysian palm exports during the 1-10 April period at 312,900 tons, down 6.6 percent from the previous month.

·

The Malaysian Palm Oil Board will reduce the crude palm export duty from current 5 percent to 4.5 percent for May.

·

Malaysian palm markets:

MBOB

S&D was viewed as bearish but a slowdown in April production supported prices on Friday.

- Last

Wednesday the USDA bought 9,070 tons of vegetable oils for its export program from $1,008.95 to $1,085.77 per ton.

- On

April 21 the USDA seeks 1,510 tons of vegetable oils under its PL480 program. - On

Friday USDA reported under the 24-hour announcement system on 4/10/20, private exporters sold 120,000 tons of soybeans for delivery to unknown.- 60,000

tons is for delivery during the 2019-20 marketing year - 60,000

tons is for delivery during the 2020-21 marketing year

- 60,000

- Results

awaited: Syria seeks 50,000 tons of soybean meal in a combo with 50,000 tons of corn on May 12.

- May

soybeans are seen in a $8.40-$8.80 range. July $8.45-$8.95 range. - May

soybean meal is seen in a $283 to $310 range. July $285-$320 range. - May

soybean oil range is 26.00 to 28.50. July 26.00-30.00 range.

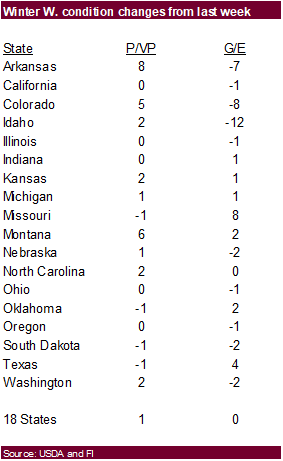

- All

three US wheat markets were higher early on Monday but traded two sided. Chicago ended 1.25-2.00 cents lower, KC wheat 1.75-2.50 cents lower and MN wheat 4.0-4.75 cents lower.

- After

the close, Egypt announced they seek wheat for May 15-25 and May 26-June 5 shipment. The Tender will be held on an FOB basis with a separate tender for freight.

- Egypt

plans to buy 3.6 million tons of local wheat, enough to cover 4.5 months of local needs. That should increase wheat reserves to over 10 months after they secure another 800,000 tons of wheat imports during their harvest season, which was announced Thursday.

Egypt harvests wheat from early May to early June. - USDA

US all-wheat export inspections as of April 09, 2020 were 608,709 tons, above a range of trade expectations, above 350,190 tons previous week and compares to 528,714 tons year ago. Major countries included Philippines for 120,629 tons, Mexico for 85,209 tons,

and Korea Rep for 66,100 tons. - US

HRW wheat growing areas will see well below average temperatures this week. Frosts, freezes and snow started over the weekend across the upper Great Plains into the upper Midwest. Snow in the north will help protect the crop but the southern areas may see

burn back. It could get as low as the 20’s in the southern areas and teens in the north.

- The

GFS midday weather models reduced rain for France and Germany this weekend and April 23-25, respectively.

- Russian

wheat prices at the end of last week were about $4.00/ton lower at $202/ton for new-crop, while old crop was up $3/ton to $227/ton.

- Romania

will ban wheat and grain exports to non-EU countries until mid-May. A

Romanian wheat cargo destined for Egypt is held up by the export ban. - Ukraine

2020 wheat production was estimated at 26.7 million tons from 28.3 million in 2019, according to APK-Inform.

- Ukraine

spring plantings were 18 percent complete as of April 9,m according to the Ministry for Development of Economy.

- India

will export 50,000 tons of wheat to Afghanistan under a government to government arrangement. They will also provide 40,000 tons of grain to Lebanon under a similar arrangement.

- Jordan

is set to receive 15 cargos of grain, or 950,000 tons between April and September.

- FranceAgriMer

reported 62 percent of the French wheat crop was in good and very good condition, as of April 6, unchanged from the previous week and compares to 83 percent year earlier. The winter barley and durum wheat conditions fell one points from the previous week.

Spring barley was 63% emerged, up from 44% a week earlier and well below 98% last year.

- Saudi

Arabia bought 600,000 tons of barley at an average price of $198.63/ton c&f for July-August shipment.

- Turkey’s

TMO bought about 250,000 tons of 12.5%-13.5% protein optional origin wheat for April 20 and May 15. Prices were widely unavailable. At least 25,000 tons was bought at $239.65 a ton c&f.

- Jordan

received offers for 120,000 tons of wheat. - USDA

reported under the 24-hour announcement system private exporters sold 120,000

tons of hard red winter wheat for delivery to unknown destination. Of the total, 60,000 tons is for 2019-20 marketing year and 60,000 tons is for 2020-21 marketing year. - USDA

reported under the 24-hour announcement system on 4/10/20, private exporters sold 165,000 tons of hard red winter wheat for delivery to China.

- 55,000

tons for delivery during the 2019-20 marketing year - 110,000

tons for delivery during the 2020-21 marketing year

- 55,000

- Ethiopia

postponed their import tender for 400,000 tons of wheat until April 23. They are in for 200,000 tons on April 15 in a separate tender.

Rice/Other

Updated 4/9/20

- May Chicago $5.25 and $5.70 range. July (new-crop) $5.00-$5.75.

- May KC $4.65 and $5.05 range. July $4.50-$5.80

- May MN $5.20 and $5.45 range. July $5.25-$5.55.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for

the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender

immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.