From: Terry Reilly

Sent: Friday, April 03, 2020 2:23:01 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 04/03/20

PDF attached

CFTC

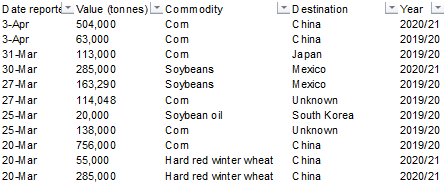

CTO will be sent in a separate email. China bought 567,000 tons of US corn.

WTI

and Brent extended gains. Higher trade in some US agriculture futures were muted on concerns over feed demand for corn and soybean meal. Palm oil traded lower. China crush margins are still near multiyear highs. US March jobs number out today was thought

to be already obsolete. 4.4% unemployment rate, down 701,000.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Weather

in South America, South Africa and India remains favorable for most oilseed development. However, concern over Sao Paulo and parts of Parana soil moisture during the next two weeks will be rising in second season corn production areas due to limited rainfall

and warm temperatures.

India’s

rapeseed is benefitting from drier weather to help reduce a quality decline because of moisture during crop maturation and harvest season.

Improving

rainfall in Southeast Asia will be good for palm oil production and corn planting.

China’s

recent flooding rain in the south and that which is expected this weekend into next week will delay early season coarse grain planting and will keep rapeseed development a little sluggish as well. Dryness is also a concern in Yunnan.

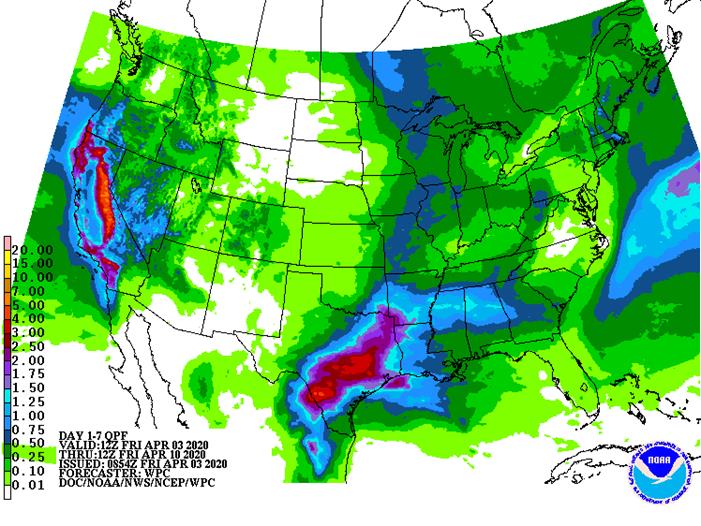

U.S.

early season grain and oilseed areas are facing similar conditions with frequent precipitation and soggy field conditions to limit field progress for a while. Today’s somewhat drier biased outlook does offer a few pockets of drying, but the bottom line will

require much more precipitation.

Australia needs greater rain in the south prior to late April and May planting of canola. Rain in New South Wales and neighboring this week has improved topsoil moisture, but follow up rain will be needed since planting does not begin until late this month.

Europe’s

drier weather bias in place today will improve field conditions for planting. Warming temperatures are needed before much early corn will be seeded and the coming week will be notably warmer. Winter rapeseed will be breaking dormancy, but no aggressive crop

development is expected for a little while. Warming next week will raise the need for timely rain as some areas dry out.

Overall,

weather today will provide a mixed influence on market weather mentality with a bearish bias.

MARKET

WEATHER MENTALITY FOR WHEAT:

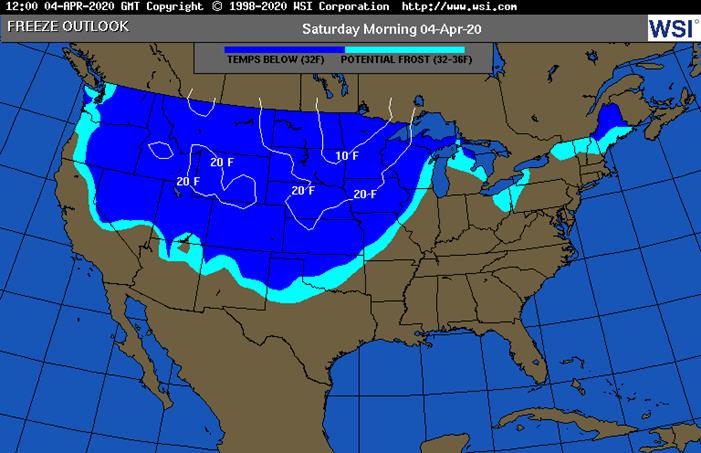

No

permanent crop damage was suspected from the bitter cold noted in the northwestern U.S. Plains this morning, although the situation was stressful and some minor damage was suspected in areas where temperatures dropped near zero Fahrenheit. Livestock stress

was also suspected because of the return of bitter cold in some areas.

India’s

drier weather this week will has been welcome after too much rain fell last weekend in northern production areas. China winter crops are in mostly good condition with more aggressive development expected as soon as additional warming kicks in.

U.S.,

Russia and Europe winter crop conditions vary from fair to very good. Recent frost and freezes in southern production areas did not permanently harm crops, but vegetative growth in the far south may have been burned back. Warming is needed in all production

areas. Soil conditions are slowly drying, but no area is critically dry. Romania, southwestern Ukraine, Kazakhstan and eastern parts of Russia’s Southern Region will need rain as soon as the next round of warming occurs later this month.

There

is some need for timely precipitation in the drier areas of western Kansas and eastern Colorado as well as central Washington. Recent wet weather in Spain was ideal for its winter grains.

North

Africa and the Middle East will need dry weather soon to promote grain maturation and harvesting. Too much moisture could result in a grain quality decline. Morocco has been too dry this year and will come up quite short on production.

Wheat planting prospects for Australia and South Africa are good this year because of recent rain and that which is expected over the next few weeks. A large part of southern Australia is still quite dry, but World Weather, Inc. anticipates improving rainfall

this autumn.

Overall, weather today will likely provide a mixed influence on market mentality.

Source:

World Weather Inc. and FI

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

MONDAY,

April 6:

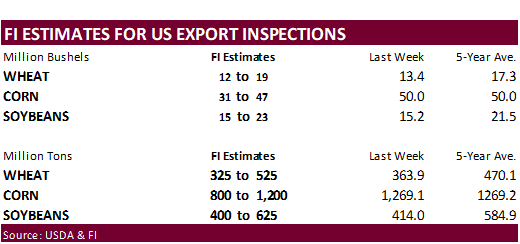

- USDA

weekly corn, soybean, wheat export inspections, 11am - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - New

Zealand Commodity Price

TUESDAY,

April 7:

- Purdue

Agriculture Sentiment, 9:30 am - France

agriculture ministry to issue field-crop planting estimates for 2020 season

WEDNESDAY,

April 8:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - CNGOIC’s

monthly report on China soy, corn supply and demand - FranceAgriMer

monthly cereals balance sheet

THURSDAY,

April 9:

- USDA’s

monthly World Agricultural Supply and Demand (Wasde) report, noon - China

agriculture outlook committee (CASDE) to publish monthly supply/demand forecast for soybean, corn, cotton and sugar - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am - Port

of Rouen data on French grain exports - Brazil

crop agency Conab posts 7th report on 2019-20 soy, grains output

FRIDAY,

April 10:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysian

Palm Oil Board to release stockpiles, export and production data - Cargo

surveyors AmSpec and Interetk to release Malaysia’s April 1-10 palm oil export numbers

Source:

Bloomberg and FI

·

US Change In Nonfarm Payrolls Mar: -701K (exp -100K; prev 272K)

·

US Unemployment Rate Mar: 4.4% (exp 3.8%; prev 3.5%)

–

Labour Force Participation Rate Mar: 62.7% (exp 63.3%; prev 63.4%)

·

US Markit Services PMI Mar F: 39.8 (est 38.5; prev 39.1)

–

Markit Composite PMI Mar F: 40.9 (prev 40.5)

·

US ISM Non-Mfg Index Mar: 52.5 (est 43.0; prev 57.3)

·

Russia To Halt All Int’l Flights From Tomorrow

·

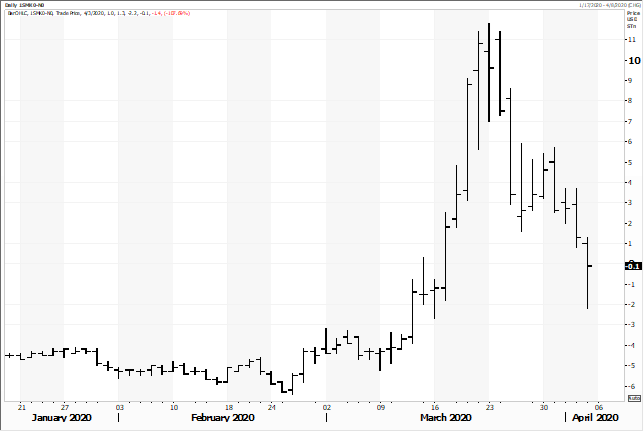

Nearby corn futures fell for the sixth straight session on fears US feed demand will not be as robust going forward. Back months ended higher. A collapse in the US livestock and hog futures are increasing

concerns that animal unit expansion will slow over the next several months. Hog futures for June dropped by the expanded limit of 4.5 cents or 8.5 percent during the trade Friday. This notion also hit the soybean meal market this week. Ongoing US biofuel

woes also pressured prices. Both nearby Brent and WTI crude oil were higher, which may have limited losses.

·

Nearby rolling weekly corn hit its lowest level since September 2016.

·

An industrial plant lowered corn bid in Marion OH 10 under, down 5, for spot bids only.

·

South Korea about 197,000 tons of corn overnight but the origin was thought to be South America.

·

Under the 24-hour announcement system, US exporters sold 567,000 tons of corn to China.

o

63,000 for 2019-20

o

504,000 tons for 2020-21

- Precipitation

for the Delta and lower Midwest early this month might be frequent enough to delay planting progress.

- The

U.S. biofuel industry has asked the Trump administration for aid via CCC program. The CCC is not only to designed to ease disasters and provide public funding for a wide variety of assistance, but it also supports food donations to countries in need. The

letter to the White House noted US plants idled some 3.5 billion gallons of annualized ethanol production, 25 percent of the industry. That figure is higher than 3 billion talked about earlier this week.

·

On Thursday we lowered our corn for ethanol for 2019-20 to a low 5.000 billion bushels, below 5.378 billion for 2018-19 and well below USDA’s 2019-20 estimate of 5.425 billion.

- The

South African Rand hit a record. ZAR below

·

Under the 24-hour announcement system, US exporters sold 567,000 tons of corn to China.

o

63,000 for 2019-20

o

504,000 tons for 2020-21

- South

Korea’s MFG bought 66,000 tons of corn at $188.45/ton c&f for shipment between June 26 and July 18. Origin was thought to be SA.

- South

Korea’s MFG bought 69,000 tons of corn at $188.49/ton c&f for arrival around August 28. Origin was thought to be SA.

- South

Korea’s KFA bought 62,000 tons of corn at $184.43/ton c&f for arrival around September 30. Origin was thought to be SA.

- Egypt

might be looking around for a couple cargos of Ukraine corn.

- CBOT

May is seen in a $3.10 and $3.70 range. July could reach below $3.00 if we see a major reduction in US ethanol production. December is seen in a $2.85-$3.95 range.

- CBOT

soybean complex was mostly higher early but collapsed on domestic soybean meal demand concerns and USDA/NASS’s downward revision to the US February crush. May soybeans finished 4.50 cents lower at $8.5425. SX 860 puts were active today.

- Soybean

meal ended $2.30-5.90 5.80 lower led by bear spreading. The Soybean meal May/July spread collapsed again, back to mid-March values.

- Soybean

oil saw a small lift for the second consecutive day on higher WTI crude oil.

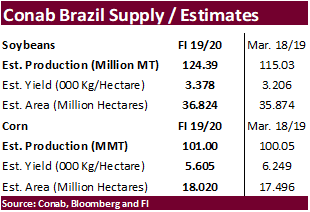

·

Abiove revised their Brazil soybean production to 120.75 million tons from 118.7 million in February, but left exports and crush unchanged at 73.5 million and 44.5 million tons. This boosted their ending

stocks from 1.3 to 3.3 million tons.

·

Brazil’s Agriculture Ministry expects large price swings due to the coronavirus outbreak.

·

The Brazilian real hit another record. It was last 5.3157 around 2:16 pm CT.

·

Argentina soybean oil as of early Friday morning slipped 5.4 percent from the previous week. US Gulf declined 0.8 percent.

·

BA Grains Exchange said they do not expect much rain for Pampas through April 8. 8 percent of the soybean crop had been harvested, below average.

·

China said they have not resumed Canadian canola imports this week after Canada’s Agriculture Minister earlier this week mentioned China would allow imports to continue.

·

CNGOIC via Bloomberg

o

China soyoil inventories at end-March 1.27MT, -90k tons m/m. Soyoil inventories may continue to drop as weekly soy crush stays low

o

Palm oil inventories at 800k tons, -130k tons m/m

o

More restaurants are open for business

o

China soy imports in March seen at 4.3m tons and 6.6m tons for April. Exports of soybeans from Brazil rose in March

·

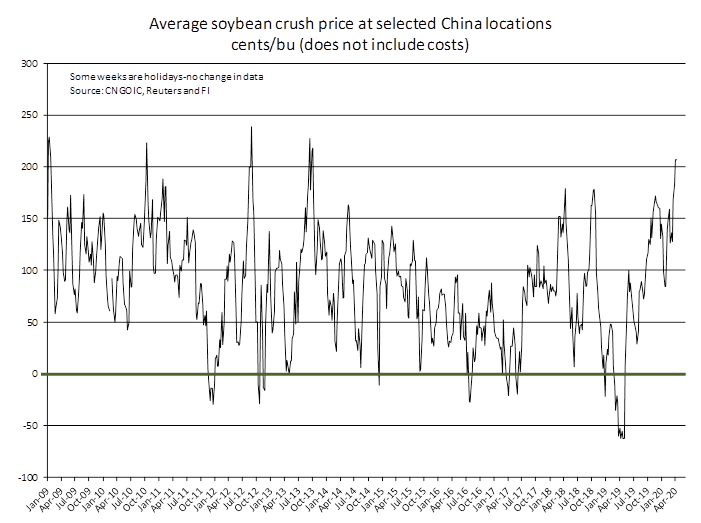

China cash crush margins as of this morning, using our calculation, were 207 cents per bushel (205 previous) and compares to 184 cents a week ago and negative 52 cents around this time last year.

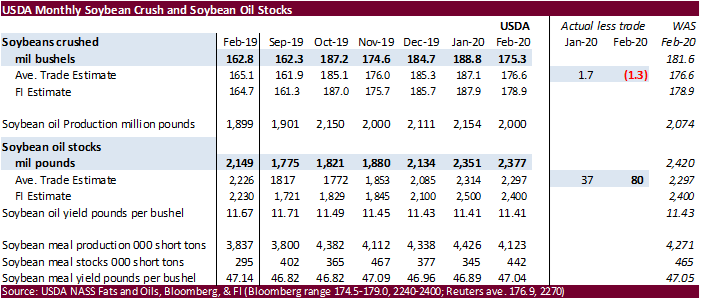

USDA

NASS revised their monthly fats and oils report.

- February

crush revised lower by 6.3 million bushels to 175.3 million - February

Soybean oil stocks revised lower 43 million pounds to 2.377 billion pounds - February

SBO unchanged at 11.43 - February

soybean meal production revised down 148,000 short tons to 4.123 million short tons.

- February

soybean meal stocks revised down 22,500 short tons to 442,000 short tons - February

soybean meal yield revised down to 47.04 from 47.05. - https://downloads.usda.library.cornell.edu/usda-esmis/files/mp48sc77c/ng452308w/g158c2196/cafo0420.pdf

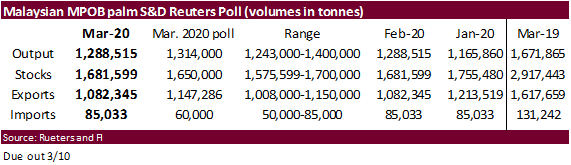

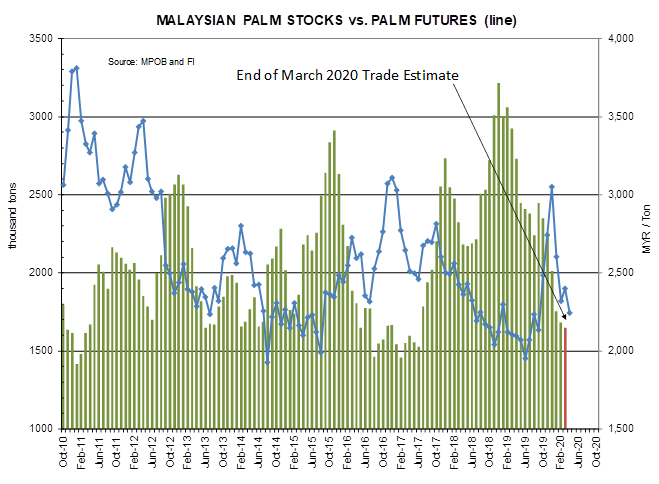

Malaysian

palm oil

slipped 5.6% this week. The palm premium over gasoil is running at its highest level since 2016 at $215/ton. Malaysia is seeing a labor shortage after many migrant workers returned home. End of March Malaysian palm oil stocks are projected to be lowest since

end of June 2017.

- Egypt

seeks 3,000 tons of soybean oil and 2,000 tons of sunflower oil on April 5 for May 1-25 delivery.

Updated

4/1/20 (top end of range lowered)

- May

soybeans are seen in a $8.40-$9.00 range. - May

meal is seen in a $305 to $340 range - May

soybean oil range is 24.50 to 27.50

- US

wheat futures higher on end of week positioning, selected country export restrictions and ongoing dryness concerns for the Black Sea wheat region. The Chicago May contract fell the past four previous sessions to a 2-week low.

- Kazakhstan

announced April wheat and flour export quotas of 200,000 tons and 70,000 tons, respectively.

- Brazil

millers asked the government to abolish its 10-percent wheat import tariff for countries residing outside of the Mercosur trade agreement and drop sanitary restriction on Russian wheat. Concerns over Argentina logistic problems prompted the request.

- Black

Sea dryness may continue into next week for half of the winter grain areas of Ukraine and Russia as the forecast for rain is less than 50 percent of normal through the end of next week. Bloomberg noted Maxar mentioned soil moisture in the top five Russian

winter-wheat regions dropped below normal by the most since at least 2008 as of April 1.

- Egypt

said they have enough wheat in its strategic reserves to last more than four months. They may tender soon. Egypt looks to increase their grain and other agriculture commodity stocks to last six months. Many commodities are at three months, with some at

5-6 months. Egypt will start buying local wheat around April 15. - Australia

saw good rain over across New South Wales over the past few days. - Iraq

said they expects to market 5-6 million tons of local wheat this season, which begins April 10.

- FranceAgriMer

reported French soft wheat conditions as of March 30 declined one percentage point from the previous week for the combined good and excellent conditions to 62 percent and compare to 84 last year. Winter barley conditions decreased one point to 62 percent

and compare to 80 year ago. Durum was 64 percent, down 2, and compare to 72 last year.

- Paris

May milling wheat futures settled up 0.25 euros, or 0.1%, at 191.00 euros ($206.05) a ton.

- On

Friday Algeria was thought to have passed on milling wheat. - Jordan

is in for 120,000 tons of wheat on April 6 for June-August shipment. - Jordan

seeks 120,000 tons of feed barley on April 7 for September through October shipment.

- Ethiopia

seeks 400,000 tons of wheat on April 7. - In

an SBS import tender, Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on April 8 for arrival in Japan by July 31.

Rice/Other

- US

rice futures hit their highest level in nearly six years. - South

Korea bought 49,993 tons of non-glutinous brown rice last week. Details via Reuters.

TONNES(M/T) ORIGIN PRICE($/T) ARRIVAL

20,000 China $818.88 July 31, 2020

15,000 Thailand $493.50 Sept. 30, 2020

14,993 Thailand $498.75 Oct. 31, 2020

- The

Philippines seek 300,000 tons of rice from Thailand and Vietnam. - Cambodia

will ban rice exports on April 5.

Updated 4/2/20

- May Chicago $5.15 and $5.68 range

- May KC $4.40 and $4.90 range

- May MN $5.15 and $5.35 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for

the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender

immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.