From: Terry Reilly

Sent: Monday, March 09, 2020 2:44:58 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 03/09/20

PDF attached

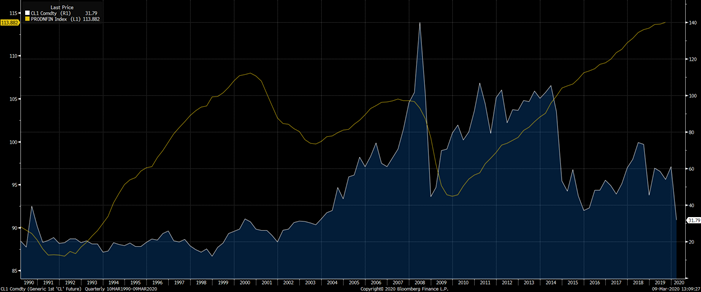

WTI

in focus today as Saudi Arabia and Russia agree to disagree. WTI and Brent crude fell around 20 percent. US stocks sold off. The widespread selling spilled over into the ag markets.

Tuesday:

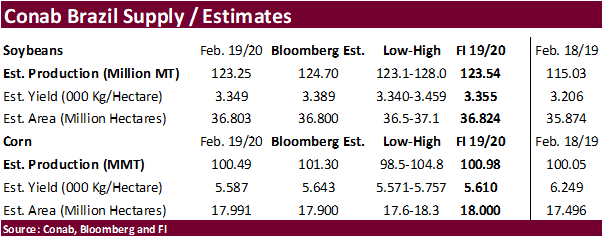

USDA, Conab and MPOB will have updated supply and demand figures.

Yellow=

U.S. productivity and costs report versus WTI

Source:

Bloomberg and FI

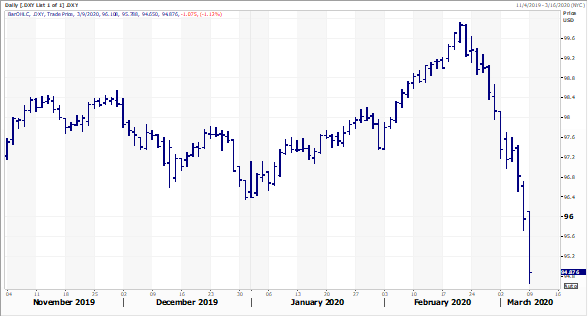

USD

at around 1:00 pm CT

Source:

Reuters and FI

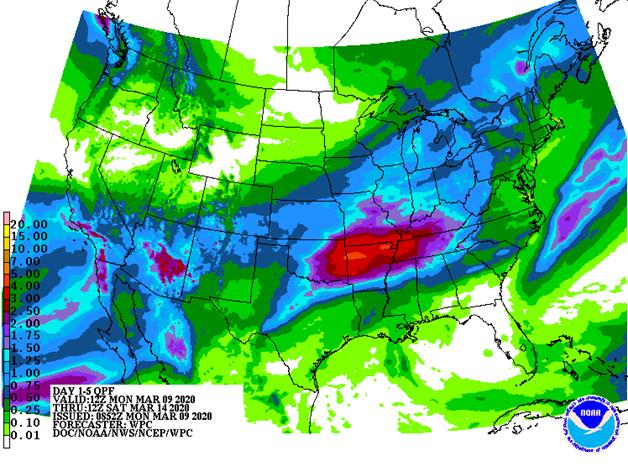

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Some

needed rain will fall in some very important Argentina crop areas this week to help curb moisture stress and to protect production potentials. Greater rain will be needed in the north and far south. Brazil weather should be mostly good with some relief from

recent drying in the west and south next week. South Africa will experience a few showers and thunderstorms with some net drying. Europe is plenty moist and poised for good early spring crop development, although moisture is needed in the southeast corner

of the continent. China winter crops along with those in India will perform well this winter with good yields. U.S. planting concerns will slowly rise over the next few weeks as the wet biased pattern from the southeastern Plains to the lower eastern Midwest

and Tennessee River Basin prevails.

Overall,

weather today will likely provide a mixed influence on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Recent

weather and that which is coming this week will continue to promote earlier than usual winter crop development in the U.S. central and southern Plains, Delta and southeastern states as well as southern Russia, southern Ukraine and parts of China. Moisture

in Canada’s Prairies will improve spring planting conditions when seasonal warming begins. North Africa will continue struggling for moisture in Morocco and northwestern Algeria as well as in parts of Spain.

Overall

weather today will likely provide a neutral to bearish bias to market mentality.

Source:

World Weather Inc. and FI

- USDA

weekly corn, soybean, wheat export inspections, 11am - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

TUESDAY,

MARCH 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - Brazil

Conab soybean and corn yield, area and production, 8am - China

agriculture ministry (CASDE) supply & demand monthly report - AmSpec,

Intertek, SGS release palm oil export data for March 1-10 - Malaysian

Palm Oil Board data on palm production, exports, stocks - Ros

Agro 4Q results

WEDNESDAY,

MARCH 11:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Santander

and Datagro hold sugar, ethanol conference, Sao Paulo - FranceAgriMer

monthly cereals balance sheet

THURSDAY,

MARCH 12:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, 8:30am - Port

of Rouen data on French grain exports - New

Zealand food prices, 5:45pm

FRIDAY,

MARCH 13:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

415,548 versus 400000-700000 range

Corn

829,865 versus 800000-1100000 range

Soybeans

572,416 versus 500000-800000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING MAR 05, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 03/05/2020 02/27/2020 03/07/2019 TO DATE TO DATE

BARLEY

0 699 0 29,131 6,974

CORN

829,865 896,221 793,570 14,947,795 26,611,680

FLAXSEED

0 0 0 520 342

MIXED

0 0 0 0 0

OATS

0 0 100 2,766 2,093

RYE

0 0 0 0 0

SORGHUM

58,711 73,207 64,158 1,460,388 949,182

SOYBEANS

572,416 672,174 888,690 30,130,673 26,858,270

SUNFLOWER

0 0 0 0 0

WHEAT

415,548 656,160 615,715 19,228,487 17,625,944

Total

1,876,540 2,298,461 2,362,233 65,799,760 72,054,485

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

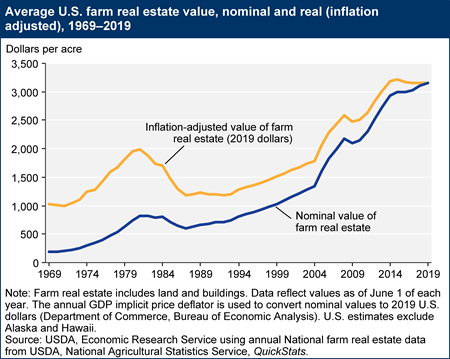

Farmland

values have stabilized since 2014

·

Covid-19 is certainly testing economic fears.

·

US White House advisers announced TARP might be implemented for travel related companies such as airlines, hotels and cruise lines. Also included energy companies.

·

US crude oil futures settled at $31.13/Bbl, down $10.15 or 24.6%.

·

US central bank stimulus is expected this week.

·

Focus may shift to not allowing businesses to fold.

·

Corn futures ended lower by 3.25 cents basis May and 4.25 for the July position. Losses could have been much worse. Higher trade in Chicago wheat limited losses in corn. Also, we saw South Korea buy corn

over the weekend which was a refreshing reminder that import tenders continue to go on.

·

December corn hit a contract low today but settled 2.25 cents off its session low.

·

Crude oil launched the widespread selling for most commodities on Monday after Saudi Arabia and Russia created a trade war. Oil prices fell 20 percent and US stock markets dropped hard. The threat in global

oil supply trigged market fears that spilled over into US agriculture commodities. Both countries stated they will increase oil production. The trade tends to associate a drop in crude oil will result in a drop in economic productivity. US crude oil futures

settled at $31.13/Bbl, down $10.15 or 24.6%.

·

Gulf corn basis slipped 3-4 cents.

·

USDA US corn export inspections as of March 05, 2020 were 829,865 tons, within a range of trade expectations, below 896,221 tons previous week and compares to 793,570 tons year ago. Major countries included

Mexico for 315,139 tons, Japan for 201,200 tons, and Chile for 84,562 tons.

·

There was talk the US White House would like to extend the time to comment on biofuel waivers (SRE appeal) by 15 days.

·

China is looking to set up 29 locust monitoring sites along the border by the end of March.

- South

Korea’s KFA bought 65,000 tons of corn from South America at around 206/ton c&f for arrival around July 10. They paid 208/ton on Friday for one cargo.

- South

Korea’s MFG bought 135,000 tons of, optional origin at $204.50 and $207.01/ton, for arrival in July.

Soybean

complex.