From: Terry Reilly

Sent: Thursday, February 20, 2020 2:21:38 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/20/20

PDF attached

Egypt

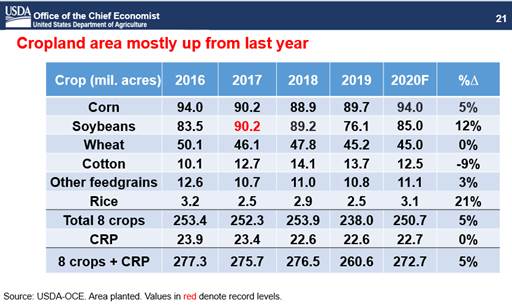

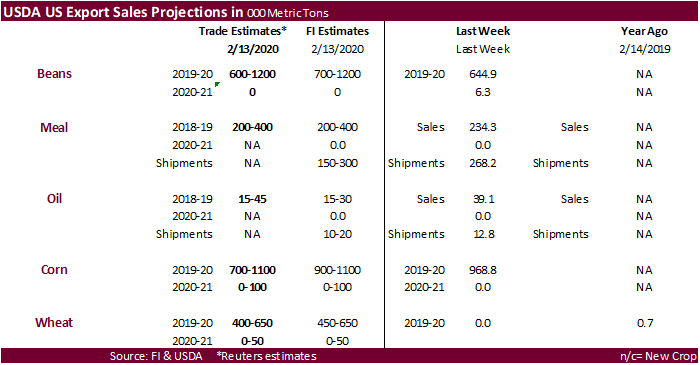

bought 120,000 tons of vegetable oils. USDA’s initial estimate for US crop plantings were near expectations for soybeans, corn and all-wheat. 2020-21 US commodity outlooks will be released Friday at 7:00 am CT.

USDA

released selected 2020 US planted area numbers this morning.

USDA 2020 outlook area versus analysts estimates (Reuters estimates), 2020 baseline and USDA 2019, in millions of acres:

·

Corn 94.0/93.6/94.5/89.7

·

Soybeans 85.0/84.6/84.0/76.1

·

All wheat 45.0/44.9/45.0/45.2

https://www.usda.gov/oce/forum/

THIS

IS WORTH THE TIME TO VIEW. See link below

https://www.usda.gov/oce/forum/2020/presentations/Johansson-Slides.pptm

We

attached a few area graphs and table after the text.

The

area for the 8-major row crops was projected by USDA at 250.8 million acres, above the baseline projection of 249.4 million and 12.8 million acres above “The Great Flood of 2019”.* The area averaged 249.9 million acres over the past five years. If realized,

soybeans would make up 34 percent of the total area planed for the 8-major row crops, up from 32 percent from 2019, and corn would make up 37 percent of the area, down one percentage point from last year.

*NYT

coined this Nov 21, 2019 https://www.nytimes.com/2019/11/21/climate/farms-climate-change-crops.html

https://www.usda.gov/oce/forum/

·

Argentina will dry down over the next 5 days, but the country has plenty of soil moisture to allow conditions to remain favorable.

·

Southern Brazil will dry down over the next two weeks but there is an opportunity for some rain Feb 24-29.

·

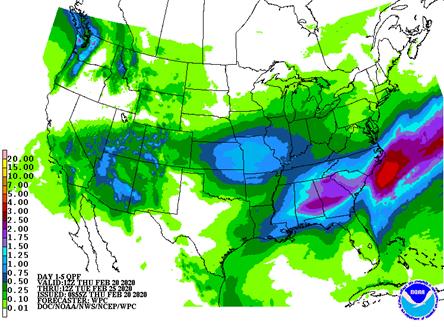

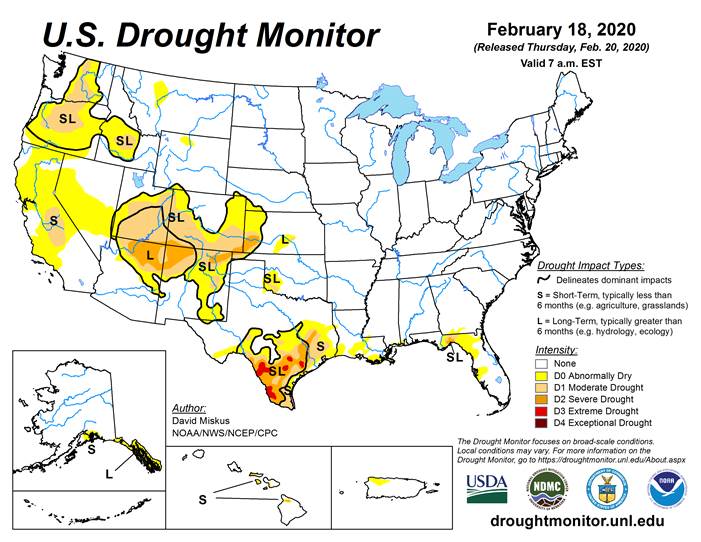

A larger central U.S. storm is expected during mid- to late-week next week that will bring significant moisture to the upper Midwest, northern Plains and a part of the western Corn Belt.

Source:

World Weather Inc. and FI

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

Drying

in Argentina over the next week to ten days will eventually grab the market’s attention, but today’s soil moisture is very good, and crops will coast through this first week of net drying without much stress. Timely rain will be needed again later in March

to ensure the best production potential. Most models are suggesting a drier bias for at least ten days and possibly two weeks with southern Rio Grande do Sul and Uruguay to be included.

Most

of Brazil’s crop weather still looks quite appealing with timely rain in most production areas and seasonable temperatures.

South

Africa will have its best summer grain and oilseed production year since 2017 with weather over the next two weeks maintaining that favorable outlook.

Southeast

Asia palm oil weather remains quite favorable and little change will occur through the next two weeks.

China’s

winter rapeseed should experience much improvement early this spring after abundant winter precipitation. India’s winter grain and oilseed crops are also expected to perform well.

Europe

weather is mostly good and winter crops will need timely rainfall to support normal development this spring especially in Spain where the greatest drying has occurred recently.

Concern

is rising over early season corn planting delays in the U.S. Delta and interior southeastern states because of too much rain. The problem of moisture excesses will continue into March delay will be realized.

Overall,

weather today will likely support a mixed influence on market mentality with bearish bias.

MARKET

WEATHER MENTALITY FOR WHEAT:

North

Africa, Spain and Portugal are drying down and significant rain will soon be needed in unirrigated areas to ensure the best production potential. Some yield cuts have already occurred in southwestern Morocco, but losses elsewhere have not been as significant.

Rain must fall soon, however, since reproduction is getting under way in North Africa and will soon occur in the Iberian Peninsula and without rain and good soil moisture yields will come crashing downward.

Limited

winterkill around the world this year has kept production potentials mostly good, although winter crops were not well established in the U.S., Southeastern Europe, southern Russia, Kazakhstan or China. With that said most of these areas have received good

amounts of moisture during the winter which should translate into improving crop development potential early in the spring so that production potentials are favorably restored.

India

is still expecting a large crop even though there is not much precipitation expected in key wheat areas for a while. Some showers will occur in eastern and far northern parts of the nation in this coming week which will support some reproduction.

Overall,

weather is still not offering a good reason for serious market price appreciation. If anything, weather conditions have left a good reason to expect crop improvements early this spring. Overall, weather today may offer a neutral to bearish bias to market mentality.

Source:

World Weather Inc. and FI

Bloomberg

Ag Calendar

- EIA

U.S. weekly ethanol inventories, production, 10:30am - USDA

Agricultural Outlook – corn, wheat, soy, cotton acreage, 8:20am - USDA

milk, read meat production, 3pm - Malaysia’s

Feb. 1-20 palm oil exports data - EARNINGS:

Wilmar

FRIDAY,

FEB. 21:

- USDA

outlook — corn, soy, wheat cotton end-stockpiles - USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am - ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

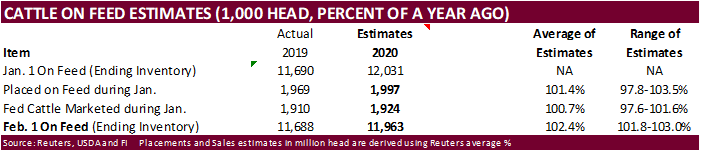

Cattle on Feed, 3pm - EARNINGS:

Pilgrim’s Pride

Source:

Bloomberg and FI

·

US Philadelphia Fed Business Outlook Feb: 36.7 (est 11.0 ; prev 17.0)

·

US Initial Jobless Claims Feb 15: 210K (est 210K ; prevR 206K ; prev 205K)

·

US Continuing Claims Feb 8: 1.726M (est 1.717M ; prevR 1.701M ; prev 1.698M)

·

USDA Sees U.S. Farm Exports To China At $14 Bln In 2020/21

·

March corn futures ended 2.00 cents lower and May was off 2.50 cents. The trade is waiting to see if China will buy a large amount of US grain.

Large

SA production prospects continue to hang over the market.

·

CH traded at $3.80 today, and every trading day since January 27.

·

USDA’s annual outlook conference started today. The full 2020-21 US commodity outlooks will be out on Friday. USDA estimated 2020 US corn area at 94.0 million acres, slightly above trade expectations and

3.8 million above the average for the last 5-years (90.2).

·

USDA Secretary said the trade details released today at the outlook forum did not include the Phase One trade detail. He added they do not know a timeline when China will step up purchases of US goods.

·

A senior US Treasury official said the coronavirus outbreak will not change China’s commitments to buy US goods.

·

There was talk China picked up four cargoes of sorghum out of the US Gulf, but no corn.

-

As

of Thus., China put the overall death toll at 2,126+ and 75,700+ infections.

·

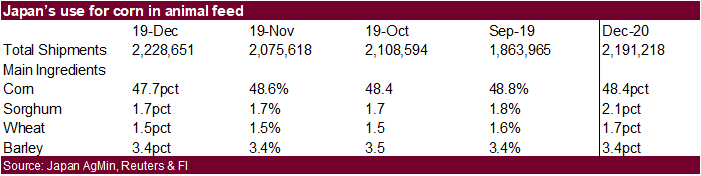

Japan’s usage of corn in animal feed fell to 47.7% in December, compared with 48.4% in the prior year, according to the AgMin.

·

China’s sow herd increased by 1.2% in January from December.

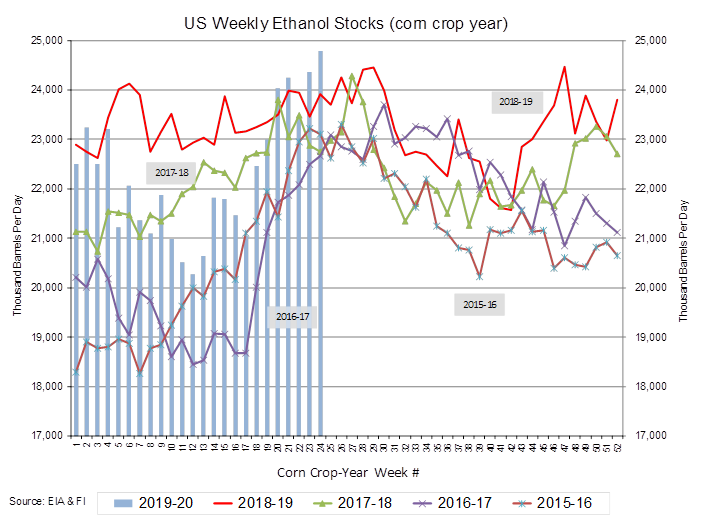

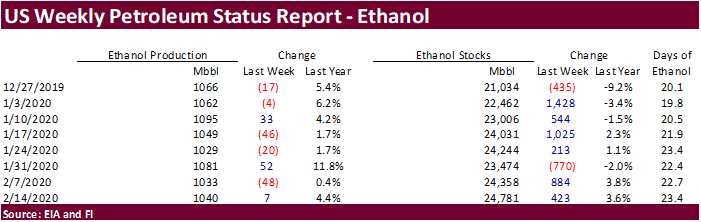

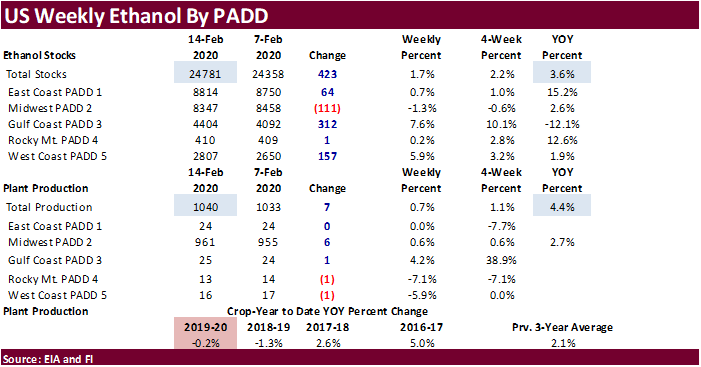

US

weekly ethanol

stocks increased 423,000 barrels to a record 24.781 million barrels. A Bloomberg poll looked for a 47,000-barrel increase.

US

weekly ethanol production was up 7,000 barrels to 1.040 million. A poll called for a 16,000-barrel increase. Ethanol production over the past 4 weeks is down on average 2,000 barrels. Production is finally catching up to last year’s pace, on a corn crop-year

year calendar basis (Sep-Aug). Sep 1 to date production is running 0.2% below last year’s pace, compared to 1.6 percent at the beginning of the year. Gasoline stocks declined nearly 2 million barrels from the previous week.

·

Reportedly Iran seeks 200,000 tons of corn for March shipment.

-

CBOT

March corn is seen in a $3.75 and $3.90 range. -

CBOT

May is seen in a $3.80 and $4.00 range.

Soybean

complex.

-

Soybeans

traded 4.50-5.50 cents lower on large SA crops, ongoing concerns over China protein demand, and doubt China will but large amounts of US soybeans over the coming weeks. Meal ended slightly lower and soybean oil 22-27 points lower despite Egypt bought a combined

120,000 tons of vegetable oils. -

USDA

estimated 2020 US soybean area at 85 million acres, slightly above trade expectations and above 84.3 million average for the last 5-years.

-

USDA

agriculture secretary said in his speech at the forum that the US has a 30 percent biofuel blend target by the year 2050.

-

China

may have been calling around for US soybean pricing yesterday, but we have not heard of any trades done. Applications for tariff free US soybeans will start March 2.

-

The

US$ was 13 points higher as of 12:30 CT and the lower. The Brazilian Real was weaker at 4.3938, an all-time low.

-

The

Argentina peso continued to struggle on Thursday. -

The

Argentina BA Grains Exchange maintained their estimate for the Argentina soybean crop at 53.1 million tons but noted recent rains could increase production. About 58 percent of the soybean crop is in the critical pod development stage.

·

CNGOIC noted China soybean stocks at 1.04 million tons, up 130,000 from the previous week.

·

Malaysia looks to fully implement B20 biodiesel by mid-2021. About 1.06 million tons of palm oil would be used to produce enough B20 annually for the transportation sector, 1.3MMT when adding B7 for the industrial

sector.

·

ITS reported 1-20 February palm exports at 817,314 tons, up 8.7 percent from 751,868 tons shipped during the same period a year ago.

·

AmSpec reported Feb 1-20 palm exports at 819,653 tons, up 10.9 percent.

-

Egypt’s

GASC bought 60,000 tons of soybean oil and 60,000 tons of sunflower oil for arrival April 10-30. The soyoil was thought to be bought at $767.00 a ton c&f and sunflower oil at $748.00 a ton c&f. On the 13th of February they paid $782.44/ton for

soybean oil. In their last sunflower oil tender (late 2019) they paid $802.00 to 806.00/ton. Ukraine sunflower oil prices peak at around $810/ton at the end of 2019 to around $710-715/ton earlier this week.

-

CBOT

March soybeans are seen in a $8.70-$9.00 range -

March

soybean meal is seen a $285 and $300 range -

March

soybean oil 30.10-31.90 range -

May

soybeans could rally to $9.50 if China buys a large amount of US soybeans.

-

May

meal is seen in a $290 to $3.05 range -

May

soybean oil range is 29.50 to 32.25

·

US wheat ended 2.25-6.50 cents lower on lack of bullish developments and prospects for large 2020 global wheat production. The lower trade today and yesterday for US wheat futures did attract additional global

import developments, but the US remains uncompetitive, and will contribute to little or no market share of this week’s tender announcements.

-

USDA

estimated 2020 US all-wheat area at 45 million acres, slightly above trade expectations but below 48.8 million average for the last 5-years.

·

May Paris wheat futures were unchanged at 196.25 euros.

·

EU granted import licenses for 9,450 tons of wheat under its TRQ program, bringing total imports to 109,071 tons. EU also awarded 27,400 tons of barley.

·

Coceral looks for EU’s soft-wheat production to end up near 137.9 million tons in 2020 compared with 145.7 million tons a year earlier. Heavy rain in northern Europe hindered production prospects.

·

APK-Inform estimated February 1 grain stocks at 12.8 million tons, 2 percent below a year earlier.

·

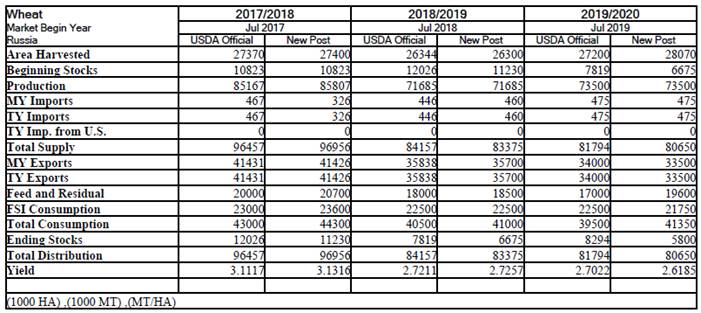

USDA/FAS sees the Russian 2020 wheat crop at 87 million tons. Russia’s AgMin looks for a 3-5 percent increase, or 83-87 million tons for 2020

·

ProAgro sees the Ukraine 2020 grain crop down 3.19% to 72.673 million tons from 75.1 million tons in 2019. Wheat was estimated 7 percent lower at 26.234 million tons from 28.3 million tons in 2019.

-

Saudi

Arabia seeks 715,000 tons of 11% and 12.5& protein wheat on February 21 for April-June shipment.

-

Syria

passed on 200,000 tons of wheat from Russia (should have closed February 17) for shipment within 60 days of contract signing.

-

Tunisia

bought 75,000 tons of feed barley at $205.67-$206.56/ton c&f for March and April shipment.

-

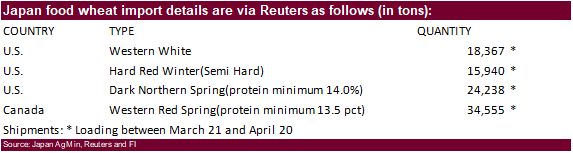

Japan

bought 93,100 tons of milling wheat. Original details as follows:

-

Taiwan

seeks 102,525 tons of US wheat on February 21 for April and/or early May shipment.

-

Jordan

issued a new import tender for 120,000 tons of wheat set to close February 25 for Sep-Oct shipment.

-

Jordan

issued a new import tender for 120,000 tons of feed barley set to close February 26 for June-July shipment.

-

Japan

in an SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of feed barley for arrival in Japan by July 30, on Feb. 26.

-

Bangladesh

seeks 50,000 tons of wheat by February 27. -

Morocco

seeks 354,000 tons of US durum wheat on March 5 for arrival by May 31.

Rice/Other

-

None

reported

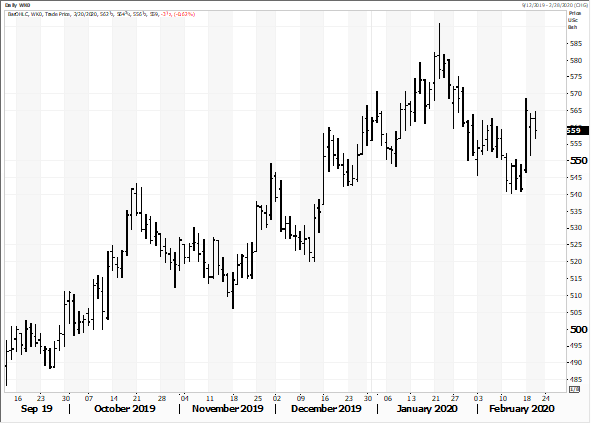

CBOT

May Wheat

Source:

Reuters and FI

Updated 2/19/20 – rolled to May

·

CBOT Chicago May wheat is seen in a $5.35-$5.80 range

·

CBOT KC May wheat is seen in a $4.70-$5.05 range

·

MN May wheat is seen in a $5.30-$5.65 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for

the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender

immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.