From: Terry Reilly

Sent: Wednesday, February 12, 2020 2:34:50 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/12/20

Global tenders increased especially in soybean meal and corn. The pace of the coronavirus spread is slowing but deaths continue to rise. China officials are asking local crushers to resume operations, if they have not already.

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

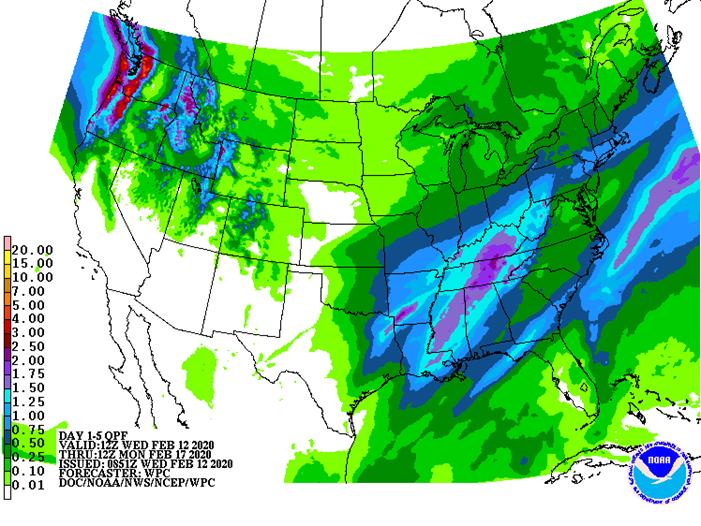

Favorable soil moisture is present in Argentina, Brazil, South Africa, India and some eastern Australia locations which should support crop development. There is still some concern over harvest conditions in early season soybean areas of Brazil which may lead to more delay in second season corn planting.

More rain will fall this week in northern and eastern Europe and from there to Ukraine and that will improve early season crop development potentials for areas that were too dry last autumn.

China’s winter crops are still rated favorably with a big potential for improving rapeseed conditions in the early weeks of spring after recent weeks of rain.

India’s winter crops are still poised to perform quite favorably, despite a drier biased outlook for the next ten days.

Southeast Asia crops are still rated well, despite erratically distributed rainfall in recent weeks.

Eastern Australia sorghum conditions have improved, but drought remains in key production areas and much more rain will be needed before winter planting of canola begins in late April. Summer crop development has improved, but it will still be a very small crop.

South Africa crop conditions are still rated quite favorably with little change likely, despite some net drying for a while.

Today’s weather will have a mixed influence on market mentality.

MARKET WEATHER MENTALITY FOR WHEAT:

Many of the winter crop areas in the world that experienced poor crop establishment because of dryness last autumn have seen some timely precipitation in recent weeks. The moisture should help improve winter crop establishment prior to reproduction this spring. There has also been very little winterkill this year and that should be supporting larger crops.

The biggest dry concern today is in North Africa and in particular southwestern Morocco where durum wheat and barley production has been cut. There is potential for larger small grain losses from North Africa if improved rainfall does not occur soon. Spain and Portugal are also drying out, but have adequate subsoil moisture for now.

Overall, despite market performance of late, there is still no good weather related reason for futures price appreciation and some caution is warranted there.

Today’s weather will maintain a low impact on market mentality.

Source: World Weather Inc. and FI

- EIA U.S. weekly ethanol inventories, production, 10:30am

- FranceAgriMer monthly cereals balance sheet

THURSDAY, FEB. 13:

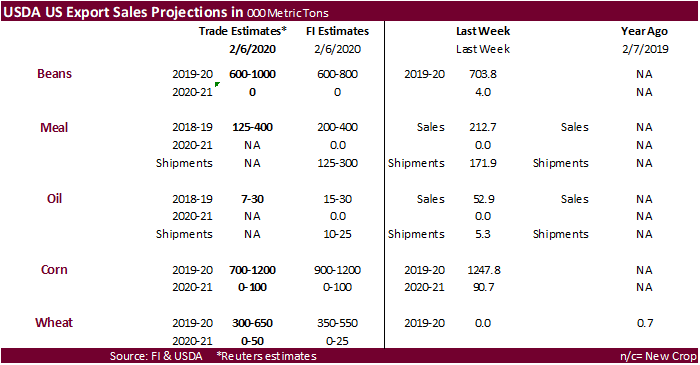

- USDA weekly crop net-export sales for corn, soybeans, wheat, 8:30am

- Giant pulp maker Suzano holds investor day in Sao Paulo

- Brazil’s grain exporter group Anec holds conference on 2019-20 crop outlook

FRIDAY, FEB. 14:

- ICE Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer crop conditions – French crops office expected to resume crop-conditions reports after winter break

- New Zealand food prices

- Biosev holds analyst conference call to discuss 4Q earnings.

Source: Bloomberg and FI

Macros

US DoE Crude Oil Inventories (W/W) 07-Feb: 7459K (est 3200K; prev 3355K)

– Distillate: -2013K (est -750K; prev -1512K)

– Cushing: 1668K (prev 1068K)

– Gasoline: -95K (est 650K; prev -91K)

– Refinery Utilization: 0.60% (est -0.40%; prev 0.20%)

· Corn futures started the day lower on follow through selling and lower wheat, despite a spike in South Korean import business. But then turned higher after Chicago wheat rebounded. Bull spreading was a feature.

· Corn futures ended 1.00-3.25 cents higher

· South Korea bought at least 261,000 tons of corn overnight. One source noted SK bought up to 330,000 tons. They were also thought to have picked up a cargo of feed wheat. Much of the corn was also said to be sourced from origins other than US PNW due to quality problems.

· 1115+ deaths and more than 44,000 cases of coronavirus was recorded. https://www.bbc.com/news/world-asia-51470363

· China’s state reserve will sell 20,000 tons of frozen pork on Feb. 14.

· The weekly USDA Broiler Report showed eggs set in the US up 5 percent and chicks placed up 4 percent. Cumulative placements from the week ending January 4, 2020 through February 8, 2020 for the United States were 1.14 billion. Cumulative placements were up 4 percent from the same period a year earlier.

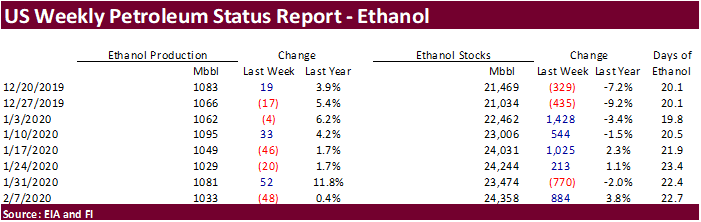

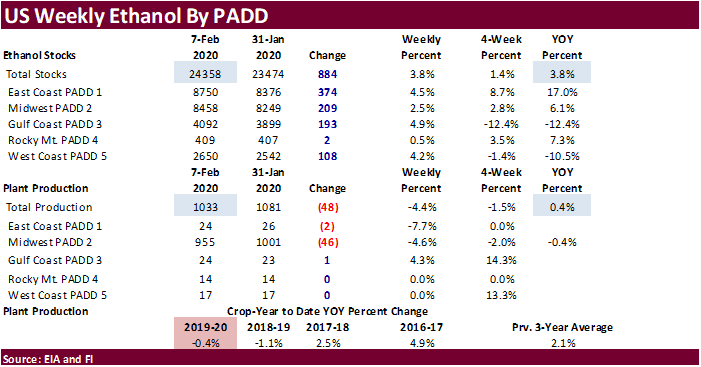

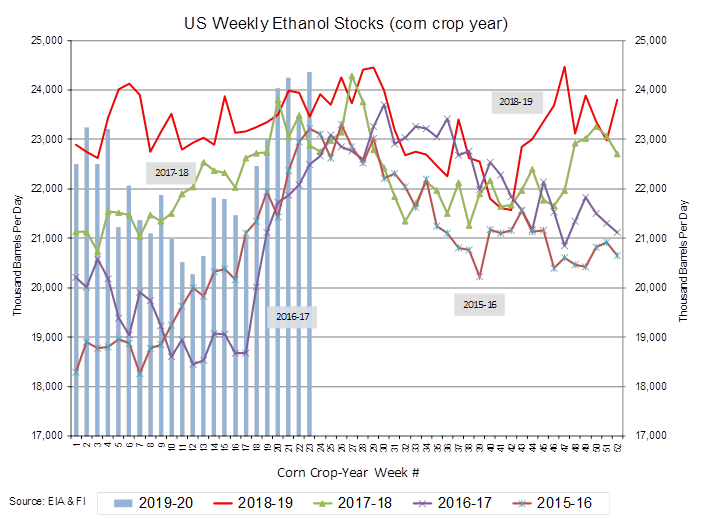

US weekly ethanol production fell 48,000 barrels to 1.033 million. A Bloomberg poll looked for it to be down 16,000. US ethanol stocks increased 884,000 barrels to 24.358 million (trade was looking for a 132k increase). For the past 4 weeks, ethanol production declined on average by 16,000 barrels and stocks increased 338,000 barrels. Ethanol stocks are near a six-month high. Corn crop year to date production is running 0.4 percent below the same period a year ago, an improvement from where it was running at the end of December (2.0 percent lower). The ethanol blend rate was running at 90.1 percent, above 89.7 percent previous week. We raised our corn for ethanol use from 5.400 billion bushels to 5.415 billion. USDA is at 5.425 billion versus 5.376 billion in 2018-19.

- South Korea’s Feed Leaders Committee (FLC) bought about 65,000 tons of optional origin corn at $212.23 a ton c&f for arrival in South Korea around May 20.

- South Korea’s Major Feedmill Group (MFG) bought 130,000 tons of optional origin corn at $213.25 and $214.99/ton for arrival in South Korea in the second half of May.

- South Korea’s KFA bought about 66,000 tons of optional origin yellow corn at around $212.95 a ton c&f for arrival in South Korea around May 20.

- Algeria’s ONAB seeks 35,000 tons of optional origin corn on Feb. 13 for shipment in the second half of March

Soybean complex.