From: Terry Reilly

Sent: Thursday, February 06, 2020 2:44:19 PM (UTC-06:00) Central Time (US & Canada)

Subject: FI Evening Grain Comments 02/06/20

PDF attached

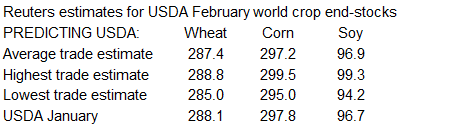

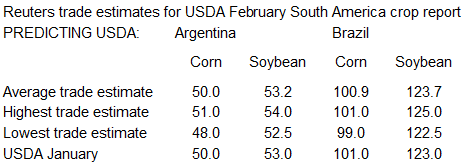

USDA

export sales were within expectations. GS roll starts Friday. Dow Jones hit an all-time high today.

Does

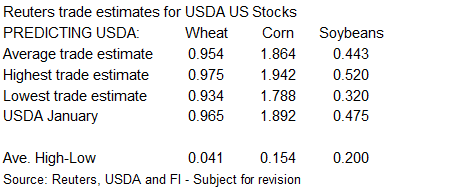

not appear USDA will incorporate Phase One trade deal into their Feb S&D report. So, we changed our US ending stocks estimates. Bottom line is we don’t know what path USDA may take. New corn, soy and wheat balances attached

https://www.usda.gov/oce/commodity/reports/USDATradeForecastsAndUSChinaAgreement.pdf

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

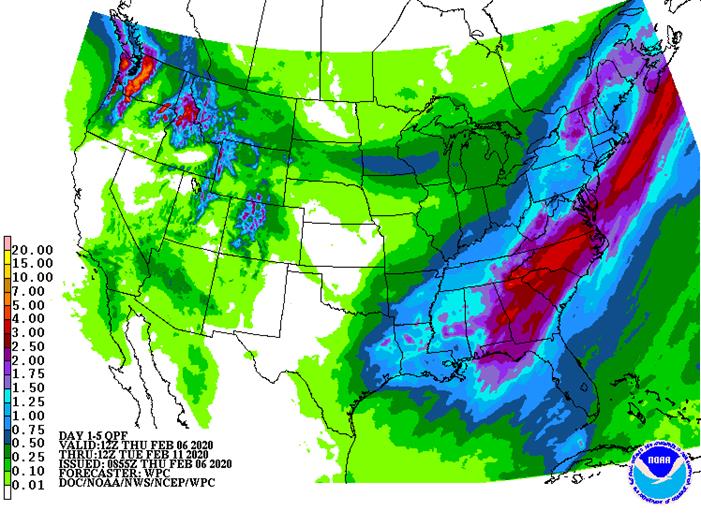

Weather

continues supportive of crops in most of Brazil and Argentina. There is some concern over rainfall in Brazil delaying some of this year’s soybean harvest, but the bottom line should not impact production for most areas. A few areas in Argentina may become

too wet in the next few days after some heavy rain already occurred overnight.

Australia’s

summer crops will get some additional rainfall in this coming week and India crops will remain in good shape. China still has potential for improving rapeseed production potential once spring arrives due to recent precipitation and improving soil moisture

in parts of southeastern Europe into Kazakhstan may do to the same for those areas in the spring.

Southeast

Asia weather will trend a little wetter in the coming week restoring favorable soil moisture to many Indonesian and Malaysian crop areas. Rain is needed most in parts of Peninsular Malaysia.

Overall,

weather today is likely to contribute a bearish bias on market mentality.

MARKET

WEATHER MENTALITY FOR WHEAT:

Weather

continues supportive of crops in most of Brazil and Argentina. There is some concern over rainfall in Brazil delaying some of this year’s soybean harvest, but the bottom line should not impact production for most areas. A few areas in Argentina may become

too wet in the next few days after some heavy rain already occurred overnight.

Australia’s

summer crops will get some additional rainfall in this coming week and India crops will remain in good shape. China still has potential for improving rapeseed production potential once spring arrives due to recent precipitation and improving soil moisture

in parts of southeastern Europe into Kazakhstan may do to the same for those areas in the spring.

Southeast

Asia weather will trend a little wetter in the coming week restoring favorable soil moisture to many Indonesian and Malaysian crop areas. Rain is needed most in parts of Peninsular Malaysia.

Overall,

weather today is likely to contribute a bearish bias on market mentality.

Source:

World Weather Inc. and FI

- UN’s

FAO World Food Price Index, 4am - USDA

weekly crop net-export sales for corn, soybeans, wheat, 8:30am

FRIDAY,

FEB. 7:

- ICE

Futures Europe weekly commitments of traders report on coffee, cocoa, sugar positions ~1:30pm (~6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Agricultural

conference organized by consultancy IKAR, Moscow - Guatemala

Coffee Exports

Source:

Bloomberg and FI

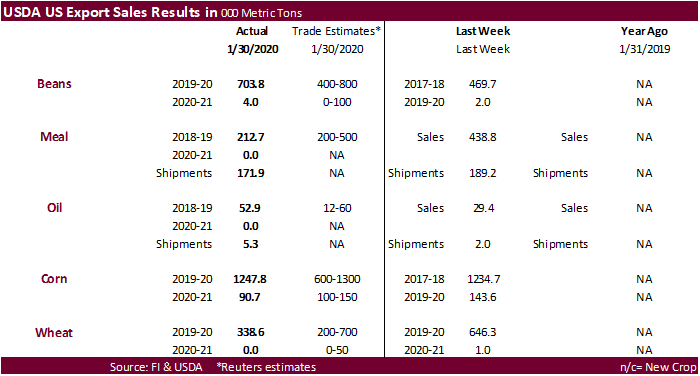

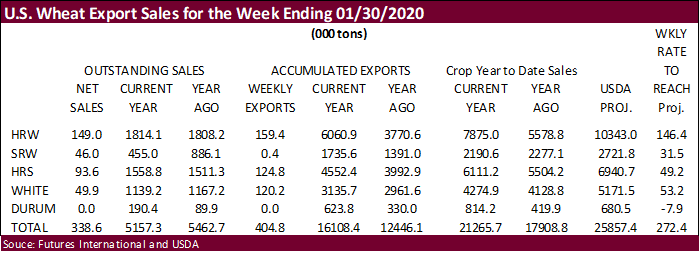

USDA

Export Sales

・

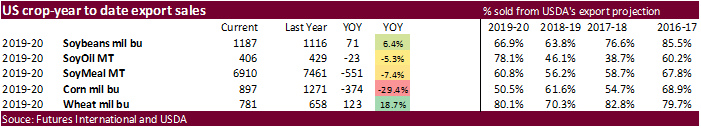

USDA export sales were within expectations for all the major commodities. Soybeans, soybean oil and corn were near the higher end of expectations.

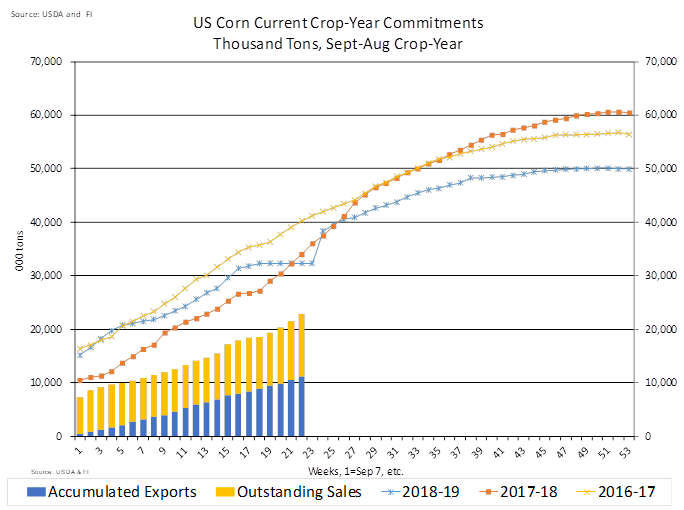

・

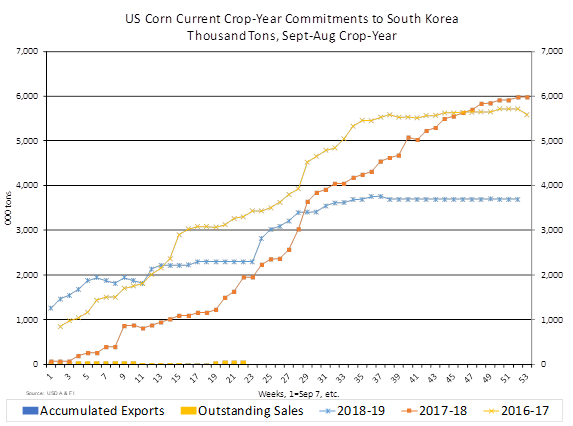

US corn commitments have a long way to go to catch up to last year’s pace (down 29 percent yoy).

・

All-wheat sales are running 19 percent above last year’s pace.

・

SBO sales were very good at 52,900 tons. Remember USDA announced 30k was sold to Egypt under the 24-hour system.

・

USDA US pork net export sales of 29,500 MT for 2020 included 5,100 to China.

・

US Initial Jobless Claims Feb-1: 202K (exp 215K; R prev 217K)

–

Continuing Claims Jan-25: 1751K (exp 1720K; prev 1703K)

・

US Nonfarm Productivity Q4 P: 1.4% (exp 1.6%; prev -0.2%)

–

Unit Labour Costs Q4 P: 1.4% (exp 1.3; prev 2.5%)

・

March corn futures ended 1.50 cents lower. Despite good export sales, crop-year to date sales are still lackluster, in part to poor commitments and shipments to South Korea. USDA export sales of 1.25 million

tons help pair some losses before the market paused.

・

Buy stops were hit at 10:40 CT in corn, soybeans and meal.

・

April hog futures traded limit higher. USDA US pork net export sales of 29,500 MT for 2020 included 5,100 to China.

-

BA

Grains Exchange reported at least 96% (latest report) of Argentina’s 2019-20 soybean crop was getting enough water. They have production at 53.1 million tons, below the 55.1 million tons in 2018-19.

・

A large number of containers are apparently stuck over in China.

-

China

plans to sell 2.96 million tons of corn from state reserves on February 7.

-

Zimbabwe

Finance Minister lifted the ban on GMO corn imports. -

Bloomberg:

Brazil January Beef Exports Rise 9.8% as Chinese Demand Double -

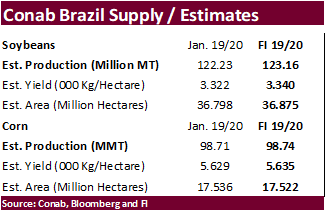

Bloomberg:

USDA FAS Boosts Brazil Soybean-Output Est. by 1m Tons to 124.5m -

USDA

Attaché estimated Ukraine 2019-20 corn exports at 28.1 million tons. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Quarterly_Kyiv_Ukraine_01-31-2020

-

South

Korea’s KOCOPIA bought 60,000 tons of corn sourced from the United States at about $221.82 a ton c&f for arrival in South Korea around April 25. -

China

plans to sell 2.96 million tons of corn from state reserves on February 7.

-

CBOT

March corn is seen in a $3.65 and $3.95 range

Soybean

complex.