PDF attached

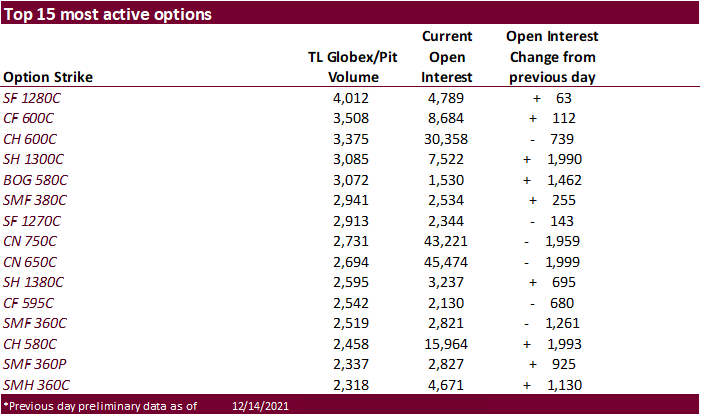

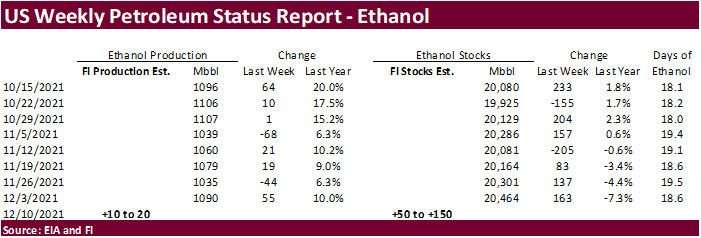

Follow through meal/oil spreading is seen today with soybeans again higher. Corn is higher in the front months and US wheat is easing after Algeria secured up to 700,000 tons of optional-origin milling wheat. Origin was thought to be Black Sea (maybe Germany) and with French origin cut out of the transaction. Meal remains the focus for the soybean complex with strong US demand. Argentina soybean meal offers appear to be drying up. Malaysian palm oil futures traded down 213 ringgit and cash was off $52.50 at $1,120.00/ton, off 4.5%. A Bloomberg poll looks for weekly US ethanol production to be down 6,000 barrels to 1.084 million (1160-1105 range) from the previous week and stocks up 115,000 barrels to 20.579 million.

WORLD WEATHER HIGHLIGHTS FOR DECEMBER 15, 2021

- Argentina’s key summer crop areas in Cordoba, Buenos Aires, southwestern Santa Fe and northeastern La Pampa are favorably moist while areas to the north and east are just a little dry.

- Argentina will experience a high-pressure ridge late this week into next week that will turn temperatures much warmer and limit rainfall leading to net drying for a while.

- The same ridge of high pressure will restrict southern Brazil rainfall too and there is already a dryness problem in western and northern Parana, southeastern Mato Grosso do Sul and southeastern Paraguay.

- The dryness issue in southern Brazil may expand and deepen over time.

- Northern Brazil will continue to experience frequent rain that should not be problematic for a while.

- In the U.S., rain and snow continues to benefit California and other western states and a small, but aggressive, storm will impact the upper Midwest and northeastern Plains today and tonight with rain, thunderstorms and significant snow.

- A threat of heavy rain and stormy conditions will also evolve in the northern Delta and lowermost Midwest Friday into Saturday.

- Bitter cold air expected in Canada’s Prairies should stay in western Canada with only a brief insurgence into the north-central U.S. Plains periodically in the coming week.

- Waves of snow will move through eastern Europe, western Russia and Ukraine to protect winter crops from colder temperatures in this coming week.

- Spain, Morocco, northwestern Algeria and the Middle East (outside of Turkey) will remain drier than usual.

- Not much rain will fall in India for a while and China will experience tranquil weather along with Australia.

- South Africa will continue to see frequent rain in summer crop areas.

· Typhoon Rai will move through the southern Visayan Islands in the Philippines Thursday and Friday inducing some property and agricultural damage.

Wednesday, Dec. 15:

- EIA weekly U.S. ethanol inventories, production

- U.S. Green Coffee Association releases monthly inventory data, 3pm

- Brazil’s Unica publishes cane crush, sugar output data (tentative)

- Malaysia’s Dec. 1-15 palm oil exports

Thursday, Dec. 16:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am

- Port of Rouen data on French grain exports

- HOLIDAY: Bangladesh

Friday, Dec. 17:

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- USDA FAS issues world coffee report, with supply-demand data

Saturday, Dec. 18:

- China’s 2nd batch of Nov. trade data, including imports of cotton, corn, wheat, and sugar

Macros

US Empire Manufacturing Dec 31.9 (est 25.0; prev 30.9)

US Retail Sales (M/M) Nov 0.3% (est 0.8%; prev 1.7%; prevR 1.8%)

– US Retail Sales Ex. Auto (M/M) Nov 0.3% (est 0.9%; prev 1.7%; prevR 1.8%)

– US Retail Sales Ex. Auto & Gas (M/M) Nov 0.2% (est 0.8%; prev 1.4%; preR 1.6%)

– US Retail Sales Control Group (M/M) Nov -0.1% (est 0.7%; prev 1.6%)

US Import Price Index (M/M) Nov 0.7% (est 0.6%; prev 1.2%; prevR 1.5%)

– US Import Price Index Ex. Petroleum (M/M) Nov 0.7% (est 0.4%; prev 0.5%; prevR 0.6%)

– US Import Price Index (Y/Y) Nov 11.7% (est 11.4%; prev 10.7%; prevR 11.0%)

– US Export Price Index (M/M) Nov 1.0% (est 0.5%; prev 1.5%; prevR 1.6%)

– US Export Price Index (Y/Y) Nov 18.2% (prev 18.0%)

Canadian CPI (M/M) Nov 0.2% (est 0.2%; prev 0.7%)

– Canadian CPI (Y/Y) Nov 4.7% (est 4.7%; prev 4.7%)

Canadian Housing Starts Nov 301.3K (est 235.0K; prev 236.6K; prevR 238.4K)

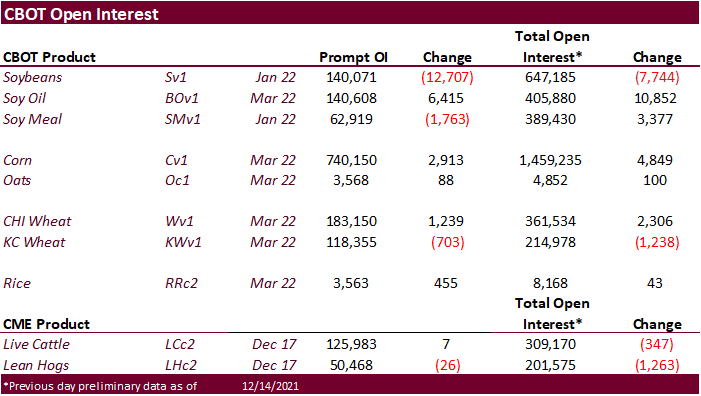

· CBOT corn is higher on strength in soybean meal and technical buying. Don’t discount a two-sided trade.

· USD was 5 points lower and WTI crude $0.46 lower at the time this was written.

· South America will see favorable precipitation this week.

Export developments.

· None reported

· Soybeans are higher on follow through buying after meal appreciated again. Soybean oil is lower on sharply lower palm oil and product spreading. Don’t discount a rebound in product spreads but note Argentina meal offers appear to be drying up.

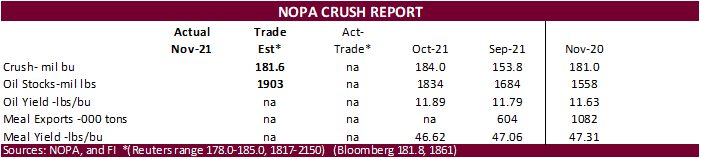

· NOPA is due out later and the average trade guess for the November crush is 181.64 million bushels, above 181.02 million during November 2020 and down from 184 million crushed during October 2021. If realized, the daily adjusted crush would be 4th largest in history. Record was established October 2020. Soybean oil stocks average 1.903 billion pounds, highest since April 2020, and if realized up for the fifth consecutive month.

· Offshore values are leading soybean oil 37 points lower and meal $0.30 short ton lower.

· Rotterdam meal values were 15-30 euros higher from late last week and Rotterdam oil 7-30 euros lower.

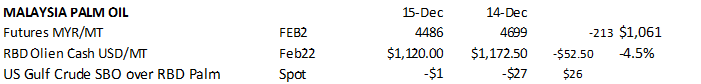

· Malaysian palm oil futures traded down 213 ringgit and cash was off $52.50 at $1,120.00/ton, off 4.5%.

· AmSpec reported Malaysian December 1-15 palm oil exports down 9.1% to 725,600 tons from 798,399 tons same period month ago. ITS reported a 12.5% decline to 772,137 tons.

· Malaysia

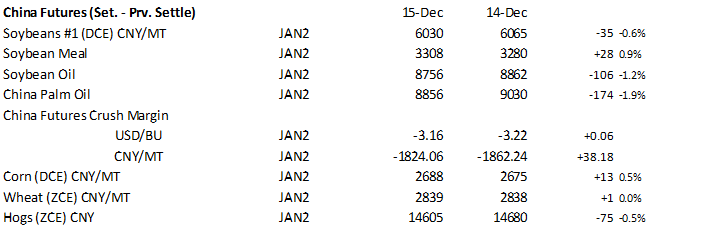

· China crush margins on our analysis was last $1.84/bu ($1.97 previous) versus $1.95 at the end of last week and compares to $1.23 a year ago.

· China futures

· The Buenos Aires grains exchange warned weather for Argentina’s crops in the coming months poses a “big challenge.” The Buenos Aires exchange expects a record corn harvest of 57 million tons and soybean production of 44 million tons, according to a Reuters article.

Export Developments

· Egypt bought 69,000 tons of international vegetable oils yesterday and 39,000 tons of local oils. Egypt said they have enough vegetable oils to last 6.5 months.

· US wheat is easing after Algeria secured up to 700,000 tons of optional-origin milling wheat at around $372 to $373 a ton c&f for large-size panamax vessels to $376 a ton c&f for smaller handymax vessels. Origin was thought to be Black Sea (maybe Germany) and with French origin cut out of the transaction, Paris March wheat futures are about 3.75 euros lower at 280.50/ton.

· Jordan passed on barley and Japan received no offers for feed wheat and feed barley.

Export Developments.

· Japan in a SBS import tender saw no offers for 80,000 tons of feed wheat and 100,000 tons of barley for arrival by March 10.

· Jordan passed on 120,000 tons of feed barley.

· Results awaited: Iran’s GTC seeks 180,000 tons of milling wheat on Dec. 15 for shipment in January and February 2022.

· The Philippines seek 120,000 tons of animal feed wheat on for shipment in 2022 between March and May. The wheat can be sourced optionally from Australia, the United States, Canada, European Union and Black Sea region.

· Another group from the Philippines seeks up to 220,000 tons of animal feed wheat on Dec. 16 for March 15 to May 31, 2022, shipment. Origins include Australia, Europe or the Black Sea region.

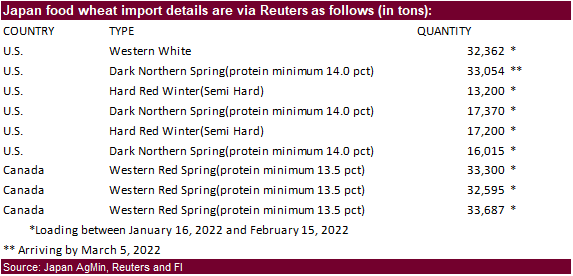

· Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 228,783 tons of food-quality wheat from the United States and Canada in regular tenders that will close on Thursday.

· Jordan seeks 120,000 tons of wheat on December 16.

· Turkey seeks about 320,000 tons of 12.5% and 13.5% protein content milling wheat on December 21 for shipment between February 1 and February 28.

Rice/Other

· South Korean Agro-Fisheries & Food Trade Corp. seeks 22,000 tons of rice from the US, set to close Dec 16.

· (Reuters) – Vietnam’s coffee exports in November were up 8.3% from October at 107,473 tons, while rice exports for the same period fell 8.4% against the preceding month, government customs data released on Tuesday showed. For the first 11 months of 2021, Vietnam exported 1.4 million tons of coffee, down 2.3% from a year earlier, Vietnam Customs said in a statement.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.