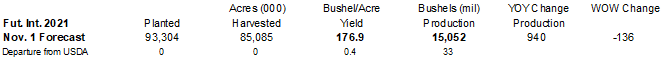

PDF attached includes updated US corn and wheat balances

Higher

close in soybeans, nearly meal and sharply higher trade in soybean oil. Corn closed higher and pulled Chicago and KC wheat along with it. Nearby Mn finished lower. Firm US cash corn and meal basis was noted. Talk of La Nina that could threat SA and US

southern Great Plains rainfall prospects was noted. USDA export inspections for corn and soybeans were excellent, but wheat fell well below expectations.

7-day

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Argentina

was dry during the weekend and will remain that way through Thursday - Rain

will develop late Thursday night and Friday before ending in the northeast Saturday - Moisture

totals will vary from 0.05 to 0.75 inch with a few amounts in the east over 1.00 inch

- Another

period of dry weather will occur Sunday through Thursday, October 28 is expected before rain evolves once again - Showers

are possible October 29-November 1 with good coverage, but confidence is a little low because of the amount of time between now and then in which weather patterns can change3 - Temperatures

will be seasonable with a slight warmer bias, especially next week - Early

corn, sunseed, rice and cotton planting will advance most favorably in areas that received rain recently. Crop emergence and establishment may be slow in areas that have low soil moisture which includes parts of the west and north. Winter wheat development

should advance relatively well as long as the rain that falls this week and next week is sufficient counter evaporative moisture losses during the drier days.

- Brazil

rainfall during the weekend was greatest in parts of center west through interior southern and center south Brazil - Amounts

varied greatly with 1.00 to 2.00 inches in eastern Bolivia, east-central Paraguay, southern Mato Grosso do Sul, northwestern Parana and southeastern Santa Catarina.

- Rainfall

elsewhere in the described region varied up to 1.10 inches - Dry

biased conditions prevailed through Sunday morning in Goias, eastern Mato Grosso , northern and eastern Minas Gerais, Espirito Santo and Bahia - Temperatures

were seasonable - Brazil

weather over the next two weeks will be well mixed for many areas, but far southern parts of the nation may experience net drying and should be closely monitored.

- No

critically dry weather is expected, but some areas could experience a net loss in soil moisture that might eventually raise the potential for crop stress in November.

- Rain

will fall most frequently and significantly in Minas Gerais during the next ten days, but sufficient rain will also occur in surrounding areas to support center west and the remainder of center south crop development in a favorable manner - Most

of Brazil’s crop areas will either have sufficient soil moisture or well-timed rainfall to support soybean, corn, rice, cotton and other summer crop planting. Sufficient moisture will also fall to support coffee, citrus and sugarcane development. Less frequent

rain in southern parts of wheat country - U.S.

harvest weather improved during the weekend with precipitation absent in the Great Plains and western Corn Belt and ended in the eastern Midwest, Delta and southeastern states

- Moisture

totals for the Friday through Sunday were greatest in the eastern Midwest, Tennessee River Basin and Delta where rainfall varied from 0.20 to 0.60 inch with a few amounts of 1.00 to 2.00 inches

- Northwestern

and southern Ohio and northeastern Kentucky were wettest - Highest

temperatures were in the 60s and 70s Fahrenheit - Lowest

temperatures were in the 20s and 30s in the west-central high Plains region and throughout the Rocky Mountain region and Great Basin while 30s and 40s occurred in the northern Plains and upper Midwest - Frost

and a few light freezes occurred in West Texas, but the cold may have been welcome for maturing crops by speeding along leaf defoliation - Frost

and freezes were not threatening to very many immature crops and warming was expected this week - U.S.

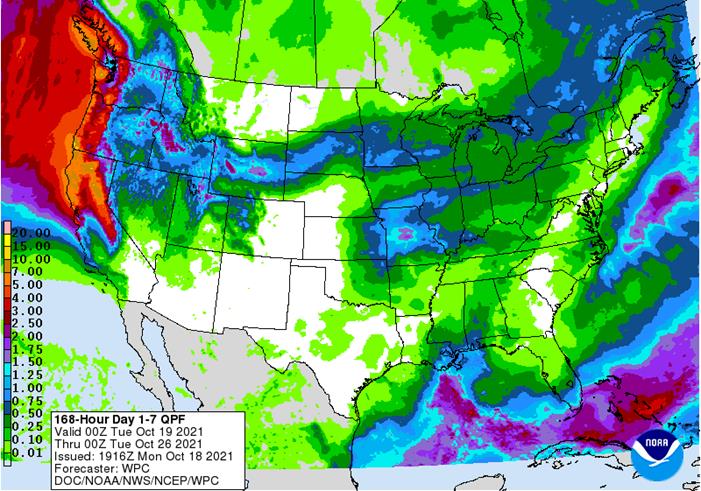

weather this week….. - Rain

will be limited to Tuesday into Thursday across the Plains and Midwest, Delta and southeastern states

- Resulting

amounts will be very light ranging from 0.10 to 0.35 inch except from South Dakota into the Great Lakes region where a few amounts of 0.35 to 1.00 inch is possible - Temperatures

will be seasonable to slightly warmer than usual with the Plains and interior western states warmest - Favorable

field progress will advance around this week’s precipitation - Both

the planting of winter crops and the harvest of summer grain and oilseeds will advance favorably during the week - Cotton

maturation and harvest progress is also expected along with other crops - U.S.

weather next week will be more active in with at least one large storm system bringing precipitation to the northern and eastern Plains, Midwest, Delta and southeastern states - Rainfall

will be sufficient to disrupt farming activity and to bolster topsoil moisture for a short period of time - Rain

is not likely to be significant in the west-central or southwestern Plains

- Waves

of rain will impact the Pacific Northwest and northern Rocky Mountain region

- Rain

and mountain snow will fall in the Sierra Nevada - A

minor disturbance may produce a few showers this weekend and a second large storm system is possible in the eastern Midwest late next week after the first large system occurs in the upper Midwest and western Corn Belt

- Temperatures

will turn colder in the western states and be warmer than usual in the central and eastern states - Farming

activity will be slowed for a little while next week because of rain, but the delays are not expected to be problematic and the moisture will be good for winter crop establishment - Another

wave of rain and snow will move through eastern Canada’s Prairies next week while this week will be dry biased - Harvesting

of this year’s crops is virtually complete, but the rain is needed to restore soil moisture after a multi-year drought seriously reduced production in 2021 - The

moisture must occur to improve spring planting conditions in 2022; however, central parts of the Prairies (southern and eastern Alberta and central through western Saskatchewan) are unlikely to get much meaningful moisture

- South

Africa weekend rain was limited to parts of Natal and the far southwestern coastal areas - Net

drying was good for fieldwork, although rain was needed in many areas to supporting spring planting and late season winter crop development - South

Africa will receive periodic rainfall during the coming week and that will bolster soil moisture for improved conditions for late season wheat development and early planting of summer crops - Showers

through Wednesday will impact half of the crop region, but rain amounts will not be more than 0.50 inch - Greater

rain is expected Thursday through and Friday with coverage of 75% from interior parts of Northern Cape and Eastern Cape through Mpumalanga, Natal and southwestern Limpopo - Alternating

periods of rain and sunshine are expected in the coming weekend and next week further supporting summer crop planting and late season winter crop development - China

rainfall Friday and Saturday was greatest from the Yangtze River Basin southward to Yunnan, Guangxi and the southern coastal provinces - Amounts

varied up to 0.79 inch most often with locally greater rainfall in southwestern Hunan where 2.83 inches resulted - Dry

conditions occurred in the North China Plain and northeastern provinces - Temperatures

have been cooler than usual recently and that may continue this week - China

weather over the next ten days will be driest in the northeastern provinces and in the North China Plain as well as lower portions of the Yellow River Basin - Rain

is likely in most other areas at one time or another and in amounts sufficient to support winter crop planting and establishment - Some

delay to farming activity will occur, but the wettest conditions will be in the interior southeastern provinces allowing fieldwork to advance around the precipitation in other areas - Temperatures

will be cooler than usual this week and then warmer next week - Central

Vietnam received heavy rainfall during the weekend - Amounts

through dawn today varied up to 18.15 inches near Hue - Most

of the greatest rain fell from Nha Trang northward to just south of Vinh. - The

heaviest rain will shift farther to the north and end today - Some

serious flooding may be occurring in parts of the region and drier weather is needed to protect personal property and some agriculture - Another

round of excessive coastal flooding is expected to begin Thursday and last into early next week - Rain

will fall frequently in Indonesia, Malaysia and Philippines through the next ten to 12 days maintaining a good outlook for palm oil, coconut, corn, rice, sugarcane, citrus and many other crops - Heavy

rain evolved in India during the week with three areas impacted most significantly - The

first was from coastal Odisha into Bangladesh where amounts ranged up to 3.25 inches, but much more was expected today and Tuesday - Rain

also fell from western and northern Madhya Pradesh to Haryana and northern Uttar Pradesh as well as western Nepal and this rain will continue today - Rainfall

of 1.50 to nearly 4.00 inches occurred in these areas through dawn today - Rainfall

in northern India will range from 2.00 to 5.00 inches today favoring Nepal and Uttaranchal

- Rainfall

of 2.00 to 6.00 inches will also impact Bangladesh and immediate neighboring areas today and Tuesday

- Far

southern India was the third area of heavy rain during the weekend, but this region will continue receive waves of rain throughout this week resulting in 2.00 to 6.00 inches of additional moisture - Drier

weather will follow Friday through next week - Most

other areas in India will experience a good mix of weather during the next two weeks with southern areas wettest and favorable drying conditions likely in the central and northwest - Western

Australia will receive some important rainfall today and Tuesday easing recent dryness and supporting winter crop development - Yield

potentials will remain very high - Drier

weather will follow later this week into the weekend - A

few more showers may occur early next week - Temperatures

will be seasonable - Other

areas in Australia are expecting to see a few showers and thunderstorms along with many days of drying which should be very good for reproducing and filling winter crops and for early season harvest progress - Temperatures

will trend warmer next week - Western

portions of the CIS will see a boost in precipitation this week in the north and some needed moisture “may” evolve next week from eastern Ukraine into the middle Volga River Basin

- Confidence

in the moisture boost for eastern Ukraine and the middle Volga Basin next week is fair, but not high and the potential event will be closely monitored - Winter

crop planting should be complete or nearly complete - Recent

temperatures have been pushing many crops into semi-dormancy - Temperatures

in the coming week to ten days will be near to above normal which might support a little more development in parts of Ukraine and Russia’s Southern Region - Southeastern

Europe’s heavy rain event finally has ended and now some gradual drying will occur that should eventually help get farmers back into the fields

- Other

areas in Europe will experience a favorable mix of weather during the next ten days

- Fieldwork

should advance well around the precipitation - Temperatures

will be near to above normal - North

Africa will be mostly dry this week, but rain will develop next week in Algeria - There

were no tropical cyclones around the world today and none was expected for a while

- Mexico

rainfall will be erratic over the next week with pockets of the nation a little wetter biased while other areas are a little drier biased - Southern

areas will be wetter biased - Central

America rainfall will be below average this week except in Costa Rica, Panama and El Salvador where rainfall will be near to above normal - Central

Asia cotton and other crop harvesting will advance swiftly as dry and warm conditions prevail - Central

Africa will continue to experience periodic rainfall during the next ten days maintaining good coffee, cocoa, sugarcane, rice, cotton and other crop conditions - Drier

weather will soon be needed in some cotton areas - Rainfall

this week is expected to be greater than usual - Today’s

Southern Oscillational Index was +11.35 and it was expected to move higher during the coming week - New

Zealand weather is expected to be a little drier than usual and temperatures will be seasonable.

Monday,

Oct. 18:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions – corn and cotton; soybeans harvested; winter wheat planted, 4pm - China’s

second batch of trade data, including corn, wheat, sugar, pork imports - China

3Q pork output and inventories - GrainCom

conference, Geneva, day 1 - Ivory

Coast cocoa arrivals

Tuesday,

Oct. 19:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - S&P

Global Platts European Sugar Virtual Conference, day 1 - GrainCom

conference, Geneva, day 2 - HOLIDAY:

Malaysia, Pakistan

Wednesday,

Oct. 20:

- EIA

weekly U.S. ethanol inventories, production - China’s

third batch of trade data, including soy, corn and pork imports by country - Malaysia

Oct. 1-20 palm oil exports - S&P

Global Platts European Sugar Virtual Conference, day 2 - USDA

total milk production, 3pm - GrainCom

conference, Geneva, day 3 - HOLIDAY:

Indonesia

Thursday,

Oct. 21:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - International

Grains Council monthly report - Port

of Rouen data on French grain exports - USDA

red meat production, 3pm

Friday,

Oct. 22:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

cattle on feed; cold storage data for pork, beef and poultry, 3pm - USDA

NASS Chicken and Eggs. - HOLIDAY:

Thailand

Source:

Bloomberg and FI

USDA

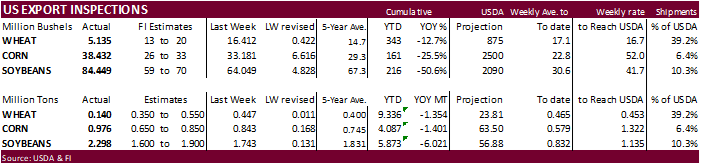

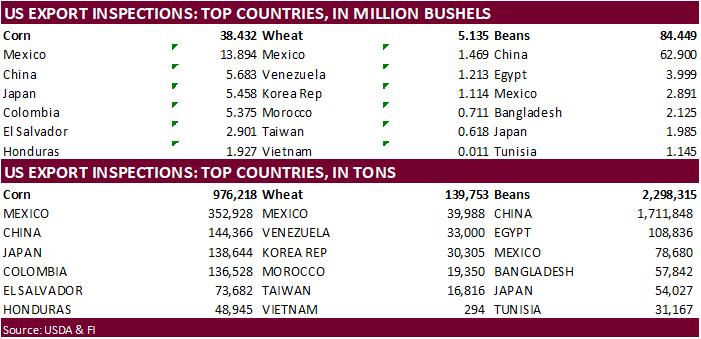

inspections versus Reuters trade range

Wheat

139,753 versus 300000-550000 range

Corn

976,218 versus 650000-850000 range

Soybeans

2,298,315 versus 1600000-2100000 range

Soybean

and corn inspections were reported above expectations while wheat fell to their lowest week since December 25, 2014. Soybeans are at their highest since December 17, 2020.

GRAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING OCT 14, 2021

-- METRIC TONS --

-------------------------------------------------------------------------

CURRENT PREVIOUS

----------- WEEK ENDING ---------- MARKET YEAR MARKET YEAR

GRAIN 10/14/2021 10/07/2021 10/15/2020 TO DATE TO DATE

BARLEY 0 1,597 0 8,147 9,069

CORN 976,218 842,848 912,646 4,087,490 5,488,804

FLAXSEED 0 0 0 24 389

MIXED 0 0 0 0 0

OATS 0 0 0 200 1,196

RYE 0 0 0 0 0

SORGHUM 37,990 70,108 74,941 337,657 471,563

SOYBEANS 2,298,315 1,743,137 2,336,517 5,873,076 11,894,136

SUNFLOWER 144 0 0 144 0

WHEAT 139,753 446,652 242,007 9,336,194 10,690,129

Total 3,452,420 3,104,342 3,566,111 19,642,932 28,555,286

------------------------------------------------------------------------

CROP MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED; SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES WATERWAY SHIPMENTS TO CANADA.

Macros

79

Counterparties Take $1.477 Tln At Fed’s Fixed-Rate Reverse Repo ($1.462 Tln, 78 Bidders)

Canadian

Housing Starts Sep: 251.2K (est 256.5K; prev 260.2K; prevR 262.8K)

US

Industrial Production (M/M) Sep: -1.3% (est 0.2%; prev 0.4%; prevR -0.1%)

–

US Capacity Utilization Sep: 75.2% (est 76.5%; prev 76.4%; prevR 76.2%)

–

US Manufacturing (SIC) Production Sep: -0.7% (est 0.1%; prev 0.2%; -0.4%)

·

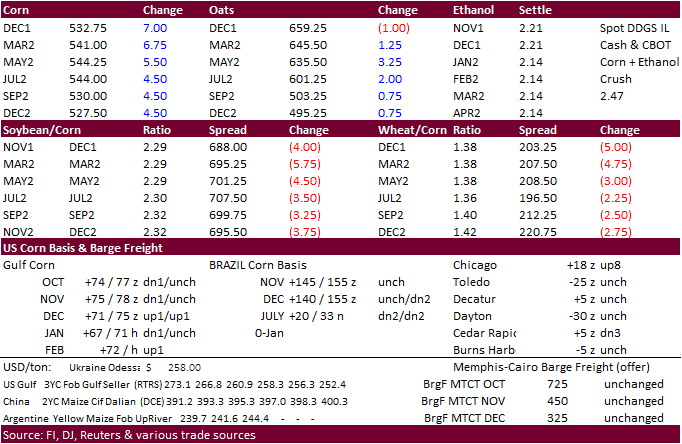

Corn rallied to close 4.75-7.00 cents higher after USDA posted excellent US corn inspections and firmer domestic corn cash prices. Chicago corn basis increased 8 cents to 18 over the December. Lack of producer selling was noted.

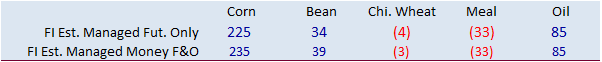

Funds bought an estimated net 7,000 corn contracts. Traders are waiting to see if China will but more US corn.

·

USDA US corn export inspections as of October 14, 2021 were 976,218 tons, above a range of trade expectations, above 842,848 tons previous week and compares to 912,646 tons year ago. Major countries included Mexico for 352,928

tons, China for 144,366 tons, and Japan for 138,644 tons.

·

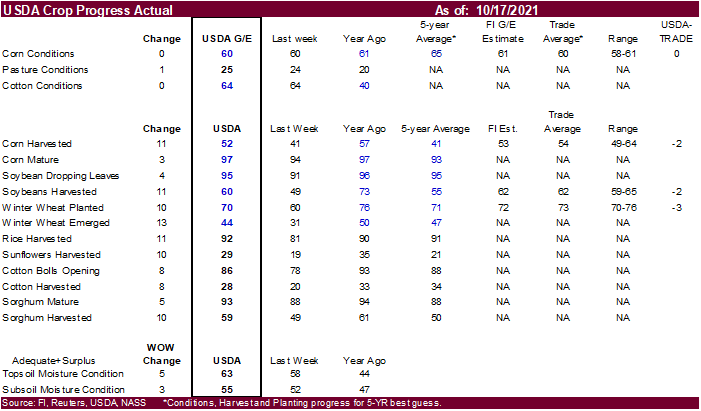

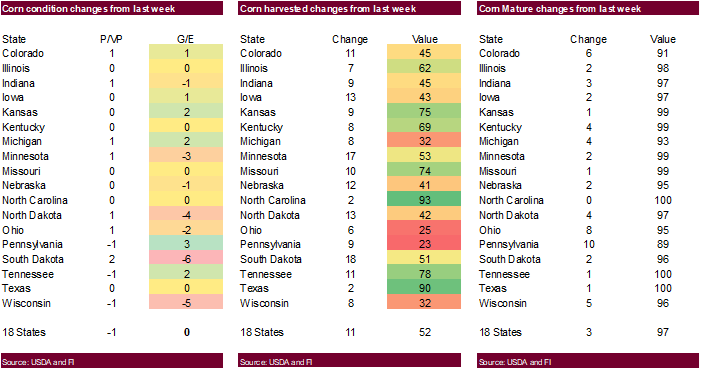

US corn conditions were unchanged from the previous week at 60 for the combined good and excellent categories, one point below the previous week and 5 points below average.

·

US corn planting progress advanced 11 points to 52 percent complete, 2 points below an average trade guess and compares to 57 percent year ago and 41 percent average.

·

Traders should continue to monitor Argentina as some commercials late last week said the government was intervening on corn and wheat export licenses, at least for old crop.

·

Most of Brazil is forecast to receive 0.75 to 2.50 inches of rain through Friday. Mato Grosso do Sul and neighboring states will remain dry.

·

China’s gross domestic product grew 4.9% from a year earlier, compared to a 7.9% gain in the second quarter, according to China’s NBS. This slowdown is in part to several economic policy changes made since the height of the pandemic.

·

China’s pork production was up 38% in the first nine months of 2021 to 39.17 million tons, according to the National Bureau of Statistics (NBS). Q3 pork output was highest in three years. China slaughtered 491.93 million hogs

in the first nine months of the year, up 35.9%. NBS reported Its pig herd expanded 18.2% to 437.64 million heads at end-September.

·

China corn imports during September were a large 3.53 million tons and year to date of 25 million tons are running 275 percent above the same period a year ago.

Export

developments.

-

None

reported

Updated

10/12/21

December

corn is seen in a $4.85-$5.55 range

March

corn is seen in a $5.00-$5.70 range

·

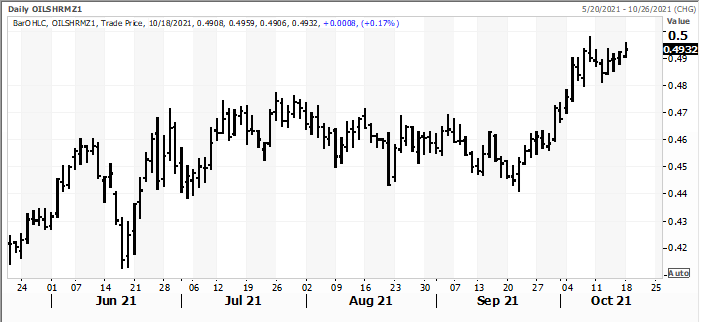

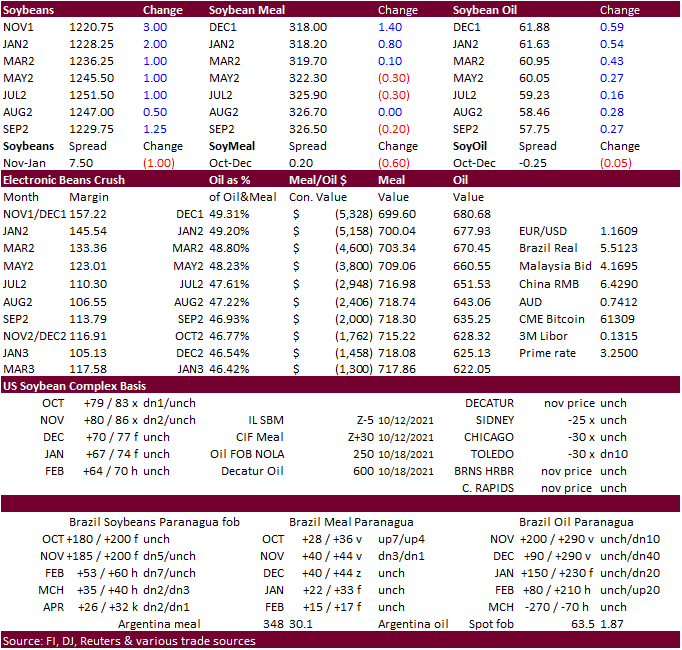

Soybeans, meal and soybean oil (up by most) ended higher in the spot contracts. Back month meal was lower. November soybeans were up 3.75 cents, December meal up $1.30, and December soybean oil up 73 points. USDA export inspections

were highest since last 2020. WTI crude oil was higher but sold off by mid-morning. Uncertainty over the RVO decisions from the EPA does continues to circulate . Another 61 SBO registrations were cancelled, leaving 244 left registered.

·

Pakistan was the latest country to lower vegetable oil import taxes. They are lowering it from 8.5% from 17% with the objective to reduce edible oil prices and food inflation.

·

Funds bought an estimated net 3,000 soybeans, bought 2,000 soybean meal and bought 4,000 soybean oil.

·

USDA US soybean export inspections as of October 14, 2021 were 2,298,315 tons, above a range of trade expectations, above 1,743,137 tons previous week and compares to 2,336,517 tons year ago. Major countries included China for

1,711,848 tons, Egypt for 108,836 tons, and Mexico for 78,680 tons.

·

CBOT soybean meal saw bull spreading. IL soymeal basis was up 4.00 from Friday. We think the lower than expected September crush and difficulty for ECB crushers to source spot soybeans supported cash prices.

·

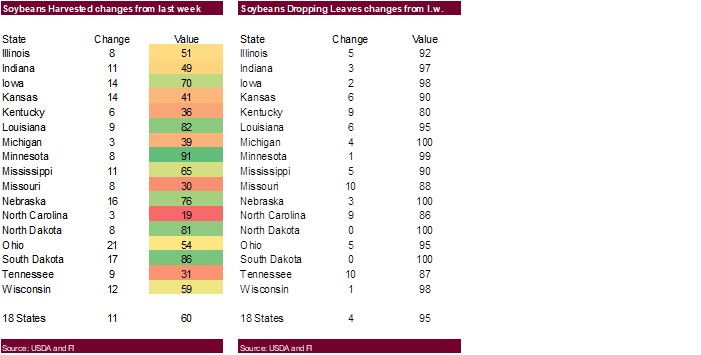

US soybean harvest progress was reported at 60 percent, 2 points below an average trade guess, below 73 year ago and above 55 percent average.

·

La Nina has been officially declared and South America, but planting progress is advancing after recent rainfall during FH October.

·

Ukraine APK-Inform lowered Ukraine’s 2021-22 sunflower seed production to 16.6 million tons from 16.7 million previous, and slightly lowered 2021-22 sunflower oil production to 7.123 million tons from 7.170 million a month ago.

·

Brazil lorry drivers threatened to go on strike from November 1 if the government does not open discussion to adjust diesel costs and/or increase inland freight prices.

·

AgRural reported a good jump in Brazil’s soybean planting progress by 12 points to 22% as of October 14. At 22 percent, progress is up 14 points from a year earlier. Safras & Mercados reported 21% as of October 15. Mato Grosso

was 45% complete and Parana 35%.

·

Argentina soybean oil exports reached 4.7 million tons, up 22% compared to the same period a year ago, according to AgMin data via AgriCensus.

·

India soybean meal exports declined 47% in September according to SEA, to 5,831 tons from 10,975 in August. April through September 2021 exports are off 49% to 161,588 tons. India will be a net importer of soybean meal this

year after granting 1.2 million tons of GM imports back in August.

·

Rains across the Midwest over the weekend were near expectations, favoring MO, southern IL, IN, OH and MI. Rain this week should favor the north central Midwest mid-workweek and eastern areas Thursday through Friday.

·

Egypt over the weekend floated an import tender for vegetable oils.

December

soybean oil share

Palm

conference:

MBOB:

Average palm future price to average 4,100 ringgit per ton in 2021. Palm production and exports to improve towards end of 2021, resulting in more manageably stocks.

Oct

18 (Reuters) –Indian Vegetable Oil Producers’ Association

·

Indian Vegetable Oil Producers’ Association Says It Sees Early Signs Of Demand Shift From Palm Oil To Soft Oil After India’s Duty Cut

·

Indian Vegetable Oil Producers’ Association Says Indonesia’s Import Share Fell To 46% In 2020/21 From 72% In 2019/20

·

Indian Vegetable Oil Producers’ Association Says Malaysia’s Import Share Rose To 45% In 2020/21 From 21% In 2019/20

·

Indian Vegetable Oil Producers’ Association Says Exemption On Palm Olein Imports Until Dec 2021 Should Not Be Extended Further

Oct

18 (Reuters) – GAPKI:

Indonesia’s

crude palm oil exports in 2021 are expected to fall 54.4% from a year earlier. Crude palm oil (CPO) exports from Indonesia are forecast to reach 3.27 million tons this year, compared with 7.17 million tons in 2020. They had earlier estimated exports of 7.5

million tons.

GAPKI

cut its forecast as India opted for refined palm products that were more economical compared to CPO, which jumped to record highs throughout the year.

Total

palm oil exports in 2021 are expected to rise to 34.42 million tons from last year’s 34.01 million tons, driven by a likely 21.2% jump in refined palm exports. Earlier, GAPKI had expected palm oil exports of 37.5 million tons.

Thomas

Mielke – Global vegetable oil prices, which have hit multi-year highs in recent months, are set to decline during the first half of 2022 due to a strong recovery in production and inventories. 2021-22 global palm production is projected to increase 3.5-4.0

million tons to nearly 80 million tons.

Export

Developments

·

Last week the USDA bought 8,000 tons of soybean meal for the Food for Purpose export program at $426.00/ton.

·

Egypt seeks 30,000 tons of soybean oil and 10,000 tons of sunflower oil on Wednesday for arrival during December 5-25.

Updated

10/18/21

Soybeans

– November $11.50-$13.00 range, March $11.50-$13.50

Soybean

meal – December $295-$335, March $300-$360

Soybean

oil – December 59-65 cent range (up 200 both ends),

March 56-65

·

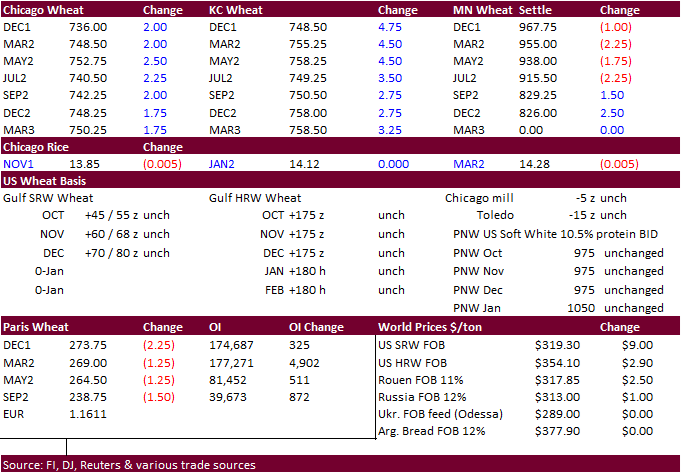

US wheat futures prices ended higher in Chicago and KC but fell in the front four months in Minneapolis. Strength in corn lent support. Some traders noted technical buying. Weekly export inspections were disappointing and were

lowest since December 2014.

·

Funds bought an estimated net 2,000 Chicago soft wheat contracts.

·

USDA US all-wheat export inspections as of October 14, 2021 were 139,753 tons, below a range of trade expectations, below 446,652 tons previous week and compares to 242,007 tons year ago. Major countries included Mexico for 39,988

tons, Venezuela for 33,000 tons, and Korea Rep for 30,305 tons.

·

Paris wheat reached another contract high but fell 2.25 euros to 274.

·

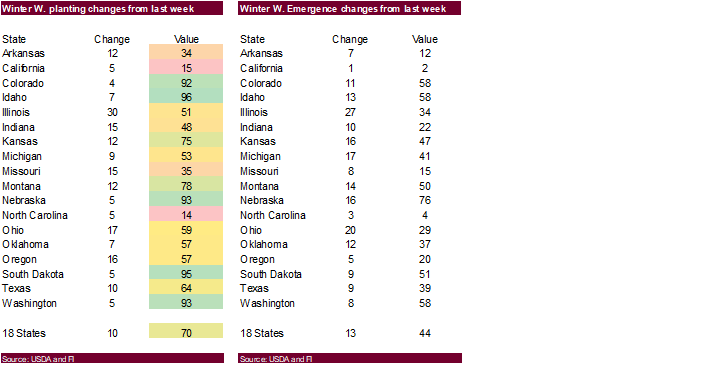

US winter wheat planting progress increased 10 points from the previous week to 70 percent, 2 points below expectations and compares to 76 year ago and 71 percent average. 44 percent of the winter wheat emerged, below 47 average.

·

Ukraine 2021-22 grain exports are up 12% from July 11 to 16.5 million tons from 14.8 million tons year earlier. That included 10.7 million tons of wheat, 4 million tons of barley and 1.5 million tons of corn.

·

Talk of La Nina would not only affect rainfall for southern Brazil and Argentina this winter but could also reduce precipitation for the US southern Great Plains.

·

The Great Plains will see light showers across eastern NE Tuesday and central TX Thursday. Wheat futures prices this morning were lower to mixed.

·

China plans to start a new round of wheat auctions from state reserves, starting October 20.

·

Egypt said they have five months of wheat reserves.

·

SovEcon projected an 80.7 million tons Russian wheat crop for 2022 from 75.5 million in 2021.

·

China brought in 640,000 tons of wheat in September, down 44.8% from a year earlier. Jan-Sep imports were 7.59 million tons, up 25 percent from year ago.

Export

Developments.

·

Ethiopia seeks 400,000 tons of wheat on November 30.

·

Jordan seeks 120,000 tons of wheat on October 20.

·

Jordan seeks 120,000 tons of feed barley on October 21 for FH January through FH March shipment.

·

Pakistan seeks 90,000 tons of wheat on October 25.

·

Last week Pakistan passed on 90,000 tons wheat.

·

Turkey seeks 300,000 tons of wheat on Oct. 21 for shipment between Dec. 10 and Dec. 31.

·

Ethiopia seeks 300,000 tons of milling wheat on November 9.

Rice/Other

·

Maldives seeks 25,000 tons of parboiled rice with offers due by October 28.

·

Mauritius seeks 6,000 tons of white rice on October 26 for January 1-March 31 shipment.

December

Chicago wheat is seen in a $7.00‐$7.75 range, March $6.50-$7.75

December

KC wheat is seen in a $7.10‐$7.95 (up 15 both ends), March $6.82-$8.25 (up 10, up 25)

December

MN wheat is seen in a $9.00‐$10.00 (unch, up 25), March $9.00-$10.00

(unch, up 25)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.