PDF attached

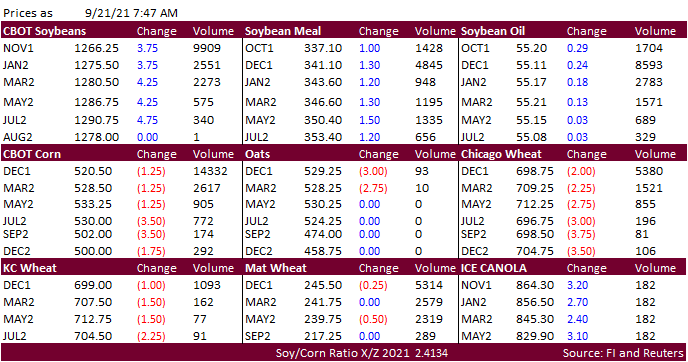

WTI

crude oil is $0.61 higher, USD 16 points lower and Dow futures higher.

November

soybeans are higher but still below their 200-day MA of $12.6850. Soybean oil is rebounding in part to a rally in cash rapeseed oil (up 15 euros) and higher palm oil. Meal rebounded to close the overnight session higher. Corn and wheat are lower. China

will be back from holiday Wednesday. US corn and soybean conditions improved one point each, and both were one point above trade expectations. US corn harvest was 10% complete, up from 4% previous week and ahead of the five-year average of 9%. IA was 4%

complete and IL was at 11%. 57% of the US corn crop was mature, 10 points above average. For soybeans, 6% of the crop had been harvested, in line with average. 58% of the soybean crop is dropping leaves, 10 points above average. This is concerning for

some analysts as they believe a fast-maturing soybean crop will not be good for test weights as the pods have not developed to their full potential.