PDF attached

No

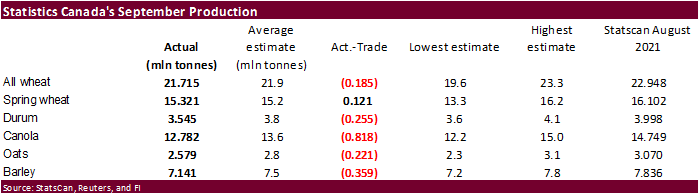

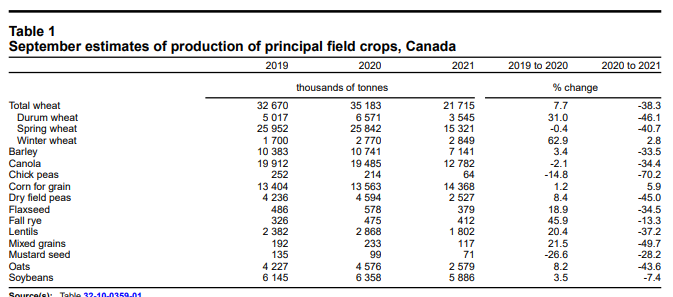

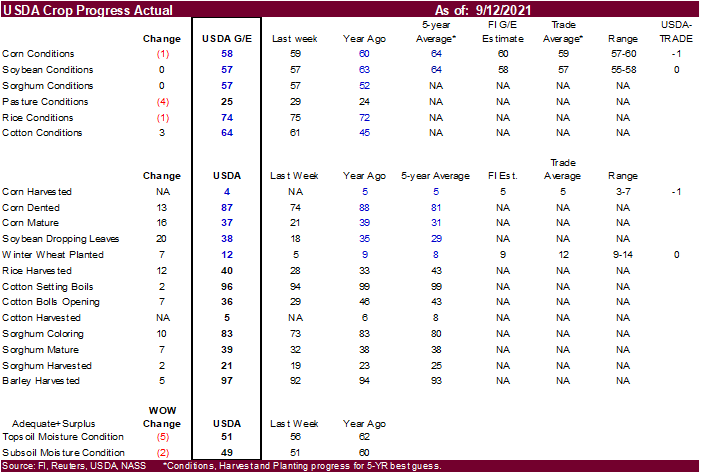

24-hour announcements. StatsCan Canadian production estimates are viewed as supportive. Prices were initially higher on the decline in the corn rating, talk of Chinese buying soybeans, higher soybean oil, and cut in the French soft wheat production by the

AgMin coupled with dry weather across the central US Great Plains.

(7:57 am CT) WTI was 59 cents higher, USD 33 points lower, and stock markets leaning towards a higher open. US corn conditions declined by one point and soybeans were unchanged. However, based on our October versus final trend yield analysis and higher US

harvested area, we boosted our corn and soybean production estimates.