PDF attached

WASHINGTON,

September 9, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

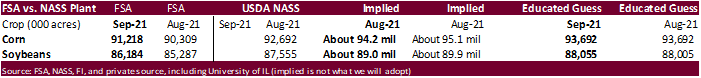

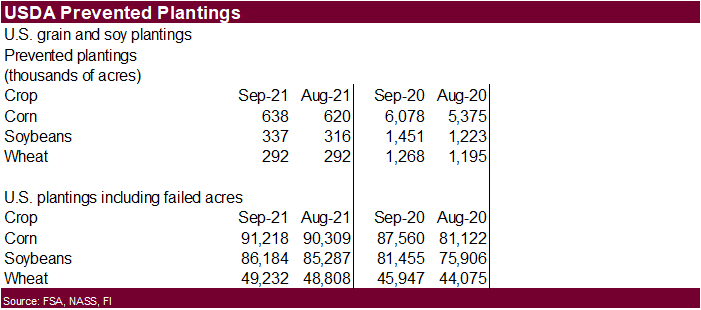

Speculative

selling is sending agriculture commodity futures lower this morning ahead of several reports due out on Friday. USDA inadvertently released September FSA US prevented planting data yesterday suggesting a large upward revision in US corn acres and to a lesser

extent, higher soybean planted area.

Conab

lowered their Brazil corn production estimate to 85.75 million tons from 86.65 million and compares to 102.6 million for 2019-20. Brazil soybean production was estimated at 135.912 million, down slightly from 135.978 million in August and compares to 124.845

million in 2019-20. Brazil’s wheat crop was seen at 8.156 million tons, down from 8.591 million in August and up from 6.235 million in 2020.

Friday

reports include export sales, S&D data, and official FSA prevented planting data.

Per

newswires data yesterday, FSA data suggests a higher US corn and soybean area for 2021. A university extension school sees a 1.6 million implied upward revision in corn and 207,000-acre higher soybeans. We are 1 million higher for corn and 500,000 acres

higher for soybeans.

![]()