PDF attached

WASHINGTON,

September 3, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 130,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

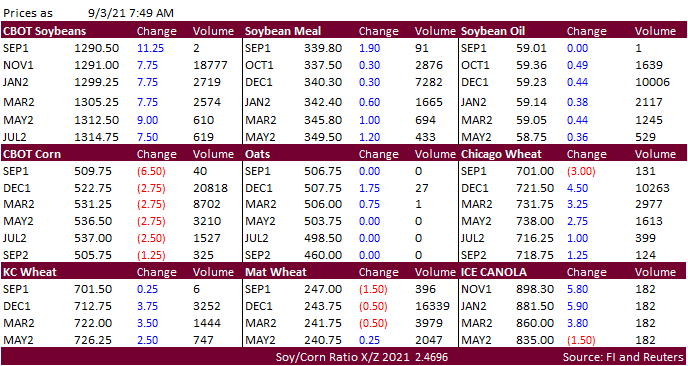

Higher

trade in the US soybean complex this morning as prices continue to rebound. Palm was again higher, by 69MYR overnight and cash increased $15/ton to $1,100/ton. Corn is lower on lack of fresh news and plummeting spot corn basis offers out of the Gulf. Wheat

is higher on expectations for Russia to slow wheat sales next week. Overall news is light. Expect positioning today ahead of the long holiday weekend.