PDF attached

Good

morning.

Last

trading session before FND deliveries.

Under

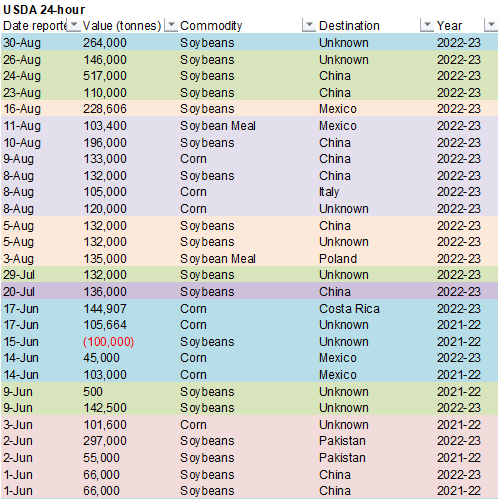

the 24-H reporting system, private exporters reported sales of 264,000 tons of soybeans for delivery to unknown destinations during the 2022-23 marketing year.

USDA

announced the weekly USDA export sales report will be delayed until further notice. Our target was for a Tuesday release. We will be running estimates for last week (8/25) later today, regardless of missing data.

US

equities are rebounding, USD down 23 at the time this was written, WTI crude oil down more than $2.30, and gold lower. Most other commodities are lower on renewed recession fears. CBOT ags are lower. US wheat is off 5-13 cents led by spring wheat after USDA

reported an improvement in conditions. Wheat futures were up nearly 5 percent on Monday so some of this is a correction. Corn is lower after rallying to a 2-month high yesterday. Europe’s grain harvest started earlier than normal allowing supplies to soon

hit the domestic and export market. The soybean complex is lower on widespread commodity selling and an unchanged USDA soybean rating. Malaysia is on holiday Wednesday so for the month futures lost 3.6%, fourth monthly consecutive loss. Offshore values were

leading SBO 12 points higher earlier this morning and meal $2.90 short ton lower.

Pakistan’s

flooding could amount to over 10 billion USD in damages. More than half a million people were displaced. The floods washed out infrastructure including textile mills. The morning weather forecast was largely unchanged for the US. The Midwestern areas will

see rain today, far north central areas Friday and south central areas Sunday. TX will see good rains through Friday before tapering off. NE and CO will remain dry. The WCB corn belt in general will see net drying over the next week. EU’s weather outlook

improved a touch with additional rain across central and southern France, Italy, Romania and Bulgaria.

WORLD

WEATHER HIGHLIGHTS FOR AUGUST 30, 2022

-

European

model removed rain from the U.S. Delta overnight -

European

model removed rain from Russia’s Southern Region overnight – this was needed -

Canada’s

Prairies are dry biased for harvest progress next ten days -

U.S.

northern Plains, Pacific Northwest, central Plains and western Corn Belt will be dry biased next ten days -

Good

spring and summer crop maturation and harvest progress to continue -

U.S.

eastern Midwest drier biased next seven days -

West

Texas receives more rain overnight with 0.30 to 1.43 inches and local totals to 1.90 inches -

Additional

rain expected next weekend and early next week -

Two

tropical cyclones still expected to evolve later this week in the Atlantic Ocean, but neither storm is expected to threaten land -

Typhoon

Hinnamnor will become a super typhoon today as it moves closer to the Ryukyu Islands of Japan -

The

storm will move through the East China Sea this weekend and then impact the Korean Peninsula and possibly a part of western Japan early next week with torrential rain and strong wind speeds, although the storm will be weaker by that time -

China’s

Yangtze River Basin falls back into a dry weather mode over the next ten days to two weeks after “parts” of the region were relieved from drought over the past several days -

Some

areas have still not seen significant rain -

This

drought area is still mostly a rice issue and not a significant corn, soybean or groundnut issue -

Good

drying conditions are expected in the North China Plain while Heilongjiang stays wet -

Western

Europe is still expecting some showers late this week and through the weekend with a significant amount of moisture possible in parts of France and the U.K. next week -

Northeastern

Europe into parts of Ukraine and southwestern Russia will be drier than usual for a while -

Showers

in Russia’s winter crop region are expected to be brief and light in the next two weeks, but “some” rain will fall -

No

changes in India weather occurred overnight leaving the northwest dry along with Pakistan while rain falls elsewhere in the nation -

Western

Argentina will stay dry biased -

Eastern

Argentina and southern Brazil will see periodic rain -

Australia

weather is expected to remain mostly good for wheat, barley and canola

Source:

World Weather INC

Bloomberg

Ag Calendar

Tuesday,

Aug. 30:

- No

major event scheduled

Wednesday,

Aug. 31:

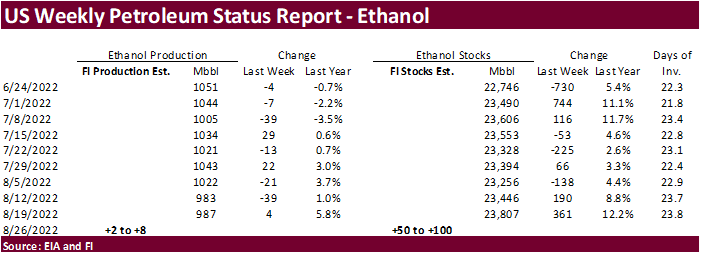

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysia’s

August palm oil export data - US

agricultural prices paid, received, 3pm - HOLIDAY:

India, Malaysia

Thursday,

Sept. 1:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Cocoa

Association of Asia hosts International Cocoa Conference, day 1 - Australia

Commodity Index - USDA

soybean crush, DDGS production, corn for ethanol - HOLIDAY:

Vietnam

Friday,

Sept. 2:

- FAO

world food price index, grains supply and demand outlook - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Cocoa

Association of Asia hosts International Cocoa Conference, day 2

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

520,791 versus 250000-650000 range

Corn

689,052 versus 500000-850000 range

Soybeans

436,851 versus 500000-825000 range

Macros

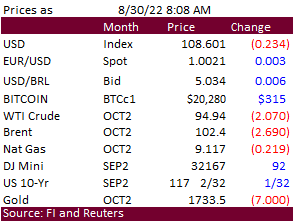

US

FHFA House Price Index (M/M) Jun: 0.1% (est 0.8%; prevR 1.3%)

US

House Price Purchase Index (Q/Q) Q2: 4.0% (prevR 4.7%)

US

CoreLogic CS 20-City (M/M) SA Jun: 0.44% (est 0.90%; prevR 1.22%)

US

CoreLogic CS 20-City (Y/Y) NSA Jun: 18.65% (est 19.20%; prevR 20.51%)

·

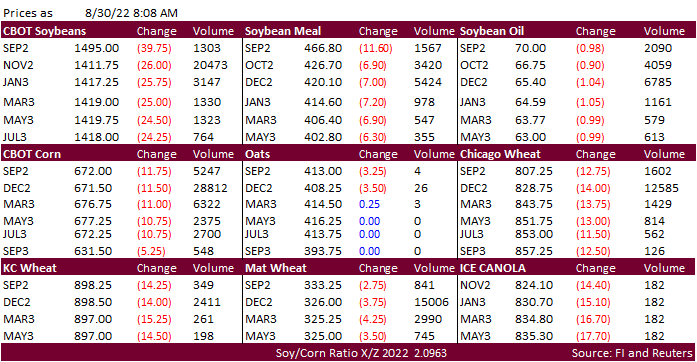

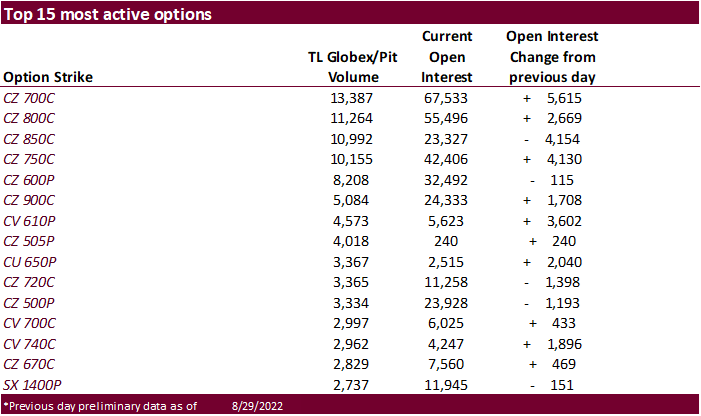

CBOT corn is lower after rallying to a 2-month high yesterday.

·

US equities are rebounding, USD down 24 at the time this was written, WTI crude oil down more than $2.30, and gold lower. Most other commodity markets (softs, metals) are lower on renewed recession fears.

·

Europe’s grain harvest started earlier than normal allowing supplies to soon hit the domestic and export market.

·

Additional corn and wheat vessels were recently approved to leave Ukraine ports. About 1.5 million tons of grain/food has sailed from Ukraine since the safe passage agreement.

·

Agritel called the French corn crop “catastrophic”, estimating production at a 15-year low of 53.8 million tons. The Baltic Dry Index fell 6 percent to 1,017 points.

·

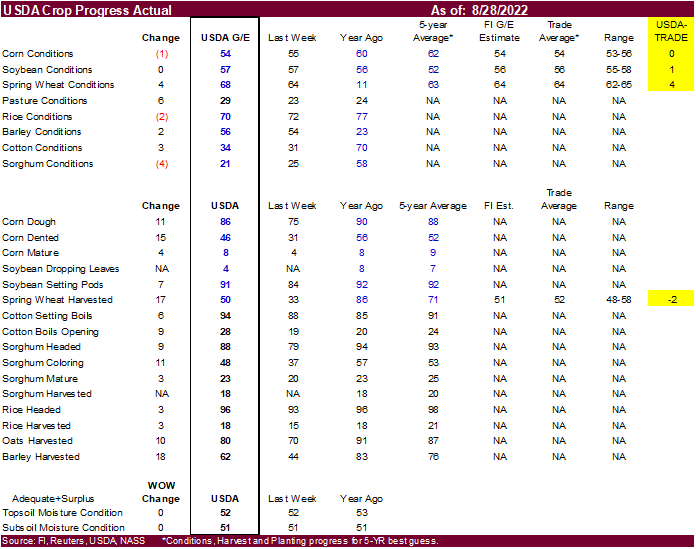

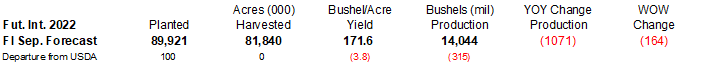

US corn conditions are down 1 point from the previous week but on our weighted average, the corn rating suggests a September yield of 171.6 bu/ac, 3.8 bu/ac below USDA. USDA’s combined G/E rating of lowest since the drought year

of 2012.

·

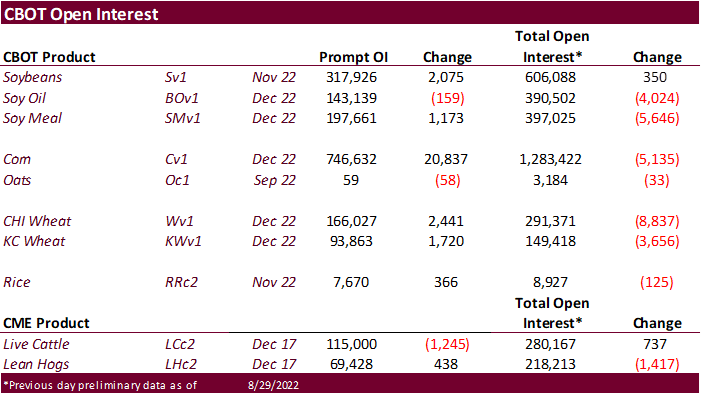

CBOT corn deliveries are expected to be low, if any, on FND August 31 (tonight). Registrations stand at zero.

·

USDA US corn export inspections as of August 25, 2022 were 689,052 tons, within a range of trade expectations, below 821,533 tons previous week and compares to 583,498 tons year ago. Major countries included China for 345,199

tons, Mexico for 234,384 tons, and Japan for 72,575 tons.

·

Brazil’s Datagro looks for Brazil’s total corn crop to end up near 120.5 million tons for 2022-23. USDA is at 126 million tons.

·

South Korea’s NOFI bought 137,000 tons of corn for December arrival. One cargo was bought of 69,000 tons was bought at 182 cents c&f over the December and another 68,000 tons was bought at an estimated premium of 184.85 cents

c&f over the December.

·

The soybean complex is lower on widespread commodity selling and an unchanged USDA soybean rating. Many outside related oilseed product markets were lower overnight.

·

Russia plans to extend its export tax on soybeans until Aug. 31, 2024, and a partial ban on rapeseed exports (from the Zabaikalsk region) until Feb. 1, 2022. The current export tax on soybeans is 20% but not less than $100 per

ton.

·

There were no changes to CBOT registrations. We look for no FND deliveries for soybeans and meal. Soybean oil deliveries are expected to be zero to 100.

·

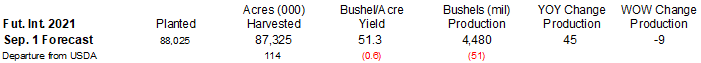

US soybean conditions were unchanged for the combined good and excellent categories. On a weighted basis, our soybean yield was lowered only a tenth of a percent to 51.3 compared to USDA’s 51.9 bu/ac.

·

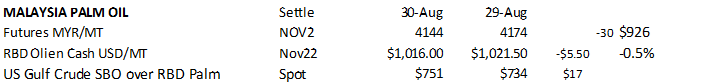

Malaysia is on holiday Wednesday so for the month futures lost 3.6%, fourth monthly consecutive loss.

·

Malaysia November palm oil was 30 ringgit lower at 4144 per ton, and cash was down $5.50 at $1021.50/ton.

·

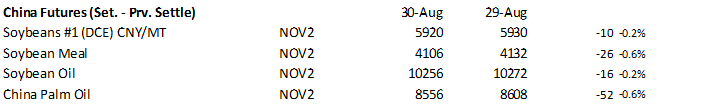

China soybean futures were down 0.2 percent, meal 0.6% lower, soybean oil down 0.2%, and palm 0.2% lower.

·

Rotterdam vegetable oils were

7-20 euros lower, and meal 4-7 lower for the positions we follow, from this time yesterday morning.

·

Offshore values were leading SBO 12 points higher earlier this morning and meal $2.90 short ton

lower.

·

Yesterday Brazil’s Datagro see the 2022-22 soybean crop for Brazil at 151.8 million tons.

Abiove

estimated 2022-23 Brazil soybean production at 151 million tons. USDA is at 149 million, up from 126 million tons for 2021-22. Abiove looks for the soybean crop area to end up near 42 million hectares. Crush was pegged at 49.2 million. They went onto say they

don’t anticipate China to buy large quantities of soybean meal from Brazil, but purchases will be important.

·

Under the 24-H reporting system, private exporters reported sales of 264,000 tons of soybeans for delivery to unknown destinations during the 2022-23 marketing year.

·

For China’s 14th weekly soybean auction set for September 2, they look for sell 500,000 tons.

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 30,000 tons of GMO-free soybeans on September 6 for arrival in SK between November 12 and Dec 12, and another arrival period of October 30 and November 30.

·

USDA’s AMS CCC seeks to sell 3,150 tons of vegetable oil on September 7 for shipment for Oct 1-31 (Oct 16 to Nov 15 for plants at ports).

·

US wheat futures are off 6-16 cents led by spring wheat after USDA reported an improvement in high protein conditions. Wheat futures were up nearly 5 percent on Monday so some of this is a correction.

·

Agritel increased their estimate of the French soft wheat crop at 33.63 million tons, up from 33.44 million projected a month ago, but below the average.

·

The Baltic Dry Index fell 6 percent to 1,017 points.

·

Paris December wheat was down 3.75 euros at 326 per ton as of 8:00 am CT.

·

Parts of HRW wheat country will see rain on and off bias the southwestern areas over the next 5 days. Rain will be heavier today through Friday then start to taper off this weekend. Not all areas will see rain. NE, CO, and surrounding

areas may see little or no precipitation.

·

US spring wheat conditions increased 4 points. We increased spring wheat production to 515 million bushels from 508 million previous and compares to 512 USDA August. Durum was increased to 76 million from 73 million and compares

to 73.6 million USDA.

·

USDA US all-wheat export inspections as of August 25, 2022 were 520,791 tons, within a range of trade expectations, below 594,273 tons previous week and compares to 435,399 tons year ago. Major countries included Mexico for 104,552

tons, China for 71,811 tons, and Vietnam for 70,045 tons.

·

Results are awaited on Algeria seeking at least 50,000 tons of wheat for LH Sep through Oct 31 shipment.

·

The Philippines passed on 100,000 tons of feed wheat Oct-Dec shipment.

·

Jordan bought 60,000 tons of wheat at $376.50/ton c&f for shipment in the second half of January 2023.

·

Jordan seeks 120,000 tons of wheat on September 6.

·

Jordan seeks 120,000 tons of barley on August 31 for Dec-Feb shipment.

·

Japan seeks 95,497 tons of food wheat form the US and Canada later this week for arrival by December 31.

·

Bangladesh delayed their 50,000 ton import tender of milling wheat set to close on September 1, to September 18. It’s for optional origin with shipment within 40 days of contract signing.

Rice/Other

·

Taiwan and Vietnam plant to raise their export price of rice but no details have been set.

·

Bangladesh seeks 50,000 tons of rice on September 6.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.