PDF attached

US

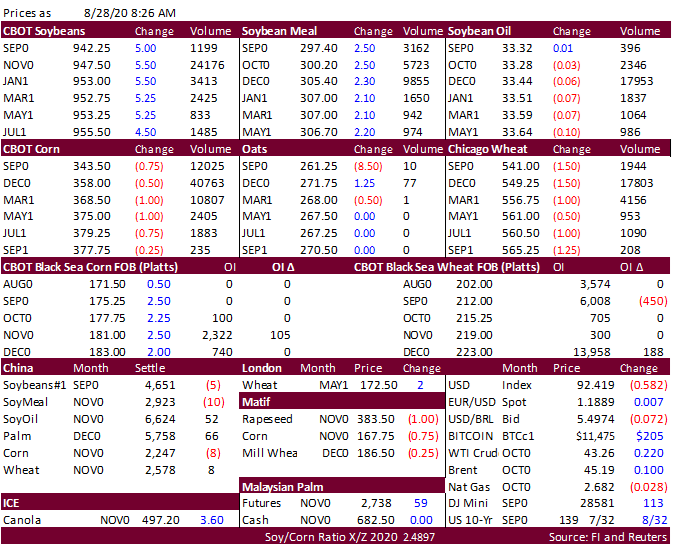

export developments slowed late this week as futures prices are up a good amount week over week. Today is position day. USD is under major pressure this morning. Look for meal/oil correction today if general agriculture prices correct. We look for US corn

conditions to decline 3 points, soybeans down 2, and spring wheat unchanged, when updated on Monday. BA Grain Exchange warned Argentina wheat yields could fall as much as 50 percent in the northern and central crop areas from frost, dryness, and insects.

FND

Delivery estimates:

Oil

1500-2500

Meal

150-300

Beans

0-25

Corn

0

Wheat

0-75

![]()