Tropical

storm Laura was upgraded to be a catastrophic Category 4 hurricane. Laura will touch land late Wednesday/early Thursday, impacting US Gulf shipments and creating localized flooding which will threaten the lower Delta/SW unharvested crops.

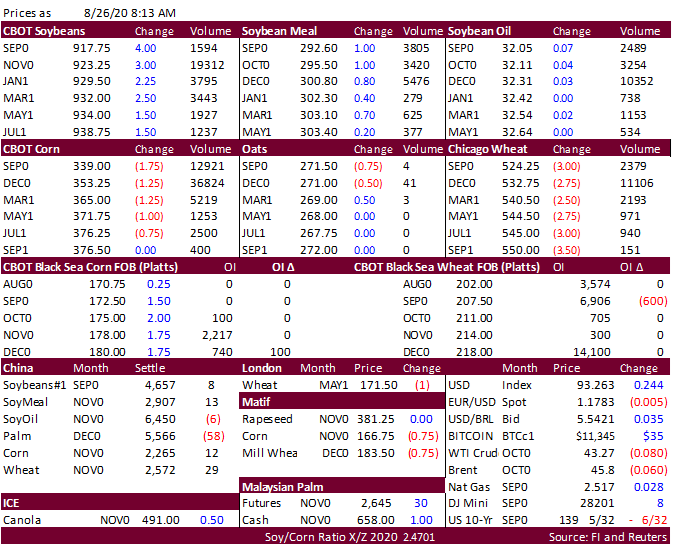

Much

of the soybean complex is higher. Bloomberg reported China may purchase about 40 million tons of US soybeans in 2020, a calendar year record. That would be about 25% more than in 2017 and 10% greater than the record set in 2016. We heard China bought at

least 6 cargoes of US beans out of the US Gulf and PNW for shipment between October and November. Products are finding limited upside as offshore values this morning were leading CBOT soybean oil 36 lower and meal $1.60 lower.

Grains

are lower on technical selling. Corn open interest was down 42,800 on Tuesday. Yesterday the funds bought an estimated net 30,000 contracts. A Bloomberg poll looks for weekly US ethanol production to be down 2,000 at 924,000 barrels (900-940 range) from

the previous week and stocks to decrease 126,000 barrels to 20.144 million. Turkey bought about 390,000 tons of red milling wheat. Japan received no offers for 80,000 tons of feed wheat and 100,000 tons of feed barley (SBS) for November 30 loading. The tropical

storm ready to slam the US Gulf will not be good for unharvested crops.

![]()