PDF attached

The

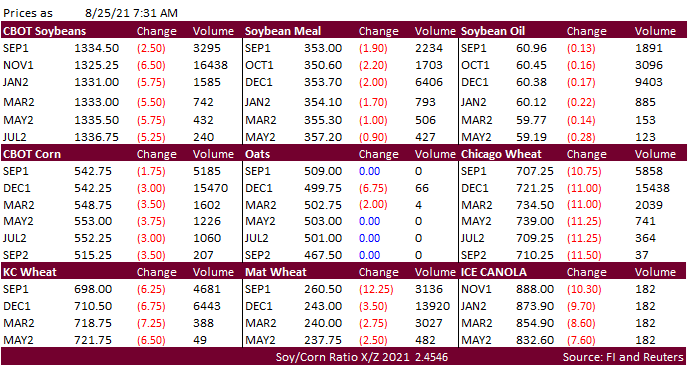

soybean complex is lower on light profit taking after contracts rallied on Tuesday. The USD was 18 points higher. Additional China demand indications for US soybeans could limit losses. Offshore values are leading soybean oil 116 points lower and meal $4.90

lower. September corn is trending lower. The Major US growing regions with exception of the southwest will see rain one time or another over the next week. Chicago wheat futures hit a two-week low, lengthening losses from Tuesday from North American harvest

pressure, lower Paris wheat and profit taking. A

Bloomberg poll looks for weekly US ethanol production to be up 2,000 barrels (962-986 range) from the previous week and stocks down 39,000 barrels to 21,519 million.