PDF attached

Larger

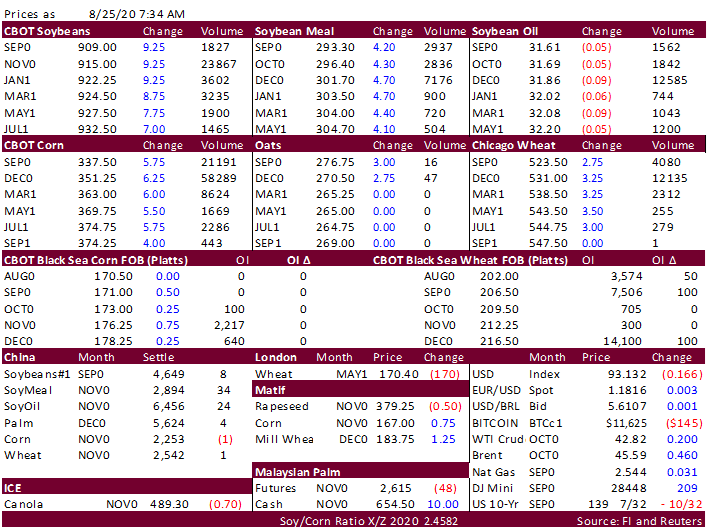

than expected decline in corn and soybean conditions sent respective futures higher overnight. Corn hit a 6-week high. Wheat was higher as well. Oil share is giving back gains from Monday’s upward swing.

We

heard China’s Sinograin bought up to 12 cargoes of US beans out of the US Gulf and PNW for shipments between December and January. China imported 8.18 million tons of Brazilian soybeans in July out of the 10.09-million-ton total. Malaysian palm oil fell

to a 4-week low.

Tender

update: Algeria seeks 30,000 tons of soybean meal on Wednesday for shipment by September 25, optional origin. Egypt is in for wheat. Jordan seeks 120,000 tons of wheat on Wednesday for October through December shipment. Taiwan seeks 100,645 tons of US

wheat on Aug 27 for Oct/Nov shipment. Results are awaited on Turkey in for wheat. Pakistan initially bought 210,000 tons of wheat for their import tender for up to 1.5 million tons of wheat. They paid around $233.85/ton C&F. Japan seeks 100,952 tons of

food wheat.