PDF attached

Higher

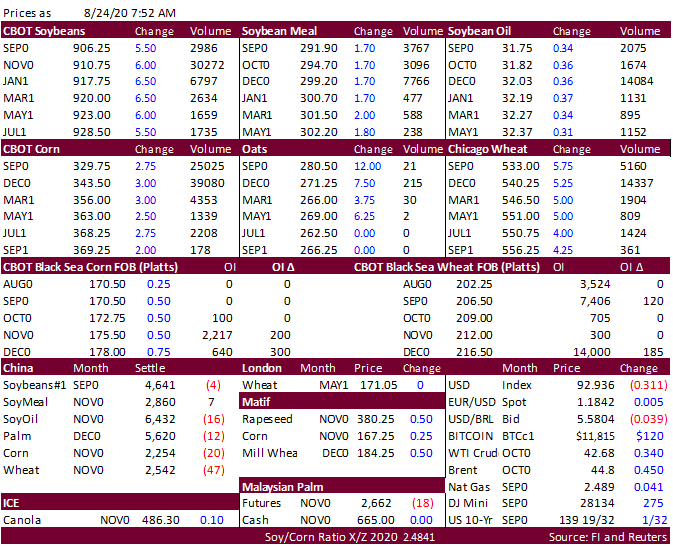

traded on a lower USD, higher WTI crude oil, and unfavorable US weather. The tropical storm expected to impact the lower Delta will not favor rice harvesting progress. Dryness and crop stress will continue to build across Iowa, northern Illinois, and northern

Indiana this week. Argentina’s wheat crop remains under threat from poor weather conditions. Pro Farmer’s corn yield came in below expectations.