PDF Attached

USDA’s

24-hour sales streak ended today. https://www.fas.usda.gov/newsroom

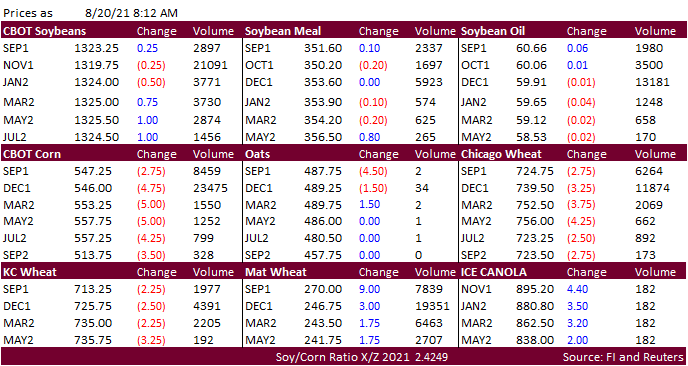

The CBOT complex is mixed on lack of direction. Global vegetable oils appreciated overnight but soybean oil is struggling amid a lower trade in WTI crude oil. Corn and Chicago wheat are lower. KC is lower on harvest pressure. MN is higher on higher Paris

wheat.

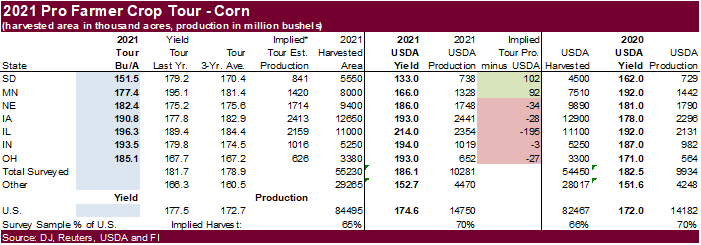

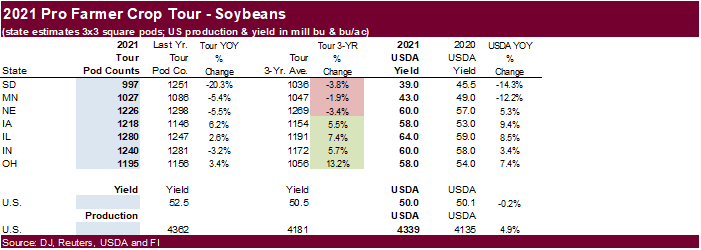

Pro

Farmer projected higher corn yields for Iowa (190.76) and higher soybean pod counts than last year and the 3-year average. Implied corn production for IA is slightly below USDA. For Minnesota, the tour pegged the corn yield sharply lower than last year and

3-year average and pod count lower than 2020 and average. Final tour results will be released around the close (1:30 PM CT they issued in 2020).

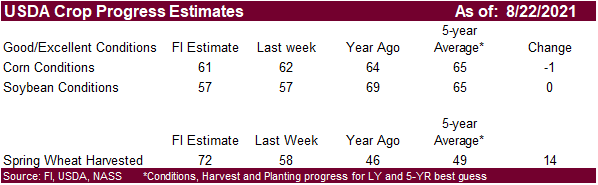

We

look for corn conditions to decline 1 in the combined good and excellent categories, and soybeans to remain unchanged. At 61 and 57 for corn and soybeans respectively, if realized, they both would be at a season low. Since more than 50 percent of the spring

wheat crop had been collected, USDA will not issue a crop progress update. Spring wheat G/E last week settled at 11 percent. Note the range this season was 9 to 45 percent, 45 at the beginning of the season. September MN rallied about $1.43 since April

30.

![]()