PDF attached

USDA-132k

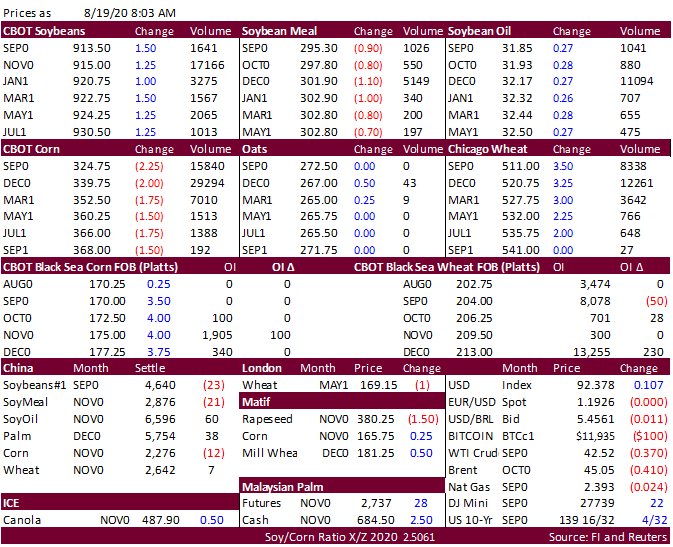

soybean were sold to China. Malaysian palm futures were up 26MYR and cash rose $12.00/ton. China vegetable oil prices were up 0.6-0.8% while soybean in China were down 23 CNY. Offshore values are favoring a higher trade in oil and meal. The soybean complex

is mostly higher led by soybean oil, with September reaching its highest level since February 14. Corn is lower after

Pro

Farmer for the second day reported very good pod counts and corn yields. IA will be surveyed on Thursday. US wheat is higher following strength in EU wheat and Algeria’s purchase of about 560,000 tons of milling wheat. Results are awaited on Pakistan in

for wheat. Japan seeks milling and feed wheat. President Trump postponed the trade talks with China, but we are under the opinion they will be revisited. A Bloomberg poll looks for weekly US ethanol production to be up 1,000 at 919,000 barrels (898-945

range) from the previous week and stocks to decrease 444,000 barrels to 19.706 million. We look for a very large new-crop export sales figure for soybeans at between 2.6 to 3.1 million tons. If figures fall short for soybeans, then we speculate some of the

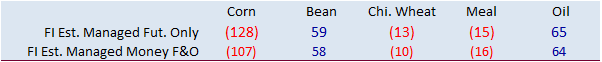

sales last week were recorded in the previous week report. Funds are still short over 100k corn so don’t discount a two-sided trade if soybeans rally today.