PDF attached

US

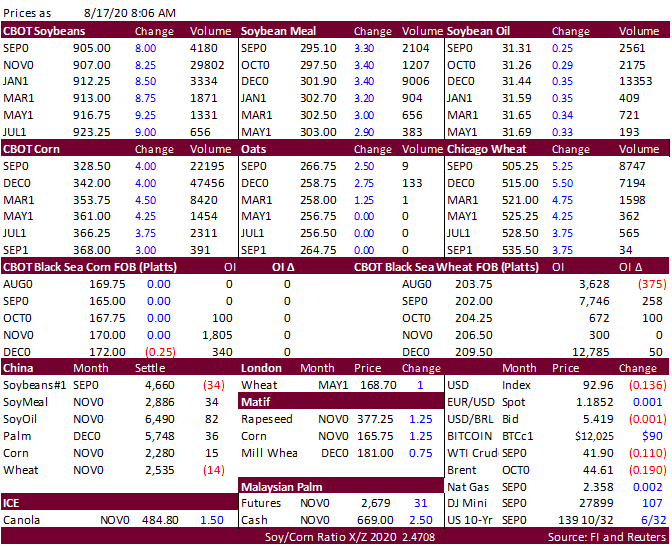

weather will be dry this week. Ukraine will see increasing crop stress and China’s grain production is expected to drop from record 2019 output. Under the 24-hour announcement system, private exporters sold 130,000 tons of HRW wheat to unknown. NOPA is

due out later today (estimates below), along with inspections and crop progress (expect a large decline in IA and IL corn conditions). Algeria is in for 50,000 tons of milling wheat and Egypt is in for vegetable oils. AmSpec reported Malaysia palm oil exports

during the Aug 1-15 period at 694,292 tons, down 16.3% from 829,294 tons exported in July 1-15. ITS reported a 16.5% decrease to 694,402 tons from 831,115 tons during FH July.

CBOT soybean registrations were down 84 with Zen-Noh Grain registering 74 and Consolidated cancelling 158. There were 87 soybean deliveries with Term stopping 62. Soybean oil registrations

were up 48 (Volga, SD) and deliveries were 57 with Bunge stopping all of them. CBOT soybean meal deliveries were 148. China pig herd in July was up 13.1 percent form year ago.