PDF attached

Report

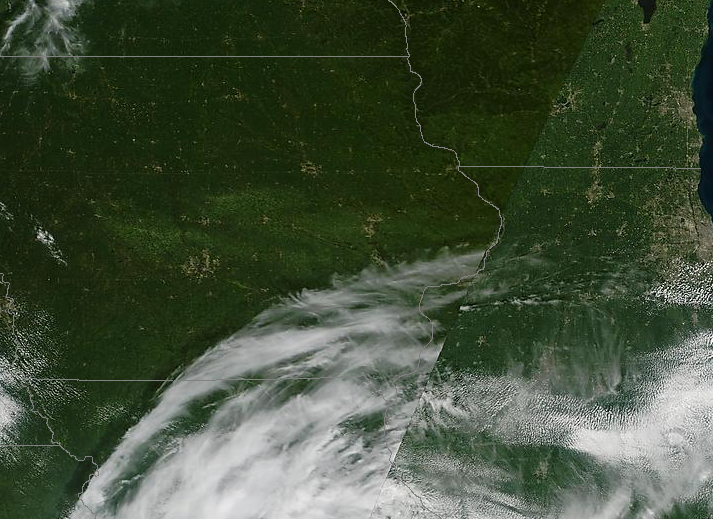

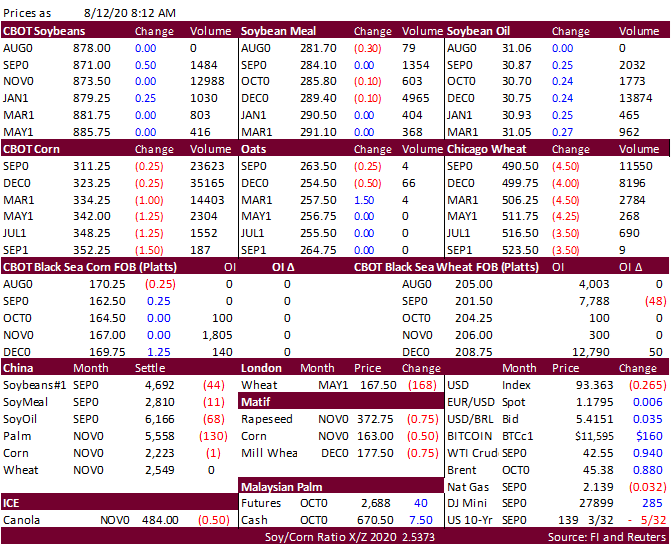

day. Trade estimates are below. CBOT prices are near unchanged in soybeans and corn and mostly lower for wheat. Note a year ago corn traded limit lower on USDA Aug report day. Note on crop damage: check out this picture of IA damage via twitter…

https://twitter.com/kennedyclouds/status/1293262701934895110?s=21