PDF Attached

Another

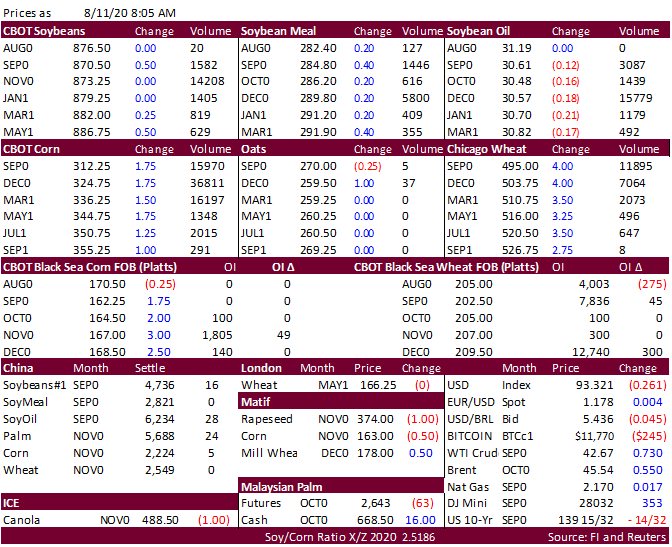

132k soybeans were announce for China. Conab reported the 2019-20 soybean production at 120.9 million tons, 100,000 tons above the previous month. Exports were seen up 2 million tons to 82 million tons for 2020. Conab Brazil corn production was upward revised

1.6 million tons to 102.1 million, with the second corn crop seen at 74.9MMT, up from 73.5MMT last month and compares to 73.2 million tons for 2018-19. The corn yield was revised up slightly to 5.520 tons/hectare from 5.453 last month. Conab sees 2020 wheat

imports at 6.7 for 2020, down from 7.3 million tons from July and compares to 7 million tons in 2019.

Pre

report day. CBOT prices are tracking USDA crop progress changes and light global import developments for grains. We heard China bought up to 5 US Oct/Nov soybean cargoes out of the Gulf and one from the PNW, along with up to 6 Q1 2021 Brazilian soybeans.

USD was 37 lower earlier, WTI 82 cents higher, and equities mostly higher. US crop progress showed corn at 71, down one & one below trade average; soybeans 74, down one & two above trade average; and spring wheat 69, down 4 & four below trade average. The

third month palm futures contract fell 66 points and cash was down $11.50/ton. China vegetable oil prices were up 0.2-0.5 percent, meal unchanged and soybeans up 16 yuan or 0.3%. Israel seeks on July 20 seeks about 200,000 tons of corn and 350,000 tons of

soybean meal. Taiwan’s MFIG on August 13 seeks up to 65,000 tons of optional origin corn for October 28-Nov 16 shipment. Egypt is in for wheat. The World Food Program plans to send 50,000 tons of wheat to Lebanon.