PDF attached

Good

morning.

A

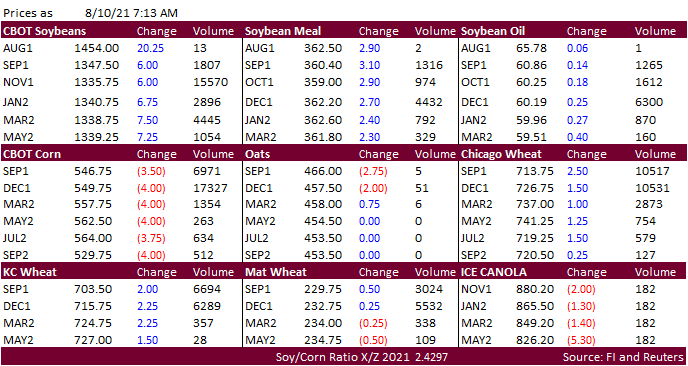

rebound in US energy markets and gold coupled with a higher lead in offshore vegetable oil and meal markets are supporting the soybean complex this morning. Recent demand by China for US soybeans also supportive. Corn is lower on improving conditions and

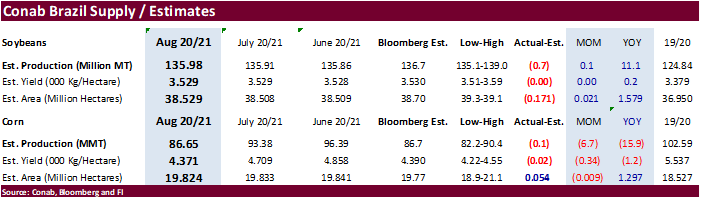

wheat mixed in part to improvement in US spring wheat conditions (MN lower), strong world demand and ongoing concerns over the Russian crop. Conab Brazil supply update was seen as neutral.

Conab

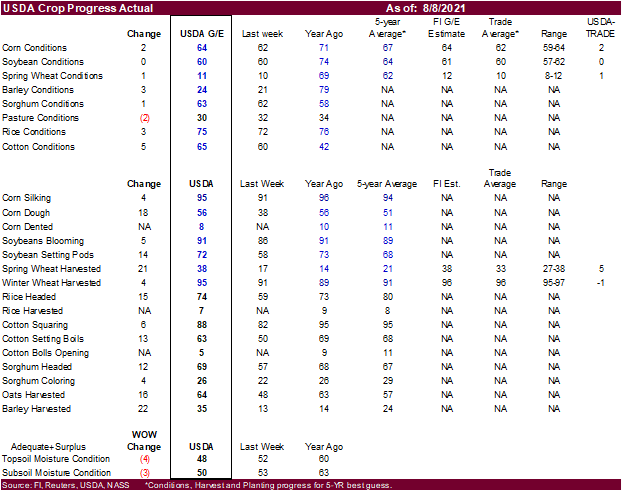

US

corn conditions improved 2 points G/E with IL leading the way by improving 11 points. US soybean conditions were unchanged but the poor/very poor was up 1. US spring wheat conditions increased one point and harvest progress was up 21 points to 38 (5 points

above a trade guess and compares to 14 year ago and 21 average).

CME

lean hog and pork limits expand.