PDF attached

Under

the 24-hour reporting system, private exporters reported to the U.S. Department of Agriculture export sales of 456,000 tons of soybeans for delivery to China during the 2020/2021 marketing year. USD was 50 higher and WTI 41 cents lower and equities lower.

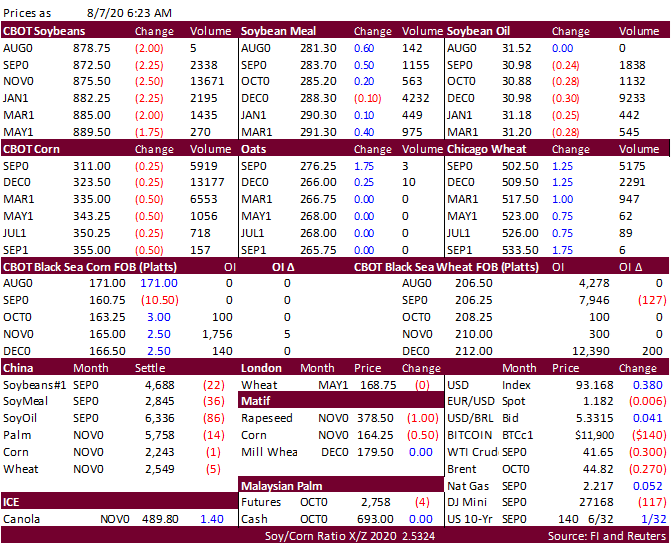

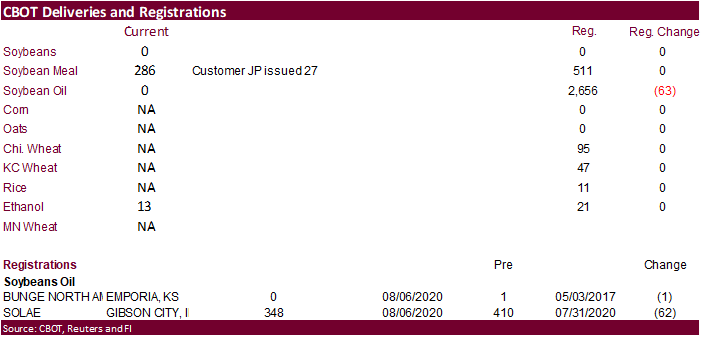

The CBOT ag futures are seeing little direction on thin news. Tender business was quiet. 286 meal were delivered and 63 soybean oil receipts were cancelled. Malaysian palm fell 7 points while cash palm was unchanged. Early June Malaysian regional palm

oil production data is indicating an already expected sharp decline from the previous year. China traded higher for soybeans and vegetable oils. CBOT soybean oil is under pressure presumably from end of week profit taking. Lack of direction is leaving a

slightly negative trade for corn and soybeans. Wheat is slightly higher on technical buying. Jan-Jun China soybean imports are 18 percent higher than the same period year ago to 55.2 MMT. July imports were a large 10.1 million tons, up from 8.63 MMT for

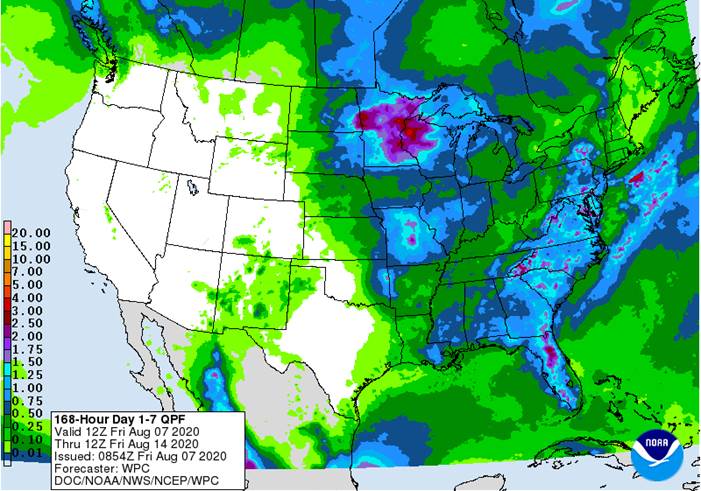

June 2019 and down from 11.16 MMT for June 2020. China imported 956,000 tons of vegetable oils in July, down 6.1% from the previous month. For Monday we look for US crop conditions to improve one point for corn, soybeans, and spring wheat.

![]()