PDF attached

Higher

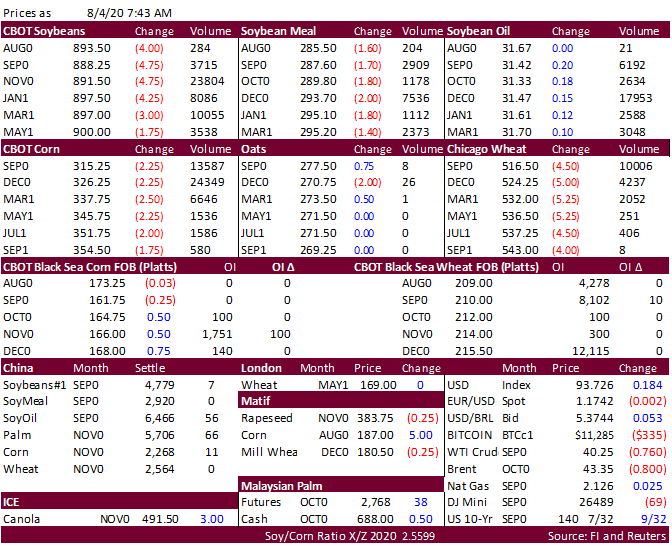

trade in Asian vegetable oil overnight. US soybeans, corn and wheat area on the defensive on large crop production prospects. US SBO is higher and meal lower. USD was up 7 points earlier this morning and WTI down 71 cents. US soybean conditions were up

one point while corn was unchanged. Spring wheat improved 3 points. The US high pressure ridge for the US is now projected to be short lived. IA, NE, and OH are in need of additional rain. StoneX sees big soybean and corn crops (yields 54.2 and 182.4).

Yesterday’s NASS crush report was seen supportive for soybean oil. Soybean and Corn Advisory sees Argentina’s 2021-22 soybean crop at 52MMT, 2 million above this year. USDA is at 50MMT for 2020-21 and 50 for 2019-20. UGA lowered their view of the Ukraine

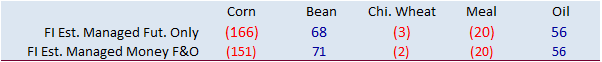

rapeseed crop to 2.93MMT from 3.33 million previously. Thailand seeks 192,600 tons of wheat and 107,700 tons of feed barley. Japan is in for 130,295 tons of food wheat. Managed money shortened their net short position in Chicago wheat yesterday by 10,000

contracts to nearly flat.