PDF attached

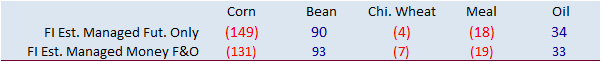

Corn

and soybean futures are lower on good US crop ratings. We are hearing some fields will see record corn yields south of Memphis. August is an important month for soybeans while the US corn crop is basically made.

Corn

and Soybean Advisory are using 178.5 corn and 51.0 soybeans. FI is at 180.0 and 50.1.

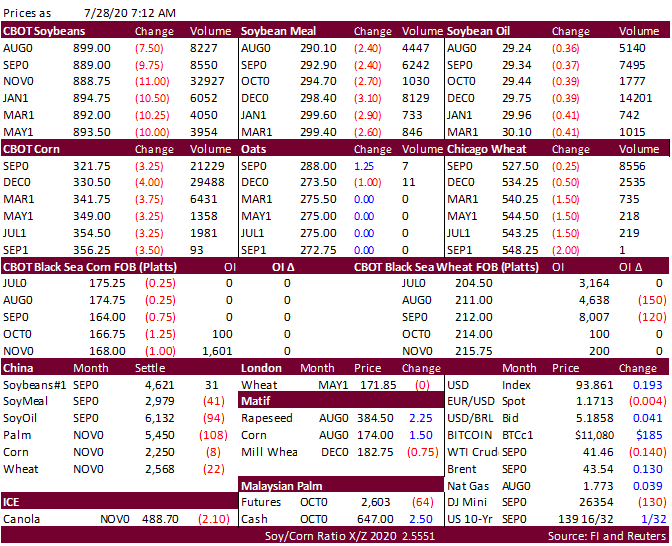

China

corn futures traded lower, off a 5- year high, after the government announced effective July 30 bidders will have to pay an extra deposit on trades, and also set delivery requirements to make sure companies where not hording corn supplies. Egypt is in for

wheat and lowest offer was $215.10/ton for 60k Russian wheat. US wheat futures mixed in Chicago while higher in KC and MN. Technical buying is seen from heavy selling on Monday.

Palm

oil traded lower on weakness in global cash prices and Indonesia lowering their 2020 target for biodiesel consumption from 9.6 to 8.3 million kiloliters. Palm futures are down 6 percent this week and 15 percent for the year. The ringgit is at a 6-week high

against the USD. USD

was up 20 earlier this morning, WTI weaker and gold mostly lower. US weather looks very good over the next week with no excessive high-pressure ridge and no prolonged periods of hot temperatures.