PDF attached

News

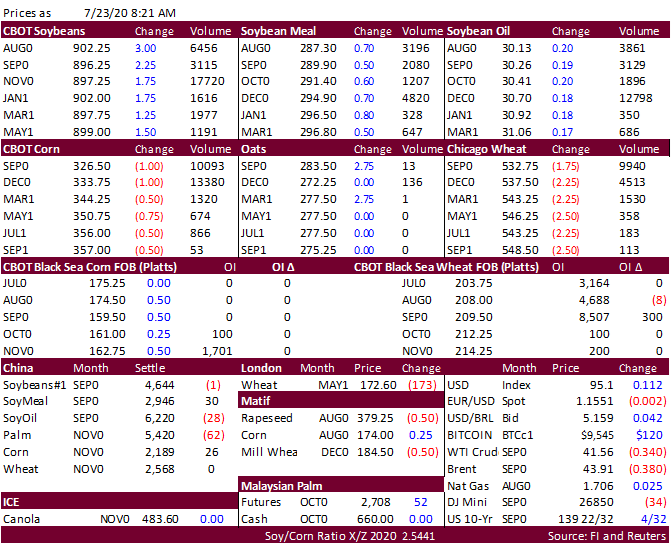

is light for this Thursday morning trade. Look for a two-sided trade in soybean and corn. USDA export sales for new crop corn and soybeans were very good. Meal sales were poor, soybean oil ok, and wheat topped expectations. USD is higher and WTI lower.

Malaysian palm was sharply higher and offshore values are leading CBOT products higher. Philippines bought 55,00 tons of feed wheat. Grains are losing ground to the soybean complex.

![]()