PDF attached

A

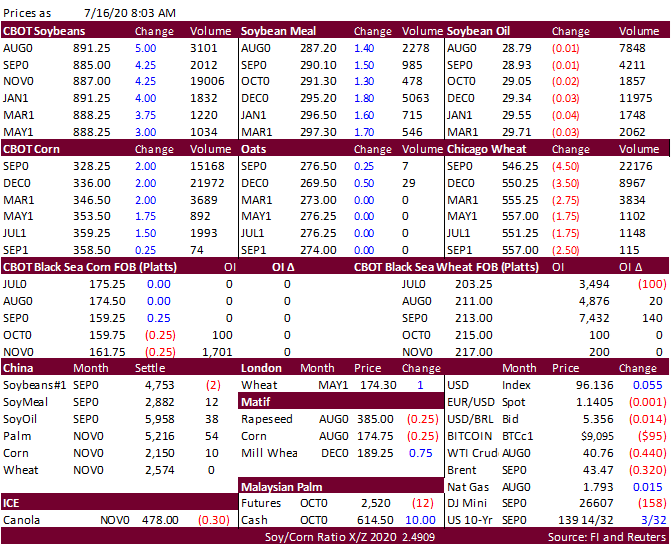

combined 873,000 tons of old and new-crop soybean 24-hour sales were sold to China and unknown.

USDA

export sales showed new-crop corn sales below expectations despite the Chinese sale. China booked 768,300 tons of old crop corn and 600,000 tons new-crop. Soybeans and meal were within expectations. Soybean oil on the lighter side. Wheat exceeded expectations.

38,500 tons were recorded for pork and 72,700 tons for sorghum.

Soybeans

and corn are higher again on follow through bullish sentiment over Chinese demand. Chicago wheat is lower after reaching a 3-month high. China was said to be in for US wheat on Wednesday. The first week of the GFS model was wetter for areas across Nebraska

through Iowa and Missouri to Ohio, Kentucky, Virginia and North Carolina, and wetter for Missouri and Delta for the July 23-25 period. The northern half of the Canadian Prairies was wetter for the July 23-25 period. We heard China bought 3-4 Q4 US soybean

cargoes. Malaysian palm oil traded lower after a 4-session winning streak. WTI crude is lower and USD higher. Reuters: Argentina does not plan to increase grains export taxes – Agriculture Minister. China sold 4.026 million tons of corn out of reserves

at an average selling price of 1,950 yuan per ton. 32 million tons were sold at auction this season, not including Sinograin sales. China’s pork production fell 4.7 percent in Q2 (April-June), a seventh consecutive of a decline, to 9.6 million tons, according

to Reuters. Saudi Arabia seeks 720,000 tons of barley on Friday. South Korea’s KOCOPIA group bought 60,000 tons of corn from Brazil at $196.31/ton c&f for Sep 5-25 arrival. South Korea’s KFA group passed on 69,000 tons of corn. Lowest price was said to be

$195.37/ton c&f for Nov 15 arrival. South Korea’s FLC group bought 65,000 tons of corn, optional origin, at $184.74/ton c&f for Oct 10 arrival. Russia’s Hydrometcentre warned unfavorable weather in the first half of July may downgrade grain harvest estimates.

They still look for a large crop, equal to an average crop of recent years. Strategie Grains lowered their EU soft wheat crop at 130.3MMT from 130.9MMT, 11.5 percent below 2019.

![]()