PDF attached

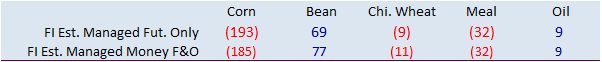

Funds

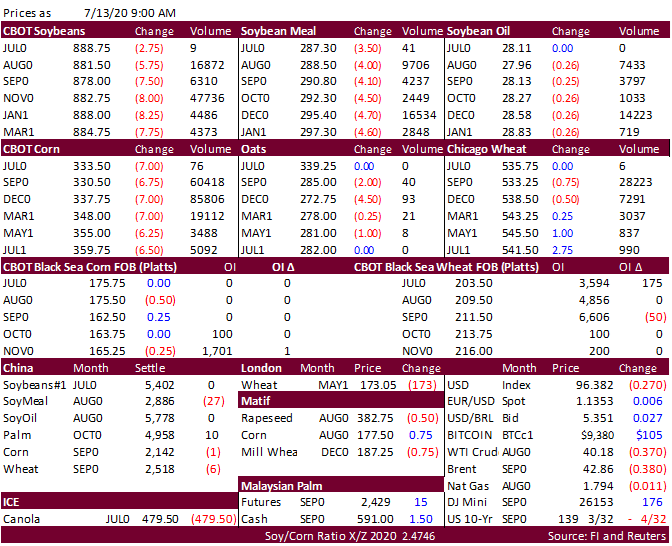

have been big sellers of corn over the last couple sessions of about 70,000 contracts. Corn and soybeans conditions were down 2 and 3 points, respectively, which is providing some support in prices this morning. Yesterday the lower trade prompted some import

business, including SK in for corn and Egypt for wheat. Jordan is seeing offers for wheat. Offshore values are very strong this morning. The GFS was wetter in the second week of the outlook in the lower parts of the Midwest.