PDF attached

Conab

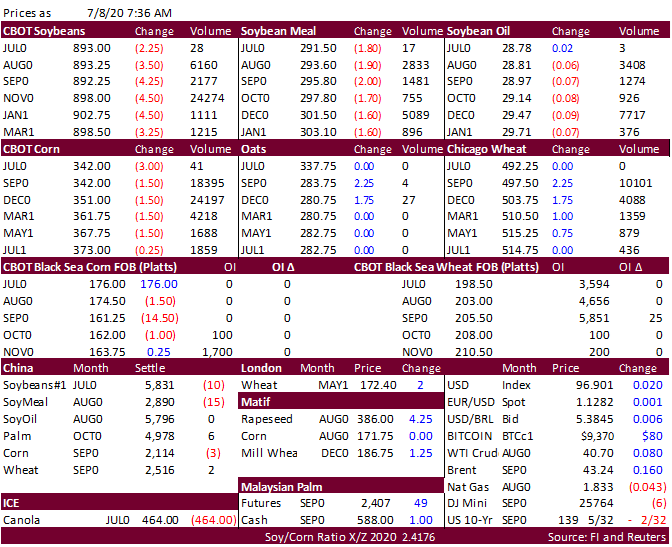

soybean production came in below expectations. The US will see localized rain bias Midwest this week before net drying occurs during the 6-10 period. The evening model runs did put rain in the second week of the outlook but compared to what region you look

at for the WCB, it varies. Soybeans traded at a 4-day low below the psychological $9.00 level but remain near a 4-month high on US weather concerns. China’s Sinograin sold 65,520 tons of soybeans out of auction. We hear state owned Chinese crushers bought

1 cargo for 2021 out of Brazil on Tuesday. Lowest offer Egypt: soybean oil $735.45/ton and sunflower oil at $768/ton. Global vegetable oil prices are rebounding with Argentina and Brazil latest to appreciate. Wheat is higher on follow through buying after

production cuts to Black Sea and French wheat. Thailand

passed on 193,300 tons of feed wheat. The Philippines seeks 110,000 tons of feed wheat on July 9. Japan received no offers for 80,000 tons of feed wheat.