PDF attached

Morning.

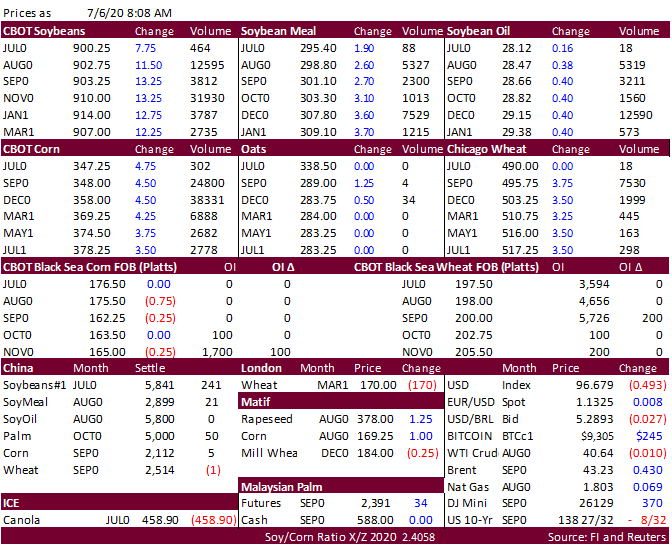

Weather, China demand and fund positions are the key drivers for the higher CBOT prices. Heat is expected across the Midwest for the balance of the week. A high-pressure ridge will follow bias WCB and lower Midwest during the second week of the forecast.

We look for crop conditions to inch lower for corn and soybeans. SW conditions are projected to decline 2 points while winter wheat may stay stable.

![]()