PDF attached

Morning.

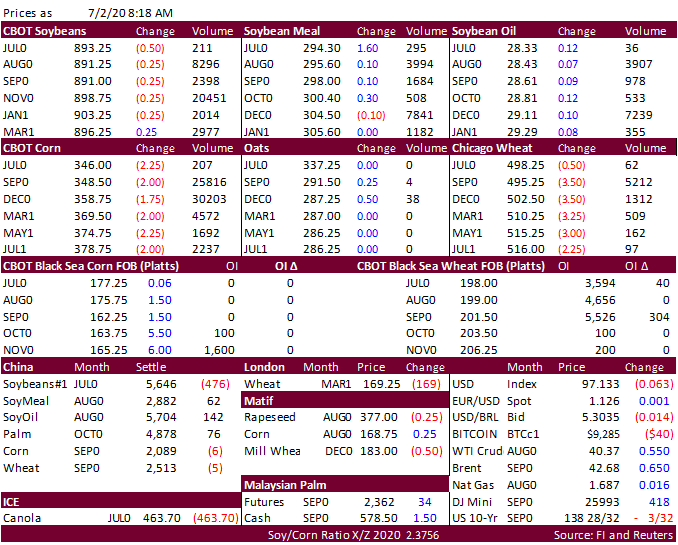

Mixed trade in the ags this morning but we could see corn and soybeans move higher. Private exporters sold 202,000 tons of new-crop corn to China and 126,000 new-crop soybeans to China. Profit taking is seen in corn and soybeans today

ahead of the long US holiday weekend. News is light. Today we close early for the US July 4 holiday (12:05 PM CT). Friday CFTC should release Commitment of Traders. Banks are open but CBOT will be closed. China sold all of its corn offered at auction,

roughly 4 million tons. They also sold 8 million tons of cotton, all offered. Jordan is in for wheat. Offshore values are basically flat for soybean oil but leading meal lower. Look for a light trade today. USDA export sales were seen neutral for the

soybean complex, lighter side for corn and within expectations for wheat. US weather outlook was largely unchanged for week one.