PDF attached

US

weather outlook is largely unchanged. Talk of dryness after 4th of July for the US Midwest may support prices.

Corn

futures are higher despite a one-point increase in US crop conditions. Follow through short covering is likely.

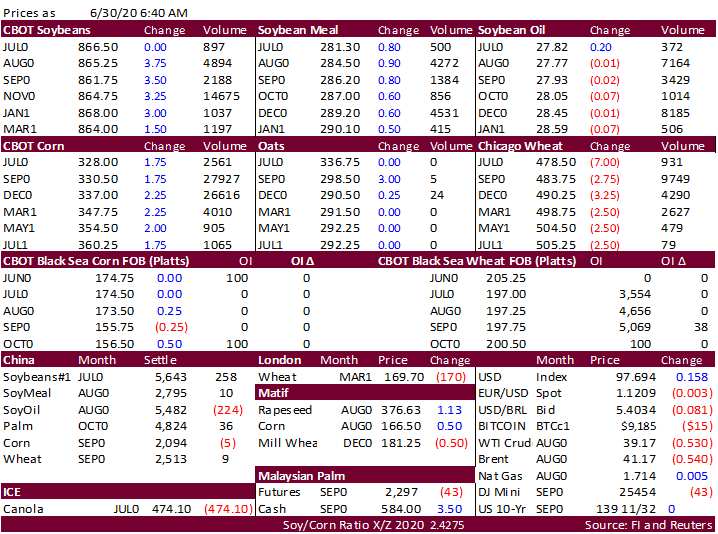

CBOT

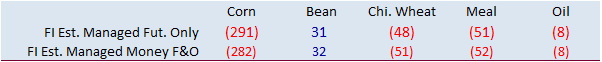

corn open interest was down 51,078 contracts on Monday. Funds

bought an estimated net 33,000 corn contracts on Monday. Yesterday

there was talk China bought up to 20 cargoes of US soybeans over the past week.

CBOT

soybeans were higher early this morning led by bull spreading, meal slightly higher and soybean oil mixed despite sharply lower Malaysian palm oil (down 44 points). China futures ended slightly higher. BRL was firmer at 5.4034 and USD was up 15 points as

of 6:31 am CT. Heavy deliveries were posted against the July soybean oil contract of 2,402 contracts with customer JP Morgan stopping 2,052. ADM Investor Services issued 1,017 lots. US wheat futures were lower for Chicago and KC and higher for MN, in part

to deliveries against the CBOT Chicago contract (nearly spreads weaker), and results from the weekly USDA crop progress report.

South

Korea’s MFG bought about 60,000 tons of feed wheat at $216.05/ton C&F for arrival around November 30. Thailand seeks 236,800 tons of feed wheat on July 1 for Aug-Jan 2021 shipment. (3 consignments).