PDF attached

Morning.

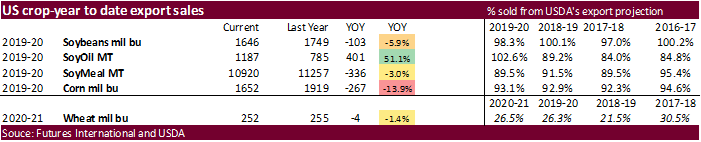

USDA

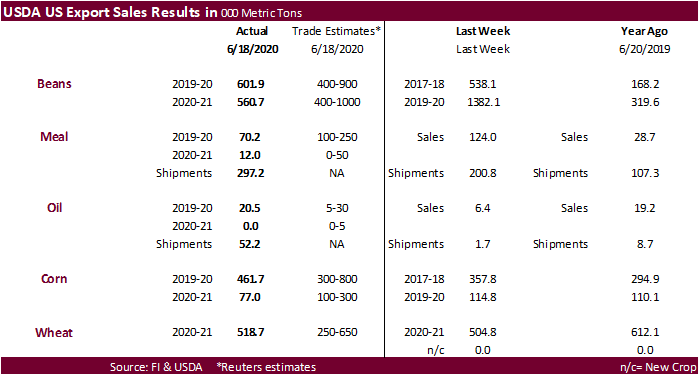

export sales for soybeans, soybean oil and wheat were within expectations. Corn was at the lower end of the trade and soybean meal sales were below expectations. Shipments of meal of nearly 300,000 tons were ok and soybean oil shipments were robust at 52,200

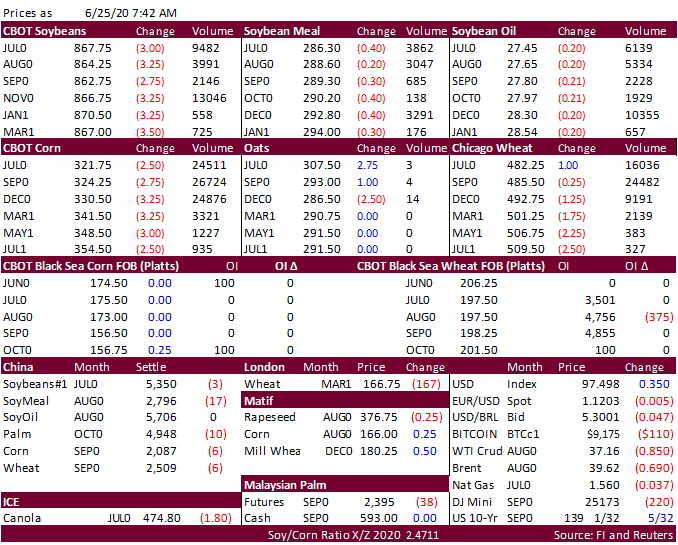

tons. China is on holiday for the Dragon Boat Festival June 25–27. September corn dropped for the fourth consecutive session to nearly a one-month low basis September on favorable US weather, even as we hear up to 7 cargoes of US corn was sold to China yesterday

along with at least 4 cargoes of Ukrainian corn. Another market down four sessions is soybean oil, under pressure today from weaker palm oil (down about 40MYR) after cargo surveyors reported a significant slowdown in palm exports over the June 20-25 period.

Soybeans are lower on coronavirus concerns and higher USD (+41). Soybean open interest fell 22,561 contracts on Wednesday. WTI was down 50 cents, below $38. Bull spreading was a feature in wheat, in part improving global export developments. Japan bought

their food wheat. Otherwise corn and soybean export developments were quiet. Hogs and Pigs are due out after the close.

![]()

USDA

export sales

for soybeans, soybean oil and wheat were within expectations. Corn was at the lower end of the trade and soybean meal sales were below expectations. Shipments of meal of nearly 300,000 tons were ok and soybean oil shipments were robust at 52,200 tons.

·

China booked a cargo of corn.

·

China booked 172,500 tons of 2019-20 soybeans, and 393,000 tons of new-crop.

·

Sorghum sales showed net reductions of 1,000 tons.

·

Pork sales were 24,100 tons.