PDF attached

Today

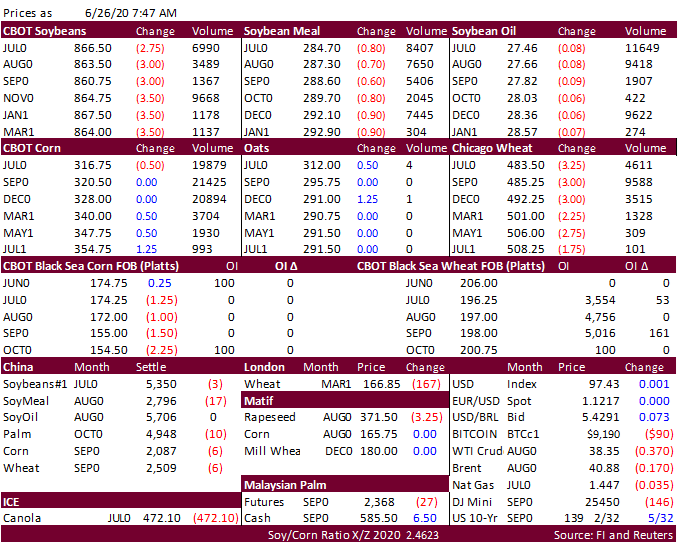

and Monday expect positioning ahead of USDA’s Acreage and Grain Stocks reports. Hogs and Pigs report was viewed supportive for corn and soybean meal, bearish for hogs.

Weather

remains a key driver which is pressuring soybeans and wheat, limiting gains in corn. Malaysian palm oil futures slid 4 percent this week on weaker mineral oil, rising palm production, and slowing of palm exports. France reported softy wheat ratings unchanged

from the previous week, but they remain at well below average levels. News is very light with China on holiday. CBOT corn open interest rose over 27,000 contracts on Thursday in part to new shorts and surge in option plays. The funds sold an estimated net

58,000 corn contracts over the combined four days. Later we get CFTC COT data as of Tuesday evening.

![]()