PDF attached

Morning.

US

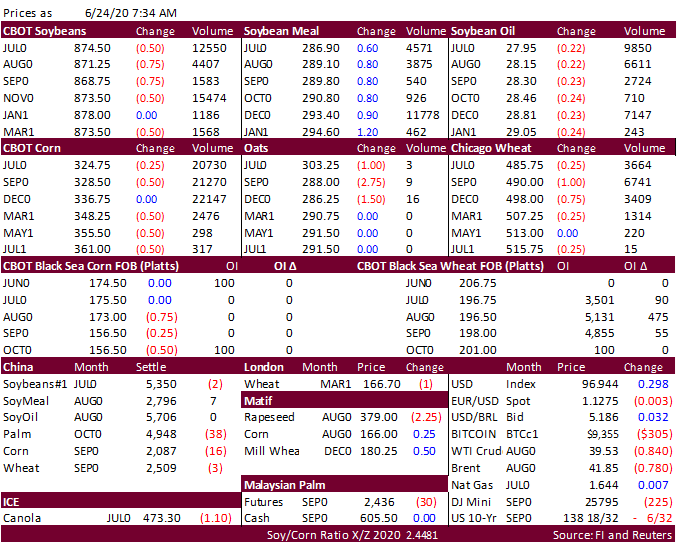

weather will remain good. GFS is wetter than the European models. WCB will remain on the drier side over the next 7 days. It was heard of that China bought another 2 US cargoes of soybeans, both out of the Gulf for Q4 shipment, and one Brazilian cargo for

Sep/Oct. Soybeans and corn and wheat are higher despite rising concerns over the recent spike in US Covid-19 cases. Anec sees Brazil June soybean exports at 12.6 million tons. Weaker Malaysian palm (down 30MYR) is weighing on SBO. Lock closers for repairs

along the IL will start July 1 and we are hearing corn is starting to flow out of the Great Lakes destined for the EU. US wheat was struggling to trade higher. Harvest pressure was winter wheat was in focus. Japan received no offers for feed wheat or barley.

China sold another 4MMT of corn out of auction.