PDF attached

Talk

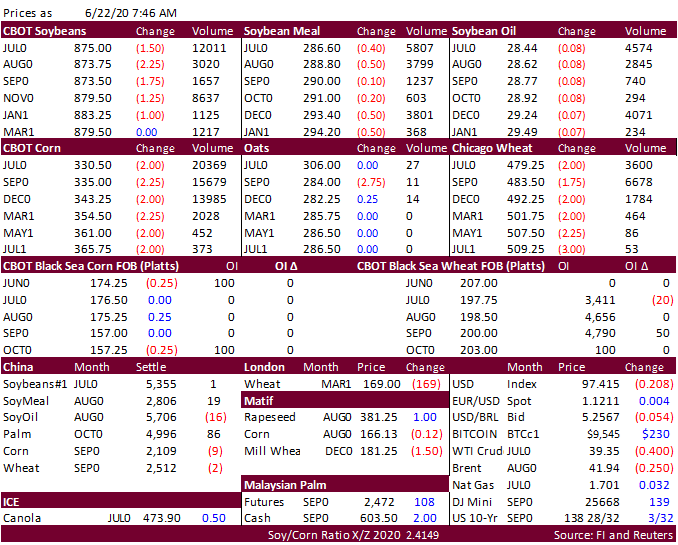

of China shopping for US wheat over the weekend maybe limiting downside movement in US wheat futures. US wheat harvest pressure is seen in the mix. IKAR increased their view of the Russian wheat crop to 79.5 million tons from 78 million previously. Corn

and soybeans are lower after rallying late last week. Egypt bought 59,000 tons of soybean oil for Aug 10-30 delivery, at 10,925 Egyptian pounds ($675.63/ton). It is estimated China bought up to 17 cargoes of soybeans last week. China crush margins remain

low but don’t discount China buying US soybeans as they remain cheaper than Brazil, at least for the 2020 positions.