PDF attached

Morning.

Several

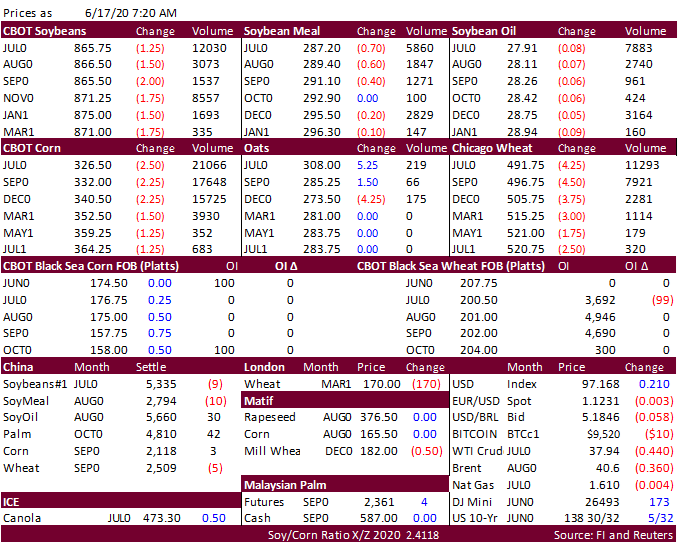

factors including US weather is slightly pressuring agriculture futures this morning. Unfavorable weather across Canada may limit downward pressure for oilseeds and wheat. Few export developments announced in wheat and Brazil beat out the US in the Taiwan

corn import tender. USD stronger and WTI crude weaker.