PDF attached

Morning.

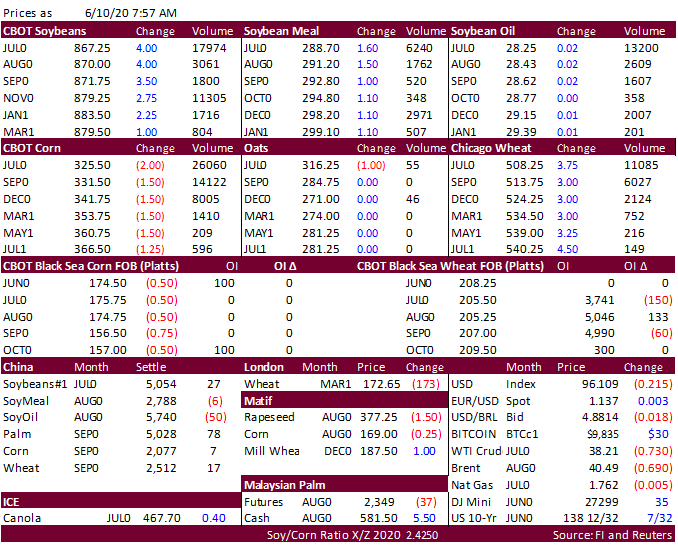

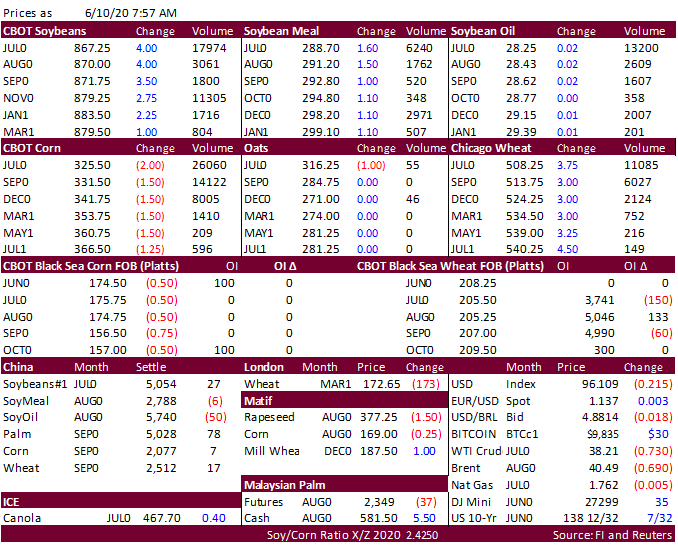

China buys Q4 US PNW soybeans, record US corn production prospects pressure futures, and wheat is higher from an uptick in global import demand.

PDF attached

Morning.

China buys Q4 US PNW soybeans, record US corn production prospects pressure futures, and wheat is higher from an uptick in global import demand.