PDF attached

Morning.

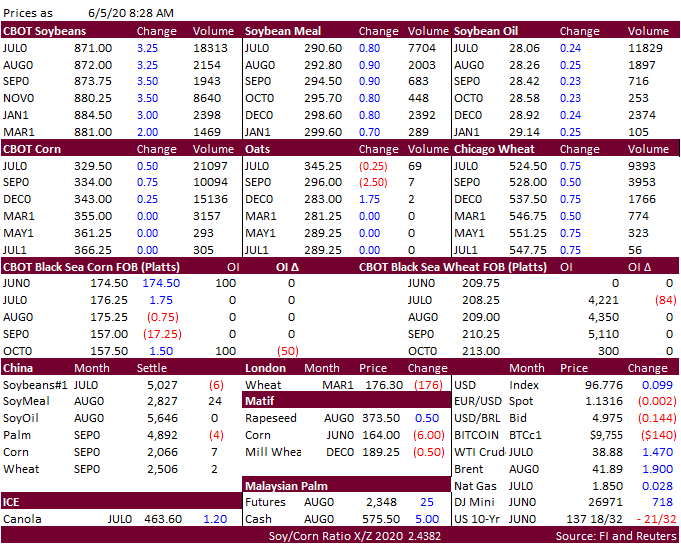

OPEC will meet on Saturday to discuss oil production cuts. US stock and crude oil markets are rallying this morning. Jobs reports from Canada and US indicate an economic recovery for North America. USD was near flat as of 7:30 CT and agriculture markets are

higher.

![]()