PDF attached

Morning.

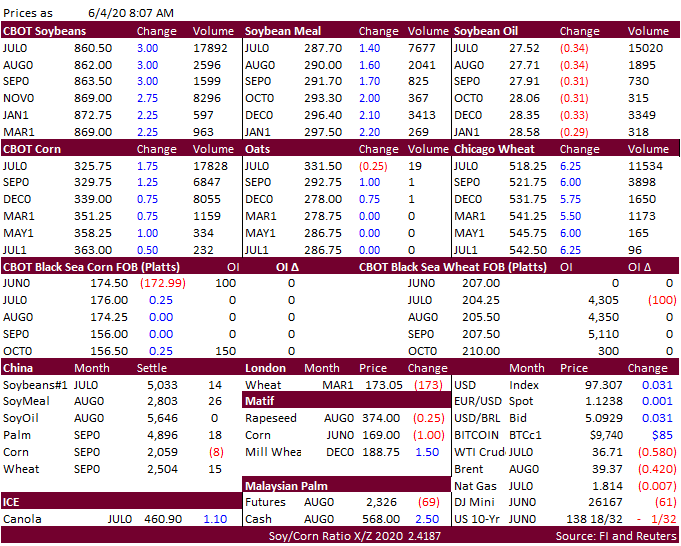

24-hour sale announced-120,000 tons of soybeans to unknown. US soybean are competitive. USDA export sales were positive. USD sold off after the EU announced another stimulus package. China sold corn out of reserves. FAO sees global wheat production well

below USDA’s outlook.