PDF Attached

Good

morning.

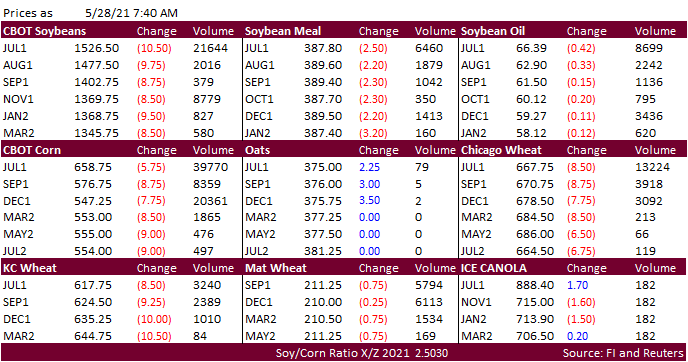

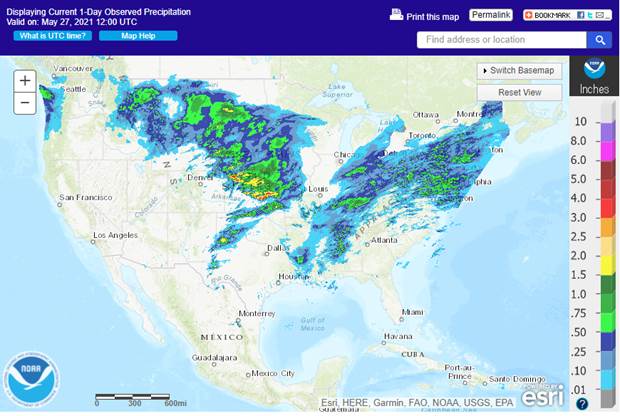

Soybean

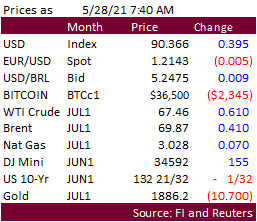

complex was lower in a US pre-holiday trade. Corn is on the defensive and Chicago wheat lower. News was light. Look for positioning today. Good rain fell across the central and northern ECB over the past day. The USD was up 33 points as of 7:32 am CT,

WTI higher, gold lower and equities higher.

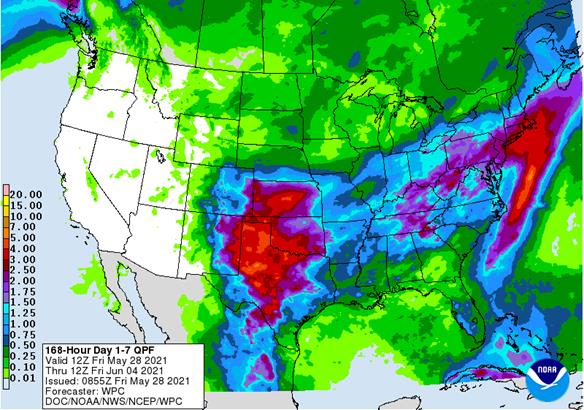

Next

7 days

World

Weather, Inc.

World

Weather Highlights for May 28

-

Frost

and freezes in North Dakota and southwestern Manitoba, Canada overnight has likely damaged some crops, but assessing the impact will be slow in coming because of the holiday weekend.

-

West

Texas cotton is still advertised to get large amounts of rain during the coming week which will continue to improve production potentials for 2021.

-

Southwestern

dryland crop areas may get some of the greatest rainfall -

The

northern U.S. Plains and Canada’s southern Prairies will experience net drying

-

Southern

Russia’s New Lands and northern Kazakhstan will also dry down in the coming week and then get rain in the following week -

Temperatures

are cooling down after being quite warm earlier this month -

No

changes were noted in South America overnight -

Drying

is expected in east-central China -

Western

Australia will get some welcome rain for its wheat, barley and canola crops. -

Eastern

Australia will dry down for a while -

Western

Russia and eastern most Europe will remain plenty wet for a while -

This

includes Ukraine as well -

Southern

China will remain quite wet -

Northeastern

China will remain a little milder than usual and see frequent periods of rain

Source:

World Weather, Inc.

Friday,

May 28:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - U.S.

agricultural prices paid, received

Monday,

May 31:

- EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia

May palm oil export data - HOLIDAY:

U.S., U.K.

Tuesday,

June 1:

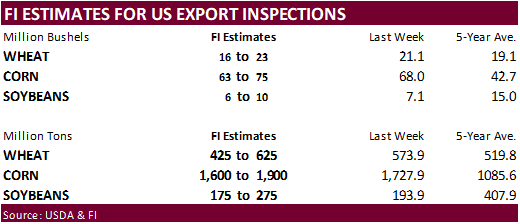

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop condition and planting — corn, cotton, soybeans, wheat, 4pm - Honduras

and Costa Rica monthly coffee exports - International

Cotton Advisory Committee updates world outlook for fiber market - Australia

Commodity Index - Purdue

Agriculture Sentiment - New

Zealand dairy trade auction - U.S.

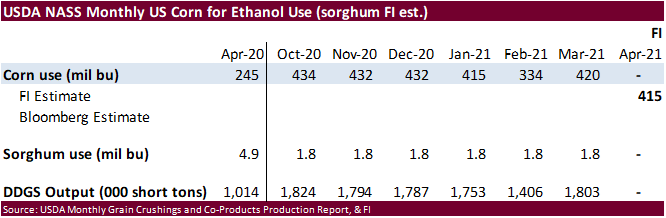

corn for ethanol, DDGS production, 3pm - USDA

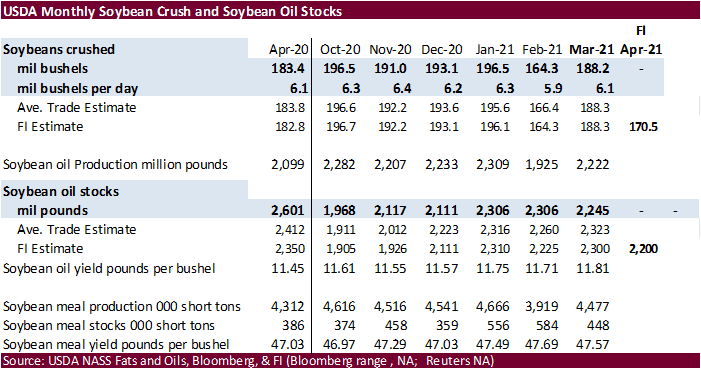

soybean crush, 3pm - HOLIDAY:

Indonesia

Wednesday,

June 2:

- Nothing

major scheduled

Thursday,

June 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - EIA

weekly U.S. ethanol inventories, production - Port

of Rouen data on French grain exports - New

Zealand Commodity Price - HOLIDAY:

Brazil, Thailand

Friday,

June 4:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

US

Personal Income Apr: -13.1% (est -14.2%; prevR 20.9%; prev 21.1%)

US

Personal Spending Apr: 0.5% (est 0.5%; prevR 4.7%; prev 4.2%)

US

Real Personal Spending Apr: -0.1% (est 0.2%; prevR 4.1%; prev 3.6%)

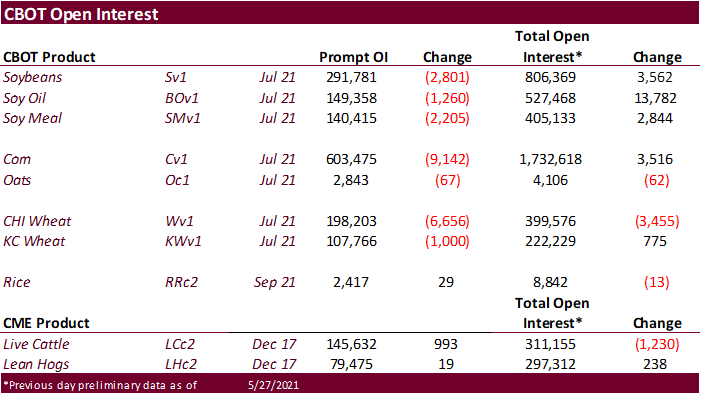

- CBOT

corn was

mostly lower on lack of fresh news and favorable US Midwest weather. Look for positioning ahead of the long holiday weekend.

- Rains

will fall across the ECB today, and west central region Monday. - Yesterday

the Buenos Aires Grain exchange said 31% of Argentina’s corn crop was harvested, down from the five-year average of 38%.

- The

French corn crop was rated 91% as of May 24, down from 93% previous week and up from 83% year ago.

Export

developments.

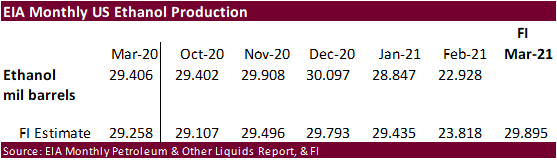

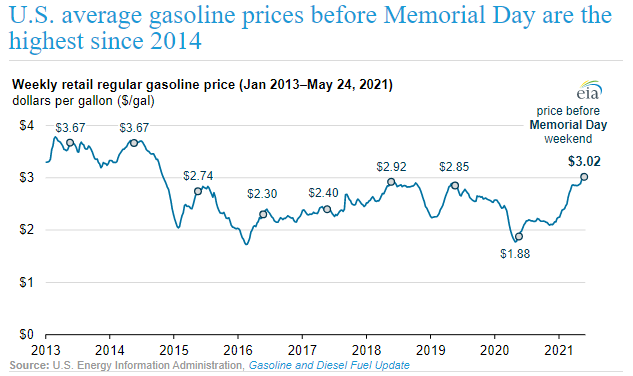

https://www.eia.gov/todayinenergy/detail.php?id=48156&src=email

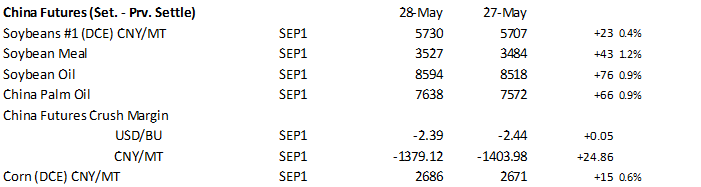

- CBOT

soybean complex turned lower during the late overnight session after gold broke. The USD was very strong (up 33). Expect technical selling and long liquidation ahead of the long holiday weekend.

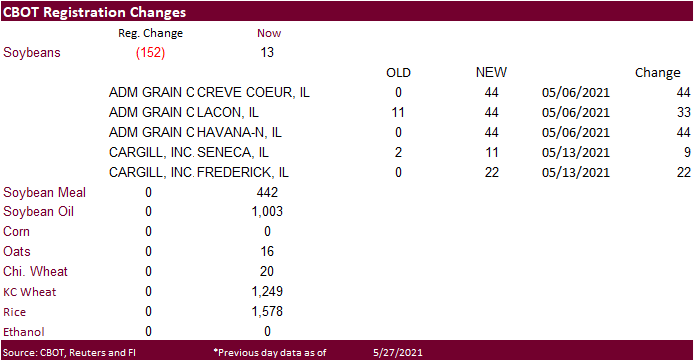

- There

were 152 CBOT registrations cancelled by ADM and Cargill at 5 locations. Registrations now stand at 13.

- Soybean

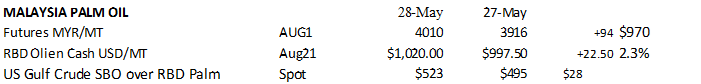

oil open interest was up about 13.7k yesterday. - Malaysia

announced a full nationwide lockdown from June 1-14. - A

Reuters poll calls for the April US soybean crush to be reported at 171.1 million bushels (170.0-173.0 range), down from 188.2 million bushels in March and below 183.4 million in April 2020. US soybean oil stocks as of April 30 were estimated at 2.171 billion

pounds (2.150-2.200 range), down from 2.245 billion at the end of March and 2.602 billion at the end of April 2020.

- Russia

reduced the export tax on soybeans to 20% from 30% from July 1 until September 2022.

- Yesterday,

Buenos Aires Grains Exchange: Argentina’s 2020-21 soy crop 43.5 million tons vs. previous 43 million. Argentina 91.4% soybean crop harvested and corn 31% corn.

- Offshore

values were leading CBOT SBO 26 points lower (160 lower for the week) and meal $1.80 higher ($6.00 higher for the week).

- Rotterdam

vegetable oil prices for soybean oil and rapeseed oil were mostly 15-60 euros higher and Rotterdam meal was about 9-13 euros higher.

- China:

- China

will launch crude palm oil and palm oil options on the Shanghai Exchange and Dalian Commodity Exchange on June 21 and June 18, respectively.

- Malaysian

palm oil futures rose about 2.5% following yesterday’s strength in soybean oil. The benchmark contract gained 0.6% this week after falling 11.43% in the previous week, its biggest weekly drop in one year.

- Malaysian

palm oil: (uses settle price).

- None

reported

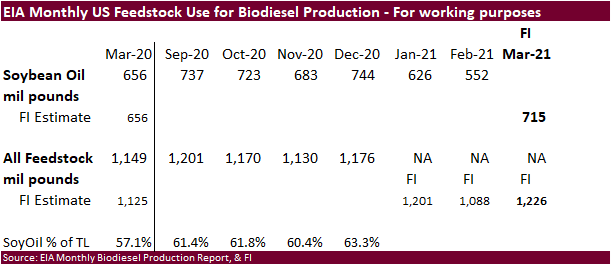

NOTE

EIA DOES NOT REPORT TOTAL FEEDSTOCKS AND BREAKDOWN BY DIESEL TYPE USE – we use this for reference only

- Chicago

and KC wheat is mostly lower in a pre-holiday trade. Traders are awaiting results on Saudi Arabia in for wheat.

- MN

wheat is higher. Frost/freezes in North Dakota overnight into this morning may have had an impact on some crops. The cold temperatures occurred in patches.

- Friday

morning’s weather shows mostly dry weather for the southwestern Plains before heavy rain falls through at least Monday. US spring wheat areas saw additional rain, but more is needed.

- Russia

shipped 350,000 tons of wheat to Syria during since March. - Australia

plans to petition the World Trade Organization to set up a panel to overlook talks over China barley anti-dumping and countervailing duties on Australian barley.

- September

Paris wheat market basis September was down 0.25 euros at 211.75. - French

soft wheat conditions as of May 24 increase a point to 80% from the previous week. Winter barley was up 2 points to 77%. Spring barley was up 1 point to 85%.

- USDA

bought 83,000 tons of HRW wheat for Africa at $263.36-$264.01/ton for July 6-16 shipment.

- Indonesia

seeks 240,000 tons of feed wheat on May 31 for Aug-Nov arrival. They bought some wheat for the week ending May 28.

- Reuters

noted Indonesia bought about 60,000 tons of Black Sea wheat late this week for August shipment at $310 a ton c&f, down from $315 a ton offered last week. Australian Premium White wheat was offered at $320 a ton c&f, unchanged from last week. - Results

awaited: Saudi Arabia seeks 720,000 tons of 12.5% wheat on May 28-31 for July 10-September 30th shipment.

- Bangladesh

seeks 50,000 tons of milling wheat on May 30. In

its weekly SBS import tender, Japan on June 2 seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival by November 25.

Rice/Other

·

Egypt seeks 100,000 tons of raw cane sugar on June 5.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.